According to the newest on-chain information, the Bitcoin Network Value to Transactions (NVT) Golden Cross has fallen into an important area. What may this imply for the price of the premier cryptocurrency?

What Does The Falling NVT Golden Cross Mean For Price?

In a latest Quicktake publish on the CryptoQuant platform, an analyst with the pseudonym Burakkesmeci revealed that the worth of Bitcoin might need reached a “local bottom.” This thrilling prognosis relies on the newest motion by the “NVT Golden Cross” metric.

For context, the “Network Value to Transactions” ratio is an on-chain indicator that estimates the distinction between the Bitcoin market capitalization and transaction quantity. Typically, a excessive NVT worth indicators that an asset’s value is excessive in comparison with the community’s transaction quantity, suggesting that the coin is overvalued.

Conversely, when the worth of the NVT metric is low, it implies that the coin’s market worth is small relative to the transaction quantity. Usually, this means that the asset is undervalued and its value may nonetheless have room for upside motion.

Now, the Golden Cross indicator is a modified iteration of the NVT ratio, and it helps to mark gradual purchase and promote zones in short-term traits. According to Burakkesmeci defined that when the NVT GC exceeds 2.2 (the crimson zone), it implies that the worth in a short-term development is overheating (and the formation of a possible native high).

On the opposite hand, the NVT Golden Cross dipping beneath -1.6 means that the worth decline is carrying out, signaling a possible backside. Burakkesmeci famous that these native tops and bottoms are areas moderately than simply exact ranges.

As proven within the chart above, the NVT Golden Cross has crossed beneath -1.6 and is at the moment round -3.3, suggesting that the Bitcoin price is at a local bottom. According to the CryptoQuant analyst, this might symbolize a “gradual buying opportunity” for traders seeking to get into the market.

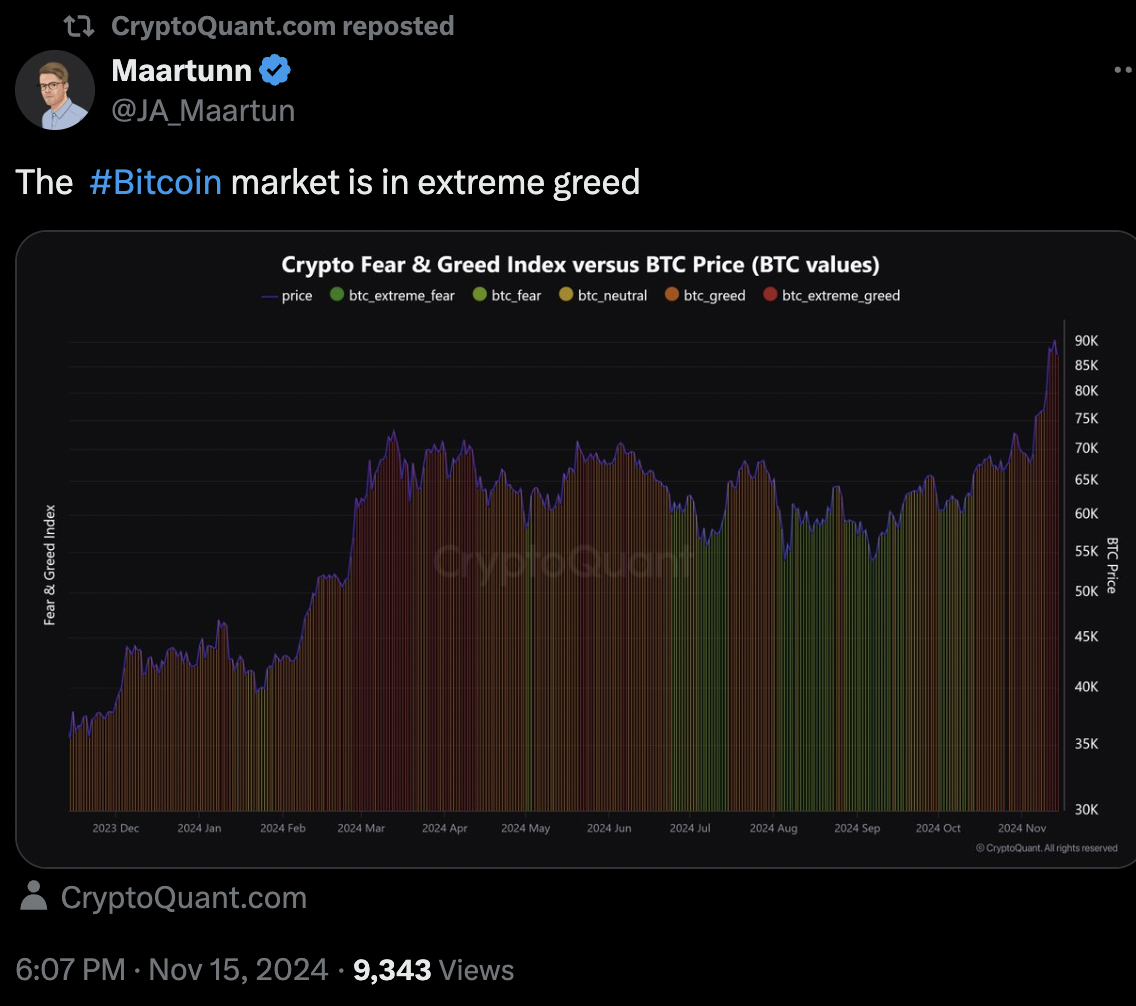

Bitcoin Market In Extreme Greed

Investors will wish to proceed with warning particularly because the Bitcoin market appears to be overheating in the long run. According to a different CryptoQuant analyst, the Fear & Greed Index has flagged excessive greed for the premier cryptocurrency.

Typically, when the Fear & Greed Index strikes towards one finish, there’s a potential for market reversal relying on the sentiment. In this case, the place the market is in extreme greed, the Bitcoin value could also be about to witness a correction.

As of this writing, the worth of BTC sits simply beneath $91,000, reflecting a 3% improve prior to now day. According to CoinGecko information, the market chief is up by a formidable 19% within the final seven days.