The Bitcoin value rally has famous a pause right now, with buyers shifting focus in direction of the upcoming US CPI inflation knowledge. Besides, it additionally displays the expectations of the market specialists, who anticipate a slight pullback forward for BTC earlier than additional run within the coming days. However, regardless of that Peter Brandt signifies a bullish run for BTC forward, sparking optimism available in the market.

Bitcoin Price To Hit $327K, Peter Brand Predicts

In a current X publish, veteran dealer Peter Brand shared a bullish outlook on Bitcoin value, suggesting that the crypto may hit new highs within the coming days. Notably, Brandt posted a chart, displaying two attainable value paths for BTC, that are $134K and $327K. Sharing the chart, he has shared two potential situations which may determine the place the flagship crypto is heading subsequent.

For context, he stated some imagine that Bitcoin is overbought, and in that case, it may hit $134K subsequent. However, he additionally famous that many within the crypto neighborhood imagine that BTC value has simply began its bull run, which could set its subsequent goal at $327K.

Notably, his evaluation has captured each bullish and bearish potentialities, with the excessive goal of $327K has caught the buyers’ eyes. Besides, the chart’s dual-range potentialities point out that BTC may expertise vital volatility in its path forward, however a breakout may push it past its current ATHs.

Although the decrease goal of $134K seems extra possible, the flagship crypto may additionally goal the upper vary outlook in the long term. Notably, the anticipated clear regulatory path within the US for crypto and a pro-crypto regulatory physique beneath Donald Trump may assist the current crypto market rally to proceed.

Besides, Brandt has additionally not too long ago predicted BTC to hit $200K. This prediction additionally aligned with Bernstein analysts’ outlook, who’ve additionally predicted an identical surge for the crypto within the coming days.

Will BTC Face Challenge Ahead?

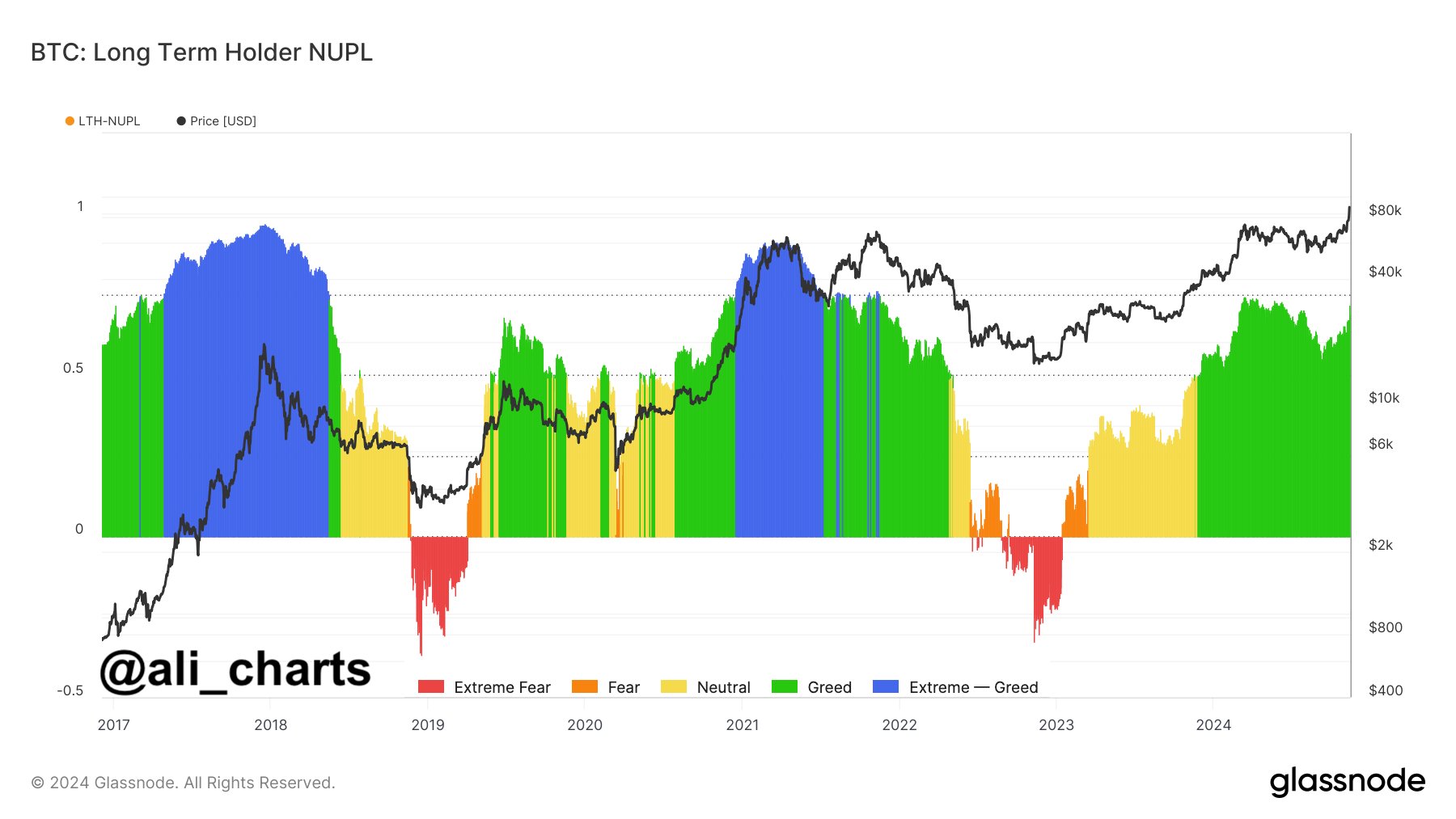

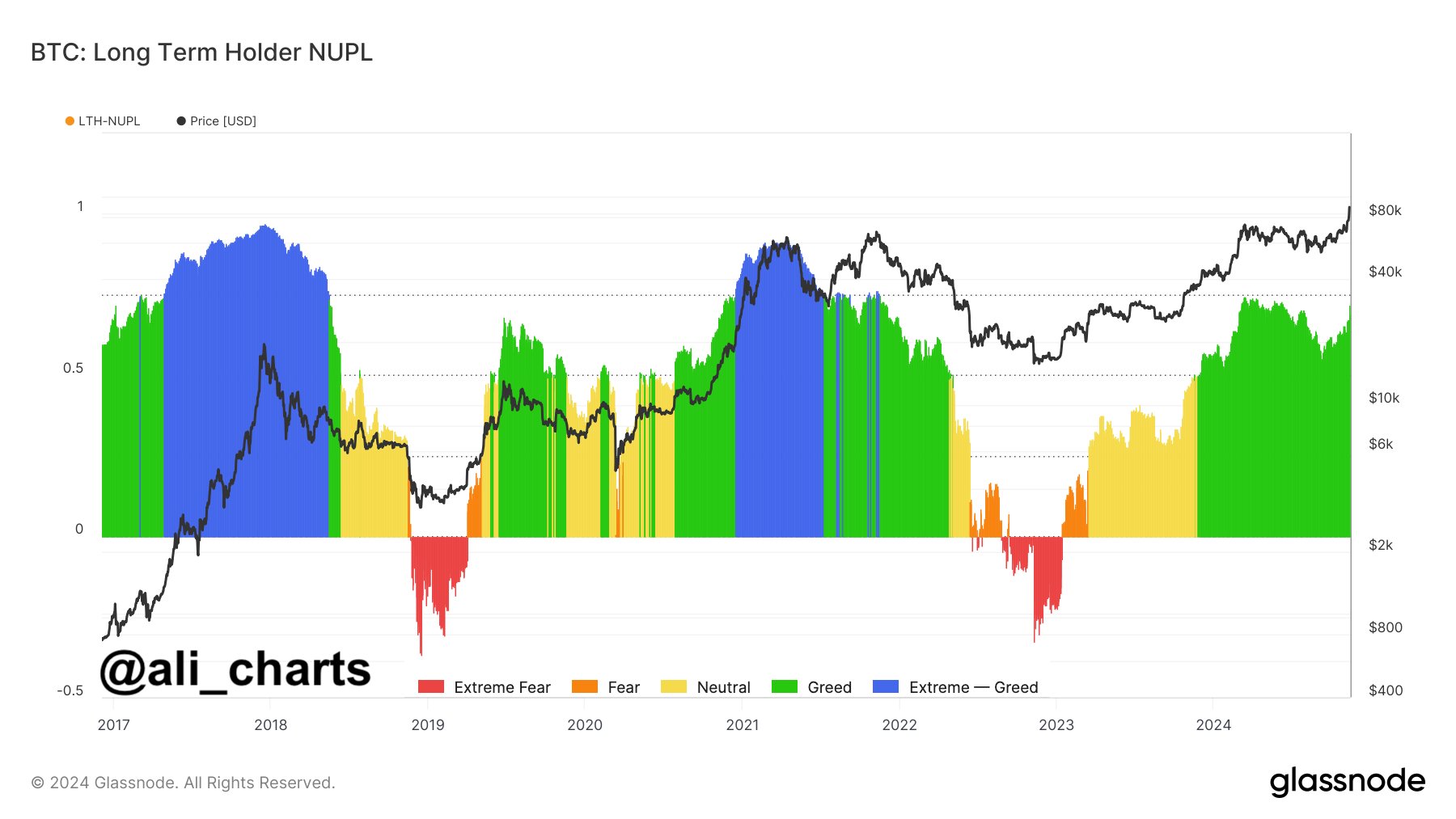

While Peter Brandt stays optimistic about Bitcoin value, different market analysts seem to have remained cautious over short-term volatility attributable to US CPI and different macroeconomic components. A outstanding crypto analyst Ali Martinez not too long ago shared his observations on X, noting that long-term Bitcoin holders are nonetheless not displaying indicators of “extreme greed” regardless of Bitcoin’s current value will increase.

This restraint amongst holders signifies a degree of confidence and stability, as long-term holders usually sign total market sentiment and future value sustainability. Martinez’s remark aligns with Brandt’s view of a possible rally, although he hints at a gradual buildup in momentum reasonably than a direct surge.

However, the near-term outlook is clouded by upcoming US CPI inflation data, which may impression investor sentiment throughout the monetary markets. Many specialists anticipate a quick pullback in BTC costs as merchants digest financial updates and put together forward of time for attainable rate of interest cuts by the Federal Reserve.

Meanwhile, BTC price today was down over 2% and exchanged arms at $87,540, whereas its buying and selling quantity fell 14% to $119 billion. However, the crypto has touched a 24-hour excessive of $89,915.57, after touching an ATH of $89,956 this week. Further BTC Futures Open Interest additionally fell practically 3% within the final 24-hour timeframe, indicating that the buyers are staying within the sideline forward of the essential financial knowledge.

Disclaimer: The offered content material might embody the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty on your private monetary loss.