Ethereum has reached a brand new native excessive at $3,219, marking a formidable 35% surge since final Monday. This speedy rise has ignited sturdy optimism amongst analysts and buyers, who now see Ethereum as primed for additional positive aspects because it begins to point out energy in opposition to Bitcoin. The rally displays renewed confidence in ETH’s potential, particularly as main stakeholders improve their exercise.

Related Reading

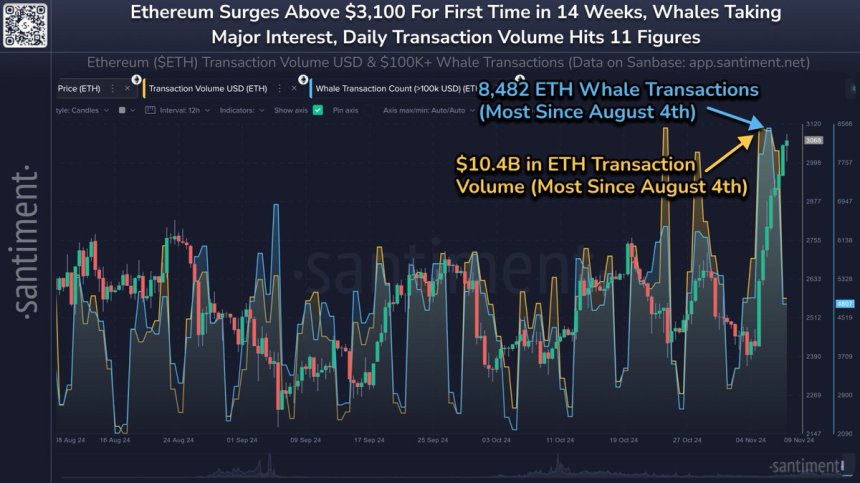

Key information from Santiment helps this bullish outlook, highlighting a major spike in whale transactions. Increased exercise amongst massive ETH holders typically indicators accumulation, suggesting that influential gamers see the potential for Ethereum’s continued development. This uptick in whale transactions is usually seen as a precursor to additional value appreciation, because it signifies sustained curiosity from high-volume buyers.

As ETH continues to rise, analysts are intently watching its efficiency in opposition to Bitcoin, noting that Ethereum’s latest momentum might point out the start of a extra sustained uptrend.

Ethereum Bull Phase Starting

Ethereum has formally entered a bullish part after decisively breaking key resistance ranges and establishing a constructive value construction. Recent data from Santiment confirms this upward trend, as Ethereum is now exhibiting sturdy development metrics that recommend additional positive aspects could lie forward.

Whale transaction information factors to a major improve in exercise from main stakeholders—wallets holding substantial quantities of ETH—who’ve actively contributed to Ethereum reaching its highest value in over 14 weeks.

In addition to heightened whale exercise, Ethereum’s transaction quantity has surged, reaching as a lot as $10.4 billion over the previous a number of days. This quantity spike is an encouraging signal of rising demand and sustained curiosity in ETH at its present ranges. Large transactions typically sign confidence from institutional gamers and high-net-worth buyers, reinforcing the bullish sentiment round Ethereum as they improve their holdings.

Related Reading

Santiment analysts recommend that Bitcoin’s efficiency throughout this bull run might function a catalyst for Ethereum, with earnings possible redistributing from BTC to ETH as market contributors diversify into high altcoins. This dynamic has traditionally benefited Ethereum throughout sturdy market cycles, probably setting the stage for ETH to revisit its earlier all-time excessive.

Additionally, Ethereum’s community exercise seems strong, one other key indicator of sustained development potential. With elevated stakeholder participation, excessive transaction quantity, and a wholesome community, Ethereum appears well-positioned for continued upward momentum within the present bullish surroundings.

ETH Testing Fresh Supply

Ethereum (ETH) is at present buying and selling at $3,170, exhibiting energy after an aggressive transfer above the 200-day transferring common (MA) at $2,955. This breakout above a long-term resistance degree indicators that bulls are actually firmly in management as ETH reaches new provide zones. Holding above the 200-day MA is a constructive indicator for sustaining the bullish pattern, as this degree typically helps value motion when breached on an upward transfer.

If ETH experiences a pullback, a drop again to the 200-day MA round $2,955 would symbolize a wholesome retracement, probably setting the stage for additional positive aspects. A consolidation at or close to this degree would possible entice extra demand, supporting a continuation of the uptrend.

Related Reading

However, the present sturdy value motion mixed with contemporary demand coming into the market might propel Ethereum even greater with no vital pullback. The momentum ETH is constructing now could assist it break via successive provide ranges within the close to time period, pushing towards greater targets. For now, Ethereum’s upward trajectory is supported by stable technical ranges and a market surroundings more and more favorable for continued positive aspects.

Featured picture from Dall-E, chart from TradingView