Bitcoin miner MARA has introduced the acquisition of 11,774 BTC for $1.1 billion, bringing its complete Bitcoin holdings to 40,435 BTC. The Bitcoin miner is the general public firm with the second largest Bitcoin holdings, and this announcement comes only a day after MicroStrategy, the general public firm with the most important BTC holding, introduced one other buy.

MARA Acquires 11,774 BTC For $1.1 Billion

MARA revealed in a current filing with the SEC that it had bought 11,774 BTC for $1.1 billion. Meanwhile, the Bitcoin miner additionally confirmed this buy in an X put up, stating that it used the proceeds from its zero-coupon convertible notes choices to make this buy.

The firm acquired these bitcoins at a median worth of $96,000 per BTC and has achieved a BTC yield of 12.3% quarter-to-date (QTD) and 47.6% year-to-date (YTD). Following this current buy, the Bitcoin miner now holds 40,435 BTC, price round $3.9 billion primarily based on the present Bitcoin price.

MicroStrategy co-founder Michael Saylor additionally commented on MARA’s announcement, relating the truth that the corporate has achieved a BTC yield of 47.6% YTD, which appeared to have impressed the tech entrepreneur and Bitcoin advocate.

Interestingly, MARA Holding’s announcement comes only a day after Saylor’s firm introduced that it purchased 21,550 BTC for $2.1 billion. MicroStrategy and Marathon Digital are the general public firms with the most important Bitcoin holdings. However, the software program firm is properly forward, with 423,650 BTC in comparison with the Bitcoin miner’s 40,435 BTC.

Other firms are already trying to emulate this Bitcoin technique, and Microsoft may quickly be one in every of them. The firm’s shareholders will vote as we speak on a Bitcoin adoption proposal, which, if handed, would see the tech firm undertake the flagship crypto on its steadiness sheet.

What Next For Bitcoin As Institutional FOMO Continues

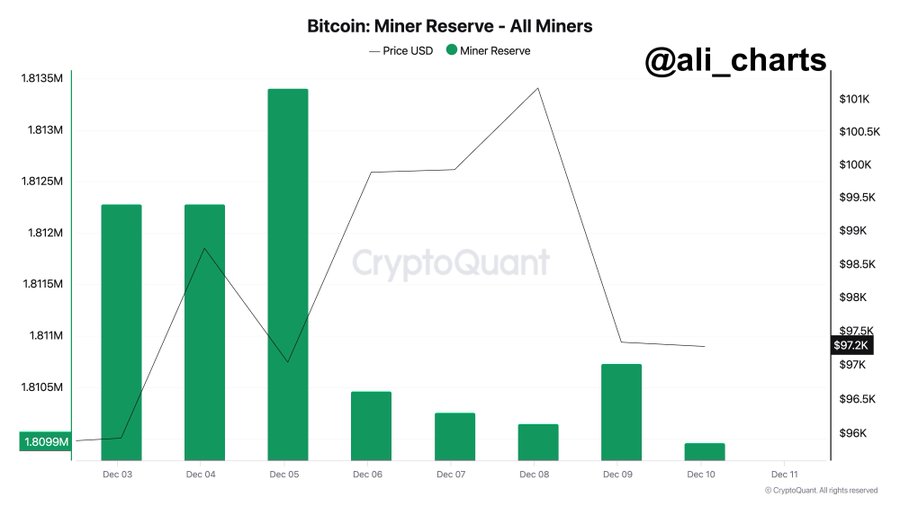

Amid MARA and MicroStrategy’s Bitcoin purchases, the BTC worth stays tepid, consolidating inside this $97,000 area. Crypto analyst Ali Martinez warned that the flagship crypto wants to carry above $96,000 to keep up its bullish outlook.

According to the analyst, the Bitcoin worth may drop to as little as $85,000 in a repeat of final 12 months’s sample. Meanwhile, whereas whales like MARA and MicroStrategy are including to their positions, some are offloading their cash, which appears to be placing important promoting strain on the flagship crypto.

Martinez revealed that Bitcoin miners have offered 771 BTC within the final 24 hours. CoinGape additionally lately reported that the Bhutan government sold $40 million Bitcoin, though they nonetheless have 1,791 BTC left.

Disclaimer: The introduced content material might embrace the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty in your private monetary loss.