Ethereum is lastly seeing a notable rebound in its value because the second-largest cryptocurrency by market capitalization, which continues to interrupt by way of vital resistance ranges.

Following its upward trajectory, seeing a nearly 10% increase previously week, discussions about Ethereum probably reaching a brand new all-time excessive by the 12 months’s finish have gained momentum.

Notably, aligning with the continuing ETH rally is renewed curiosity in Ethereum futures, with market metrics pointing to a bullish sentiment amongst merchants.

Related Reading

More Room For Growth?

A CryptoQuant analyst often known as ShayanBTC lately shared insights into the continuing rally in Ethereum, emphasizing the function of funding charges—a vital metric in futures buying and selling. Funding charges mirror the sentiment of merchants and point out whether or not the market is predominantly bullish or bearish.

According to Shayan, Ethereum’s funding charges have seen a noticeable uptick in latest weeks, suggesting that demand for lengthy positions is rising.

Despite this bullish sentiment, the analyst talked about that funding charges stay under the height of Ethereum’s earlier all-time excessive of $4,900, signaling that “it has not yet entered an overheated state.”

Meanwhile, whereas indicative of bullish sentiment, funding charges additionally act as a warning signal for potential market corrections. Historically, sharp will increase in funding charges have been adopted by sudden market corrections or liquidation cascades.

However, Shayan notes that Ethereum’s present funding charges are nonetheless manageable, implying that the market has more room to grow earlier than such dangers turn out to be important.

Ethereum Market Performance And Outlook

Ethereum is at the moment experiencing an upward trajectory, posting notable double-digit positive factors of roughly 15.6% over the previous two weeks. This bullish efficiency has propelled ETH to interrupt by way of the important $3,500 resistance stage, setting its sights on the next major resistance on the $4,000 mark.

Currently, Ethereum is buying and selling at $3,563, reflecting a 1.3% improve within the final 24 hours. However, this value represents a slight pullback from its 24-hour excessive of $3,682 recorded earlier at this time.

Additionally, Ethereum’s present value is simply 26.78% under its all-time excessive of $4,878, highlighting its gradual recovery throughout the market.

Related Reading

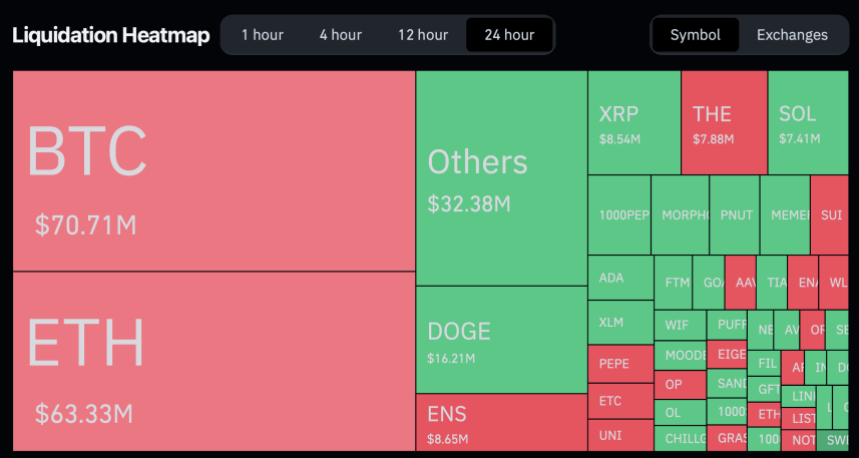

Regardless of the bullish sentiment, Coinglass data exhibits that previously 24 hours alone, 98,389 merchants have been liquidated, with the entire liquidations coming in at $278.03 million.

Out of this complete quantity of liquidations, Ethereum accounts for roughly $63.33 million, with $40 million of this liquidation coming from quick positions and $23.3 million from lengthy positions.

Amid the present value efficiency from Ethereum, the famend crypto analyst often known as Ali on X has reiterated his goal for ETH. Ali mentioned the mid-term goal stays $6,000 and long-term goal $10,000.

Our mid-term goal for #Ethereum $ETH stays $6,000… Long-term goal: $10,000! https://t.co/X4lodGGIVY pic.twitter.com/siQsJzelzE

— Ali (@ali_charts) November 27, 2024

Featured picture created with DALL-E, Chart from TradingView