Bitcoin Crash: The BTC value has been on the buyers’ radar recently, particularly because the crypto has famous a retreat immediately. This dip comes because the crypto has just lately touched its ATH crossing the $93,000 mark this week. Now, as buyers search readability on the potential components which may have triggered the latest pullback, we discover a number of the prime causes behind the BTC droop.

Bitcoin Price Crash: Why Is The Crypto Falling Today?

There could possibly be a flurry of causes which will have contributed to the latest Bitcoin value dip. The buyers is likely to be staying on the sideline after a number of macroeconomic occasions and present market traits have weighed on the emotions.

US CPI And PPI Inflation Figures Weights On Sentiment

The present US inflation knowledge exhibits a spike within the costs, sparking considerations amongst buyers over a possible hawkish transfer by the Federal Reserve forward. Notably, the US CPI inflation earlier this week got here in at 2.6%, marking its first improve within the final eight months.

Simultaneously, the US PPI inflation figures yesterday got here in at 2.4%, exceeding the market forecast and up from the 1.9% studying famous in September. Although the Bitcoin value initially rallied regardless of the hotter-than-anticipated inflation figures, it seems that the buyers are actually retaining a distance.

These set of inflation knowledge are carefully seen by the US Federal Reserve to resolve their financial coverage plans. Given the latest spike in inflationary pressures, world buyers are actually eyeing the potential transfer by the central financial institution at their December gathering.

BTC Price Slips As Bitcoin Miners’ Selling Spree Continues

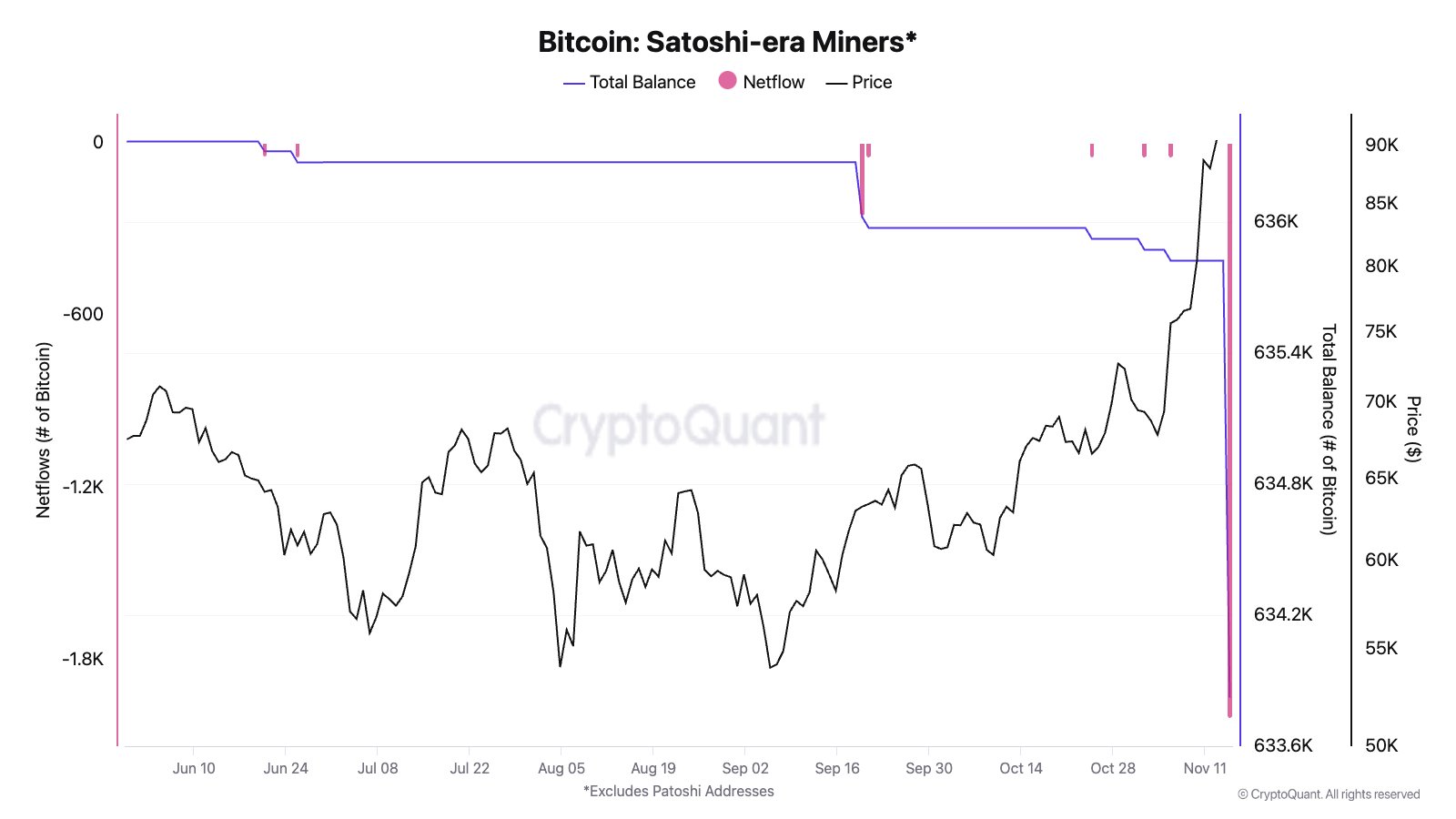

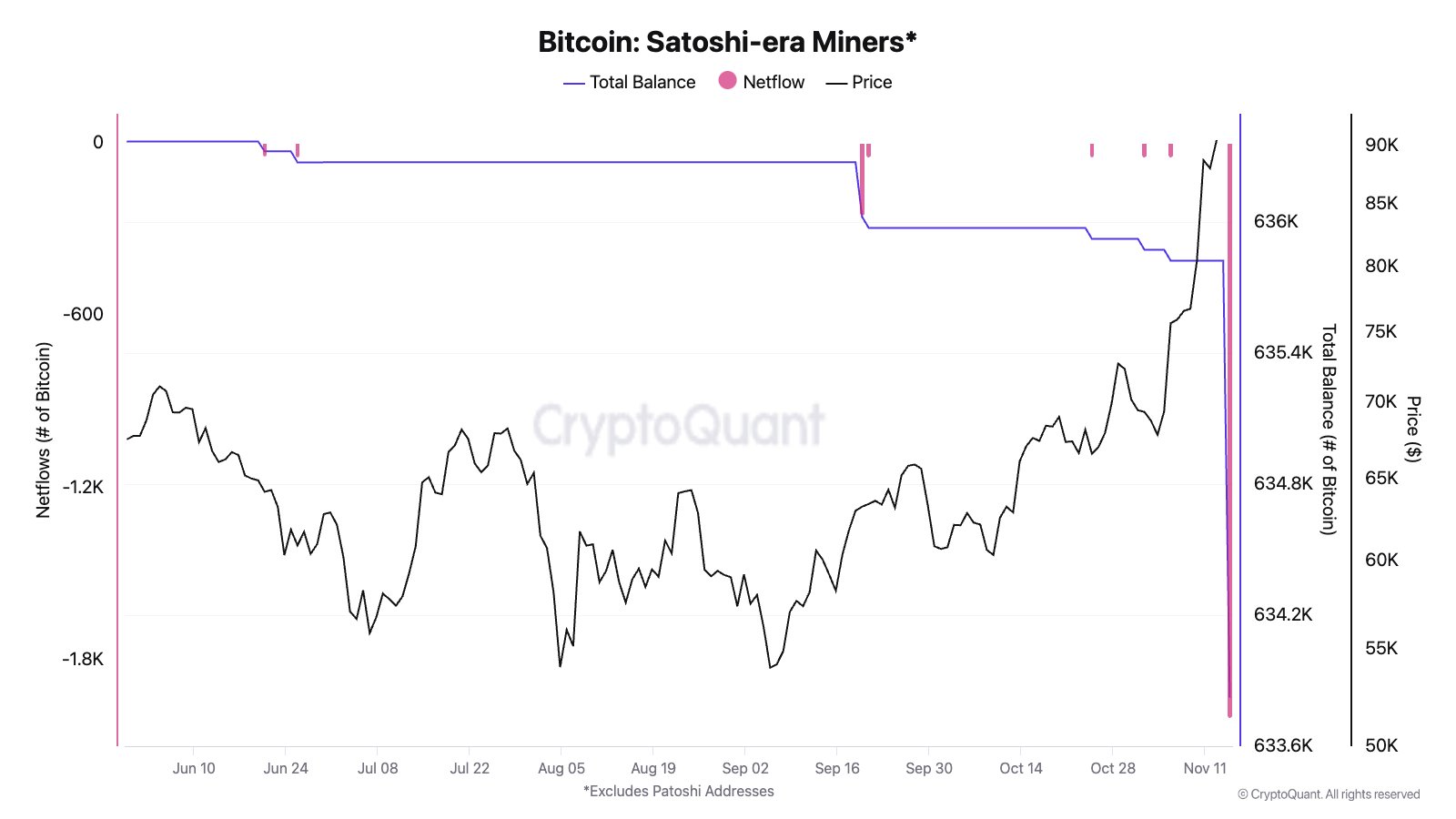

The Bitcoin miners proceed to promote their holdings, weighing on the broader market sentiment. It could possibly be one of many prime causes behind the latest BTC value dip. According to CryptoQuant Head of Research Julio Moreno, a Satoshi-era miner has offloaded 2K BTC just lately.

According to Moreno, the cash have been mined in 2010 and the miner has by no means moved them. However, as the value soars to new highs now, a few of these Bitcoins have been moved to exchanges. Besides, one other latest report confirmed that the BTC miners additionally moved 25,000 BTC yesterday, which has additionally contributed to the bearish sentiment famous at the moment.

Bitcoin ETF Outflow Signals At Muted Market Interest

The US Spot Bitcoin ETF has famous strong influx over the previous couple of days, sparking market optimism. However, on November 14, the funding devices famous an outflow of $400.7 million, ending its six-day influx streak, Farside Investors data confirmed.

Although BlackRock Bitcoin ETF (IBIT) has famous an inflow of $126.5 million, others like Fidelity’s FBTC, and Ark Invests (ARKB) have contributed to the outflow. However, regardless of the most recent outflow, the general influx to the US Spot Bitcoin ETF recorded was $27.8 billion to this point since its launch on January 10.

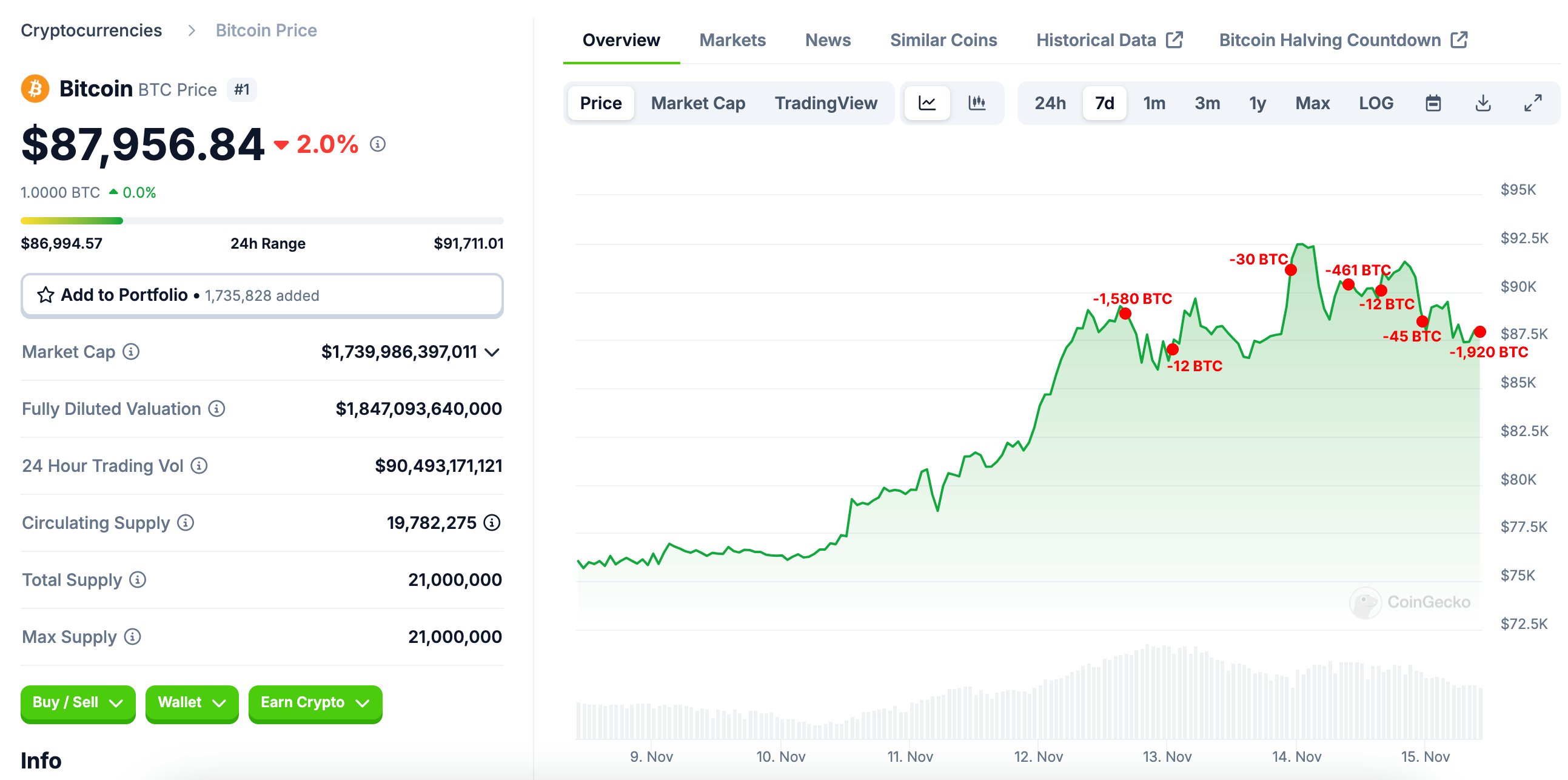

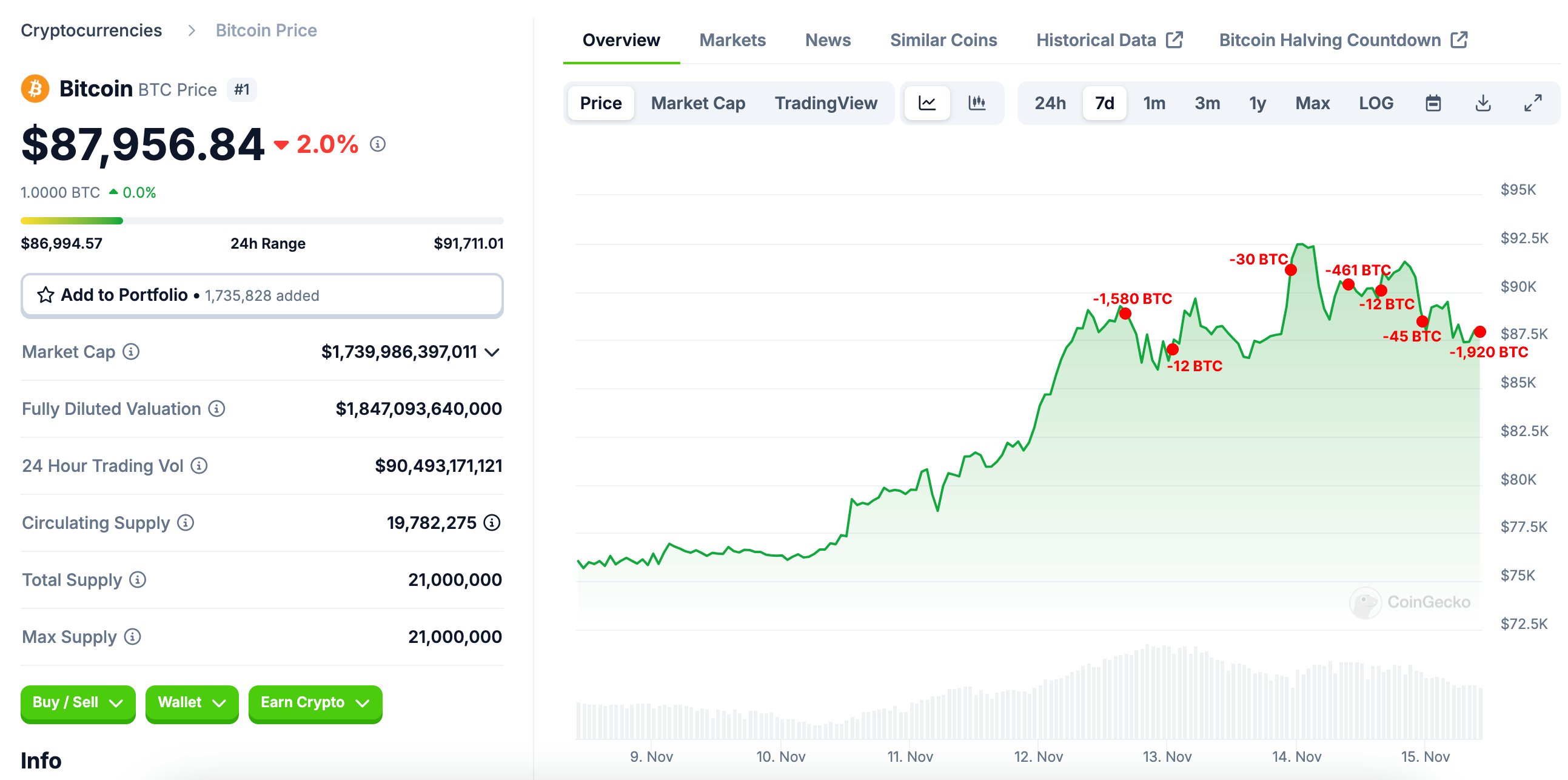

Profit-Booking Opportunity and Whale Dump

As the Bitcoin value rose to its new ATH just lately, many buyers look like taking the chance to guide earnings. For context, based on the most recent report by Lookonchain, a whale has offloaded 1,920 BTC, price round $169 million, to Binance just lately. Over the final three days, the whale has dumped a complete of 4,060 BTC, valued at round $361 million, to the identical main crypto alternate.

These large dumps sign that the buyers is likely to be reserving earnings amid the latest value surge. Considering that, the buyers are rising involved that if the selloff continues, it might additional weigh on the Bitcoin value, probably triggering additional dip forward.

Historical Trends Signals At Bitcoin Price Pullback

Despite the latest Bitcoin crash, many analysts remained optimistic about Bitcoin value’s long-term trajectory. For context, the historic knowledge signifies that BTC usually faces a slight pullback throughout the bull run, earlier than persevering with its rally to new highs.

Considering that many see the present dip as the conventional shifting sample of the crypto whereas remaining bullish on the long-term trajectory of the crypto. According to distinguished market knowledgeable Rekt Capital, the Bitcoin dips amid the bull run will provide extra alternatives for buyers to purchase at decrease costs. Considering that, the present dip seems to spice up the BTC costs additional within the coming days.

Will Bitcoin Price Crash Continue?

The BTC price today was down practically 4% throughout writing, and exchanged palms at $87,508, whereas its buying and selling quantity additionally slipped 27% to $85 billion. Notably, the crypto has touched a 24-hour excessive of $91,765, after touching its ATH of $93,434 on November 13. Furthermore, Bitcoin Futures’ Open Interest fell greater than 3%, indicating a muted curiosity from the market members.

In addition, in a latest X put up, Ali Martinez mentioned that $5.42 billion in Bitcoin earnings had been realized as the value surged earlier. This additionally put the sell-side danger ratio to 0.524%, highlighting warning for the buyers.

Also, the Bitcoin RSI was at 74 throughout writing, indicating that the crypto is at the moment in an overbought situation. However, regardless of the short-term considerations and the latest pullback in Bitcoin value, many locally stay bullish on the long-term trajectory of the crypto. For context, Peter Brandt has just lately mentioned that BTC is poised to hit $327K within the coming days.

Disclaimer: The offered content material could embrace the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability on your private monetary loss.