Bitcoin recorded one other exceptional value efficiency previously week, gaining by 19.16% in keeping with information from CoinMarketCap. The crypto market chief established a brand new all-time excessive at $93,434 on Wednesday, as odds of attaining a six-figure market value by yr’s finish are actually greater than earlier than.

Amidst the present market euphoria, CryptoQuant analyst Amr Taha has shared some market insights which will point out an impending value fall.

Bitcoin Enters Profit-Taking Zone – Sell Or HODL?

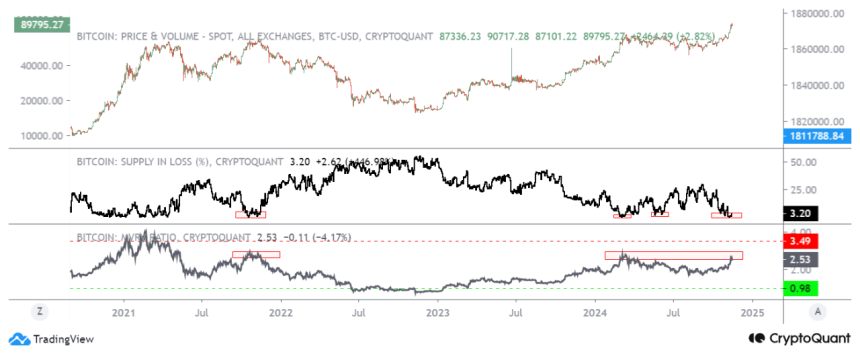

In a Quicktake post on Friday, Amr Taha acknowledged many traders could also be making ready for a cash-out because the Bitcoin MVRV ratio reached 2.64. Generally, the Market Value to Realized Value is a buying and selling indicator used to measure whether or not an asset is overvalued or undervalued or to establish market tops or bottoms.

Amr Taha explains {that a} Bitcoin MVRV ratio above 2 signifies that traders at the moment maintain vital quantities of unrealized good points and are prone to begin profit-taking. However, historic information from late 2021 and early 2022, reveals that profit-taking happens because the Bitcoin MVRV ratio strikes into a spread of two.5-3.5, and is accompanied by vital corrections.

Following the Bitcoin value surge over the previous few weeks, an MVRV ratio of two.64 presents substantial potential for a serious value correction, regardless of the minor value drops previously few days. This sentiment is additional backed by the asset’s relative energy index (RSI), which stays within the overbought zone.

However, Ama Taha additional explains that Bitcoin could generally solely type a serious market high when the MVRV ratio reaches as excessive as 4. Therefore, at 2.64, the premier cryptocurrency should still maintain its present upward value trajectory, if bullish market momentum persists. The analyst advises that traders monitor the MVRV ratio as an increase in the direction of 3 would sign the potential for additional value good points whereas a decline to a spread of 1.5-2 signifies a neighborhood market high is forming.

Short-Term Holders Realized Cap Hits $30 Billion

In addition to Bitcoin’s alarming MVRV ratio, Taha additionally famous that short-term holders have now amassed a realized market cap of over $30 billion, a stage final noticed in March 2024. The CryptoQuant analyst acknowledged Bitcoin has traditionally undergone vital value corrections each time the STH realized cap reached related ranges, signaling one other warning for traders of a possible value dip.

At the time of writing, Bitcoin is buying and selling at $91,738 with a 3.97% acquire previously 24 hours. However, the asset’s buying and selling quantity is down by 7.42% and is valued at $80.73 billion.