The unstoppable value run of Bitcoin, which began a day after the US presidential elections, is making a ripple impact within the economic system. There’s been a large leap in worth lately, with Bitcoin topping $89k earlier at the moment, displaying a 27% improve from the earlier week. Then, there are file inflows into Bitcoin ETFs, pushing funds to interrupt some data. This value motion additionally reshaped the checklist of the world’s largest property by means of market capitalization.

#Bitcoin flips Silver! Now the 8th largest asset by market cap.🚀 pic.twitter.com/RAPCJd5gd2

— MEXC (@MEXC_Official) November 12, 2024

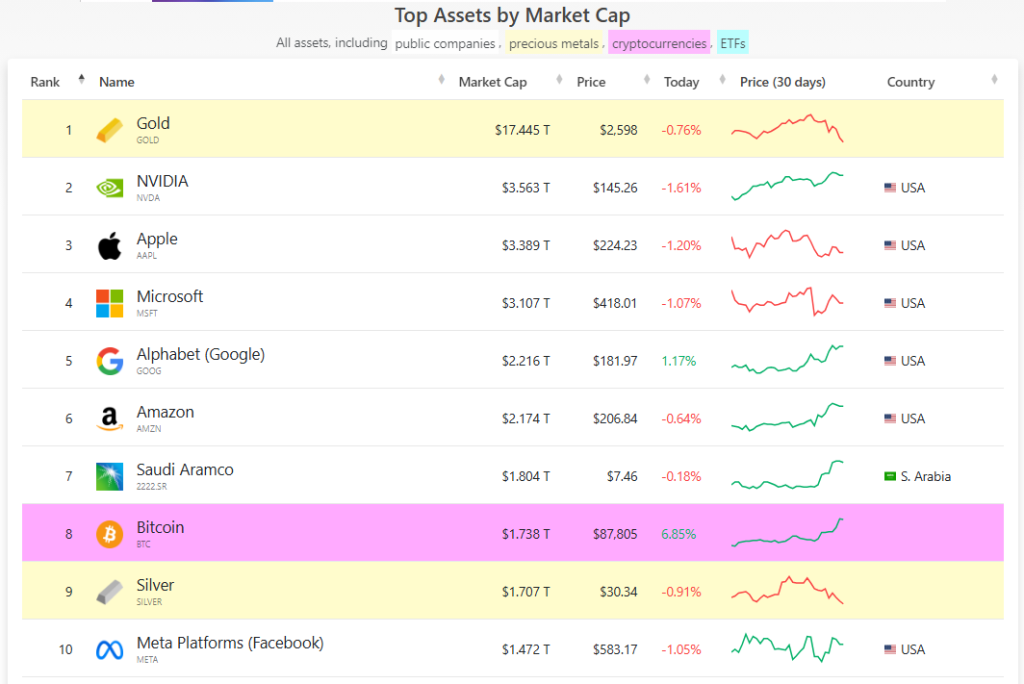

Based on the up to date checklist of prime property, Bitcoin is now ranked 8th on the checklist of the “Top 10 Largest Assets by Market Cap”, with a complete market worth of $1.756 trillion, barely forward of silver, valued at $1.736 trillion. This is the second time the digital asset has edged out silver within the rankings, pushed by a bullish sentiment on Bitcoin ETFs and blockchain normally.

Bitcoin breaking into the highest world property is a testomony to the rising public acceptance of the crypto asset and its function as an alternative choice to conventional property like gold.

Bitcoin’s Market Value Grows As Price Tops $89k

Bitcoin continues its shocking rally this week, testing one other all-time excessive at $89k. On Tuesday, Nov. twelfth, the digital asset surged past $89,0000, reflecting an 11.3% improve, whereas silver dipped by 2%, permitting Bitcoin to notch the 8th spot within the checklist.

With this newest value motion, Bitcoin now trails Saudi Aramco, which is ranked seventh. Amazon, Google, Microsoft, Apple, Nvidia, and gold spherical out the Top 10. Gold stays the world’s prime asset, with a market cap valued at $17.667 trillion, dwarfing Nvidia and Apple by round $3 trillion every.

BTC registers a brand new ATH. Source: Bitstamp

A Milestone Worth Celebrating

According to The Kobessi Letter, Bitcoin’s present market worth and up to date value motion mirror the digital asset’s potential. The commentary additional reacted that gold’s worth, which is 10x greater than BTC, is unimaginable. However, it additionally sees the potential of the highest digital asset to develop even greater.

BTCUSD buying and selling at $87,604 on the each day chart: TradingView.com

Bitcoin has constantly elevated in value lately, partly pushed by Trump’s convincing election victory. Trump has a pleasant method to the crypto group. With the Republicans capturing each homes within the final voting, will probably be simpler for the incoming president to pursue his crypto-friendly insurance policies.

Big Volumes And Bullish Sentiment From Institutional Investors

Aside from the “Trump Effect,” Bitcoin can also be rallying due to bullish sentiment from institutional traders. Many monetary establishments are integrating BTC and cryptos into their portfolios, boosting the digital property’ costs. For instance, Bloomberg senior analyst Eric Balchunas famous a strong improve in quantity for Bitcoin ETFs buying and selling, with iShares Bitcoin Trust (IBIT) having fun with a $4.5 billion buying and selling quantity yesterday.

MicroStrategy is one other firm that’s benefitting from the Bitcoin rush. Michael Saylor’s MicroStrategy holds the most important Bitcoin-based portfolio, with its shares at the moment buying and selling at $340. On Monday, the corporate introduced that it had bought 27,200 BTC, boosting its complete to 279,420.

Featured picture from Siam Bitcoin, chart from TradingView