2024 was a landmark yr for the cryptocurrency market. It was a yr when the market matured, limitations to the institutional investing world got here down, and worldwide laws began to pave the way in which for digital currencies to enter the mainstream world monetary system.

With a President-elect eager on making the US a worldwide crypto hub, the market skilled vital progress. As crypto adoption rose, extra customers turned to crypto platforms and ETFs to speculate. 2024 was a transformative expertise for the crypto market and the blockchain know-how that powers it.

The normal public, buoyed by constructive sentiment and rising crypto costs, has flocked to DeFi platforms to obtain their first pockets. Many of these new customers have discovered their technique to the extremely trusted crypto model Binance.

It takes a frontrunner to assist an business proceed to mature and Binance CEO Richard Teng has taken on that function all through 2024’s huge progress. Teng commented on his management and the long run, “we have served in the best interests of our users since day one, leading the industry’s standard and continue building the future of the industry responsibly.”

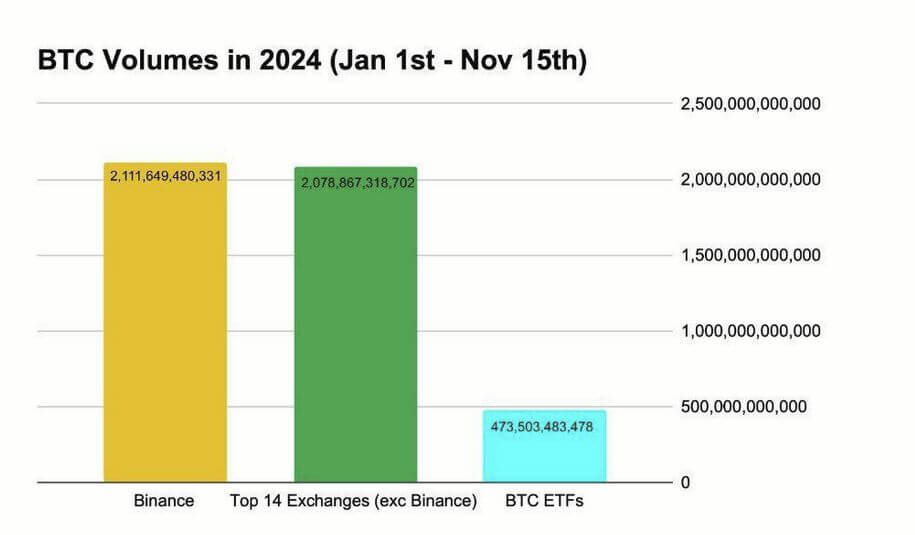

Binance accounts for about 50% of all buying and selling quantity globally. This quantity has solely elevated from Jan-Nov 2024. During the 2024 US Presidential election week, Binance captured $7.7 billion out of the $20 billion complete inflows throughout all exchanges. Combine that with the main crypto trade reaching a brand new milestone surpassing 200 million customers and safeguarding over $130 billion in consumer property.

So, these are thrilling instances for the crypto business that come off the again of lots of onerous work in 2024. The highlights of the yr included:

Institutional Involvement and Widespread Adoption

In 2024, BlackRock launched its spot Bitcoin ETF IBIT, earlier than bringing choices to the desk on November nineteenth 2024, and broke all the records on day one with 354,000 contracts traded and $1.9 billion in notional worth. This was a landmark second for the crypto business, however it got here on the finish of a yr of institutional funding.

Pension funds, hedge funds, and sovereign wealth funds have labored onerous into crypto this yr as they attempt to make the most of the expansion potential and shield towards issues with fiat foreign money. They comply with on the heels of Goldman Sachs, Morgan Stanley, and Fidelity Investments, who all provide Bitcoin as a part of their Wealth Management companies.

Institutional funding has curbed market volatility, and this yr, Bitcoin emerged as one doable safety towards inflation. New readability with the laws, improved custody options, and superior threat administration frameworks all gave the establishments the boldness to leap into crypto toes first in 2024.

The Rise and Rise of DeFi

Decentralized Finance (DeFi) is altering the world we reside in and offering an actual different to conventional banking. The world’s unbanked poor and privacy-obsessed High Net Worth Individuals alike have found the delights of downloading a crypto pockets and sending cash with low charges and no questions.

According to at least one latest examine, the worldwide DeFi market ought to be value almost $440 Billion in 2030, up from simply over $20 billion in 2023.

We can now tokenize any asset, from actual property and positive artwork to vehicles and shares, to create extra liquidity with out the assistance of a conventional financial institution. This is opening up new strategies of borrowing, saving, lending, and incomes curiosity that put the facility within the palms of the folks.

Unbanked people all over the world can have entry to primary monetary companies, together with sending and receiving cash from associates or households, with out large charges. We are additionally seeing an ecosystem of liquidity swimming pools and borrowing amenities open up that may change the world of finance.

Retail Market Integration

In the background, the Web3 know-how that underpins the crypto market has discovered a house with DeFi platforms, in addition to retail and e-commerce. Blockchain know-how is now the muse of provide chain administration, healthcare suppliers, and quite a few firm processes. If the blockchain continues to take over company and public life, then the tokenized crypto ecosystem has to go together with it.

Retailers are more and more counting on the blockchain, with Starbucks utilizing it to hint their espresso from the farm to the cup and Nike tokenizing every pair of sneakers on its Swoosh platform for authenticity and traceability.

In October 2023, Ferrari began accepting crypto funds for its high-end sportscars, becoming a member of the likes of Tesla, PayPal, Shopify, and Microsoft. This is a gradual course of, however crypto has slowly acquired the social proof it requires to interrupt by with mainstream retailers. The blockchain that types its foundations and is changing into such a mainstream hit was an surprising bonus.

Regulatory Frameworks: Chaos to Clarity

Fragmented laws that change from nation to nation are horrible for the crypto business, and 2024 was the yr it lastly acquired its home so as. The Financial Stability Board, International Monetary Fund, and World Economic Forum helped information disparate nations in the direction of one set of ordinary practices for crypto taxation, Anti Money Laundering compliance, and client safety. A easy basis of laws that works throughout borders might work wonders for the business. We’re not there but, however we’re getting nearer.

Technological Advancements Driving Maturity

It isn’t simply the political panorama that needed to change to provide the crypto market a shot at mass adoption. Real technical points with the early blockchain programs saved them as a distinct segment curiosity somewhat than an on a regular basis incidence.

Blockchain congestion, gradual transactions, excessive power consumption, and scalability had been all actual points. Ethereum 2.0 and Layer 2 options imply that Ethereum, probably the most ubiquitous blockchain by far on the subject of dApps and Web3 know-how, is now rather more scalable, with decrease charges and fewer blockchain congestion. Solana and different blockchains like BNB Smart Chain additionally provide different options, with blockchain bridges seamlessly connecting the networks.

AI integration has already modified the world of buying and selling, analytics, threat administration, and provide chain administration. Artificial Intelligence has unlocked one other degree of efficiency from Web3 know-how and automatic complicated processes that may streamline virtually any firm.

Conclusion

These elements have all mixed to create a market that’s prepared, keen, and ready for mass adoption. Institutional adoption, regulatory readability, cultural acceptance, and technical enhancements have all helped the cryptocurrency business go from a sideshow to a central participant in 2024. We haven’t seen something but, and subsequent yr might be the largest but.