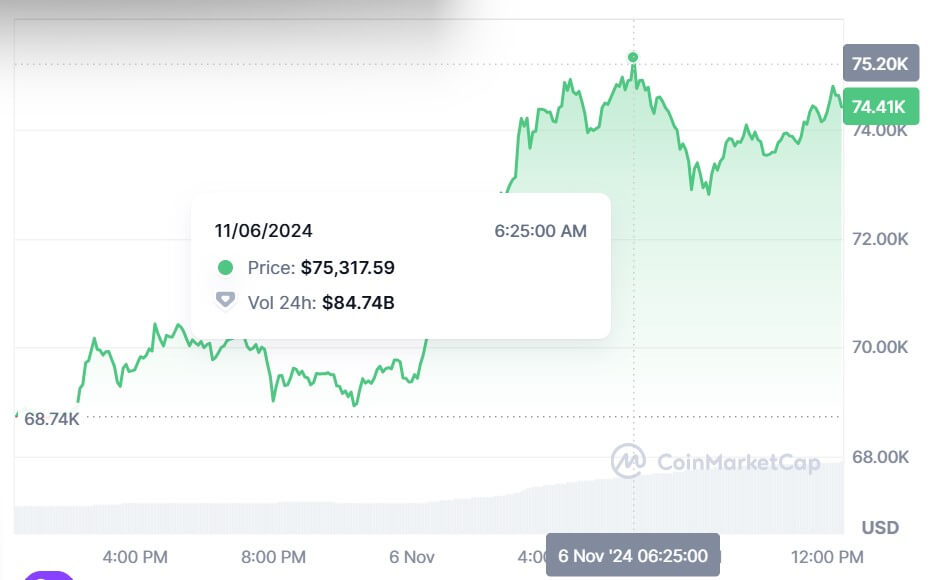

- Bitcoin reached a excessive of $75,317 within the early hours of this morning

- In September, Bernstein analysts predicted Bitcoin to attain between $80,000 and $90,000 by the top of 2024 if Trump received

- Unity’s COO stated to CoinJournal stated it was “disingenuous” to say Trump profitable the US election was the only real cause Bitcoin’s price went up

Bitcoin rose to a document excessive of over $75,000 early this morning as voting outcomes signalled a Donald Trump win for the White House.

Data from CoinMarketCap exhibits Bitcoin achieved a high of $75,317 round 6:25 this morning. Before the election outcomes began coming in final evening, Bitcoin was buying and selling at round $69,000.

However, because the night progressed and into the early morning, Bitcoin continued an upward trajectory earlier than reaching its new all-time excessive.

Bitcoin’s final all-time excessive happened in March when it reached $73,000.

Data from AP News exhibits Trump has taken 277 of the electoral outcomes in contrast to Vice President and presidential candidate Kamala Harris’ 224.

Will the price rise proceed?

While the brand new excessive comes amid the US election outcomes, many might be questioning whether or not this upward motion will proceed. In September, Bernstein analysts predicted that Bitcoin might attain between $80,000 and $90,000 by the top of 2024 if Trump received the presidential election.

According to James Toldeano, COO of self-custody pockets Unity, folks want to understand that information based mostly on the 2012, 2016, and 2020 US elections doesn’t reveal constant patterns for the crypto market regarding election outcomes.

“Some have looked at the 2020 election and seen the price rise from $13,760 prior to the election on November 1, to $19,698 following the election on December 1, and immediately asserted it was the election that drove the increase,” stated Toldeano to Coinjournal.

In actuality, Toldeano added, a number of elements contributed to the price rise, together with US stimulus payments, growing curiosity from firms like MicroStrategy buying Bitcoin, and other people seeing Bitcoin as a protected funding throughout the Covid pandemic.

“While the election happened during this time, it’s disingenuous to say it directly caused the price increase,” he stated.

In the long-term, it received’t be the election that strikes the crypto market, however “broader macroeconomic events, technological advancements, shifting market sentiment, and factors outside of the next President’s control,” Toldeano defined.

Pro-crypto

Former US President Donald Trump has come throughout as extra crypto-friendly in contrast to Harris.

Back in May, Trump promised that, if he was re-elected, he’d free Ross Ulbricht, the Silk Road creator. Ulbricht has already served 11 years in prison. In August, Trump additionally promised to make America the “crypto capital of the planet.”

In September, Trump turned the primary US president to use the Bitcoin community. He achieved this after sending a Bitcoin transaction at PubKey, a crypto-themed bar in New York forward of his marketing campaign rally in Long Island.

On the flip facet, Harris has been muted about her stance on crypto regardless of saying her administration would support a crypto regulatory framework if she turned the following US president.

“Incoming President Trump has the power to save crypto in the US where urgent change is needed,” stated Jesper Johansen, CEO and founding father of Northstake, an Ethereum staking market, to Coinjournal.

“First amongst the new administration’s priorities should be to define staking as an opportunity for US investors,” Johansen continued. “The question still lingers: is staking a commodity or a security?”

Johansen stated that $6 billion is sitting in Ethereum exchange-traded funds (ETFs), which aren’t being staked, which means buyers are lacking out on financial alternatives. According to Johansen, this might be one of many the explanation why the uptake of Ethereum ETFs hasn’t been as in style as Bitcoin ETFs.

“Once these core issues have been solved, changes are needed within the SEC to ensure that crypto is viewed as a vehicle of innovation, rather than something to be feared,” he added.

Ahead of the election, Trump stated he’d take away Gary Gensler, chair of the US Securities and Exchange Commission (SEC); nevertheless, it stays to be seen whether or not this may occur as a result of the SEC is an unbiased federal company.

At the time of publishing, Bitcoin is buying and selling at round $74,000.