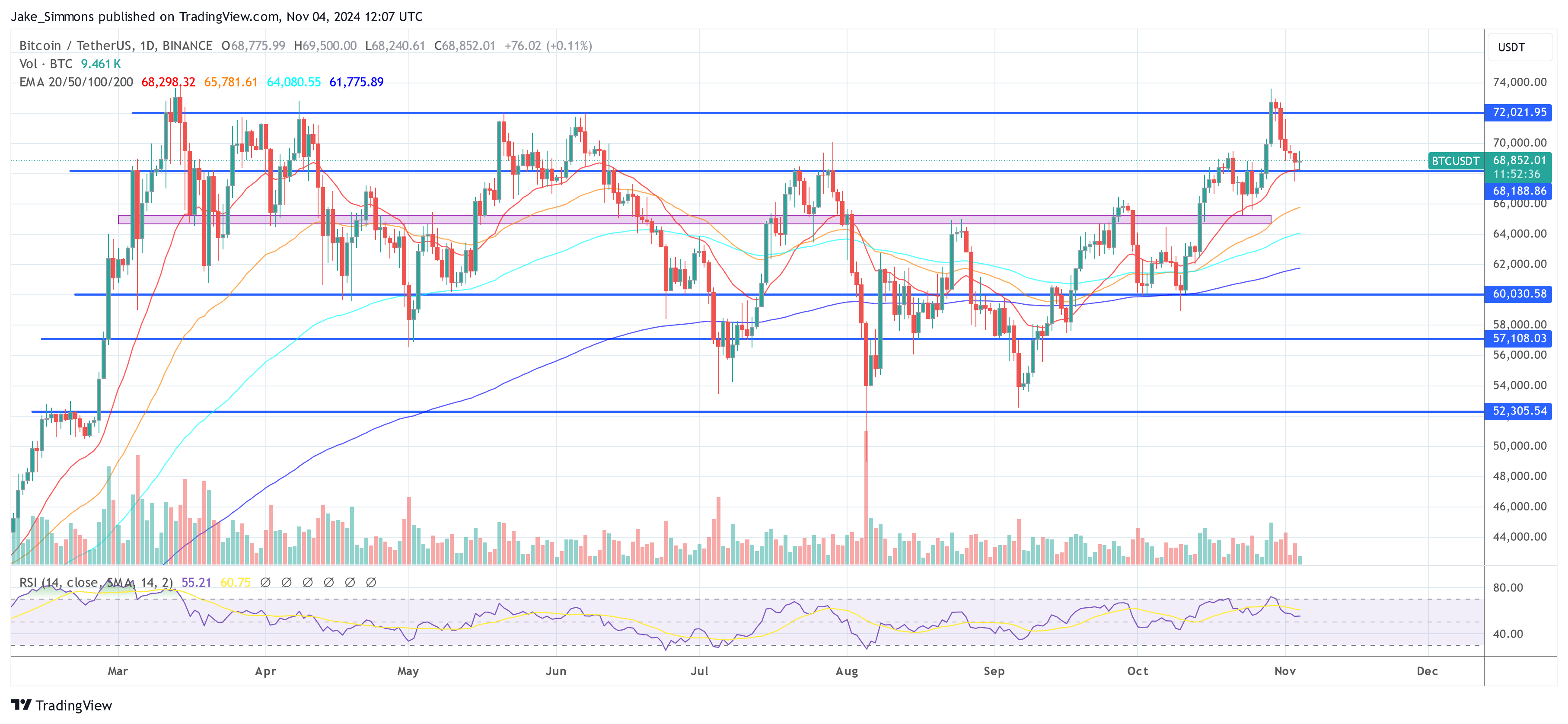

The Bitcoin value has posted 5 consecutive crimson each day candles because it stopped simply in need of its all-time excessive at $73,620 final Tuesday. As a outcome, the BTC value has fallen by round 7%. This decline is obvious on the weekly chart, which exhibits a serious bearish weekly candle – a headstone doji.

Chartered Market Technician (CMT) Aksel Kibar noted through X, “BTCUSD weekly candle can look similar to GOLD,” and defined that it signifies a reversal is on the horizon. However, he added, “It just isn’t reliable as a person candle. Best to mix it with a following weak candle as a affirmation of development reversal. […] The market narrative is that the bulls try and push to new highs over the session however the bears push the worth motion to close the open by the session shut.

Bitcoin To Hit $75,000 By End Of November?

Despite this, Singapore-based crypto buying and selling agency QCP Capital stays bullish in its newest investor note, highlighting vital shifts in each political prediction markets and the BTC derivatives market.

Related Reading

According to QCP Capital, the chances on the decentralized prediction market Polymarket have “moved closer to actual poll estimates,” with Vice President Kamala Harris and former President Donald Trump “locked in a tight race.” While Polymarket nonetheless favors Trump at 55%, this marks a lower from 66% per week in the past, indicating a narrowing margin that aligns extra intently with mainstream polling information.

The agency additionally famous a cautious sentiment prevailing within the cryptocurrency market. The “sideways price action over the weekend” and a lower in leveraged perpetual futures positioning—from $30 billion to $26 billion throughout exchanges—recommend that merchants are adopting a wait-and-see method. This pullback could also be as a consequence of uncertainties surrounding macroeconomic components or the upcoming election.

Despite the present market hesitancy, QCP Capital sees potential for vital upward motion in Bitcoin’s value. The agency questioned whether or not that is “the calm before a break from the multi-month range and push toward all-time highs.” Supporting this outlook, QCP noticed a rise in topside positioning with substantial shopping for of end-November $75,000 name choices since final Friday. This surge in name choices at that strike value means that merchants are positioning for a considerable rally by the top of November.

Related Reading

Additionally, the agency highlighted elevated exercise in choices tied to the election date. “Election-date options positions are also rising,” QCP famous, with Friday implied volatility exceeding 87%, at the same time as realized volatility stays at 40%. The elevated implied volatility signifies that choices merchants are anticipating vital value swings across the election interval.

Looking forward, QCP Capital expects Bitcoin’s spot value to stay range-bound till the US election outcomes present extra readability. The agency said that they “expect spot to chop around this range until we get more clarity on the election results this week,” including that “a Trump win is likely to cause a knee-jerk reaction higher, and vice versa if Kamala wins.”

At press time, BTC traded at $68,852.

Featured picture created with DALL.E, chart from TradingView.com