- Michael Saylor introduced plans to elevate funds to purchase Bitcoin by issuing and promoting $21 billion value of MicroStrategy shares.

- The fairness elevate is a component of a bigger plan to elevate $42 billion for Bitcoin purchases over the subsequent three years.

- The at-the-market fairness providing will dilute present shares by 42% of their capitalisation, which at the moment stands at $50 billion.

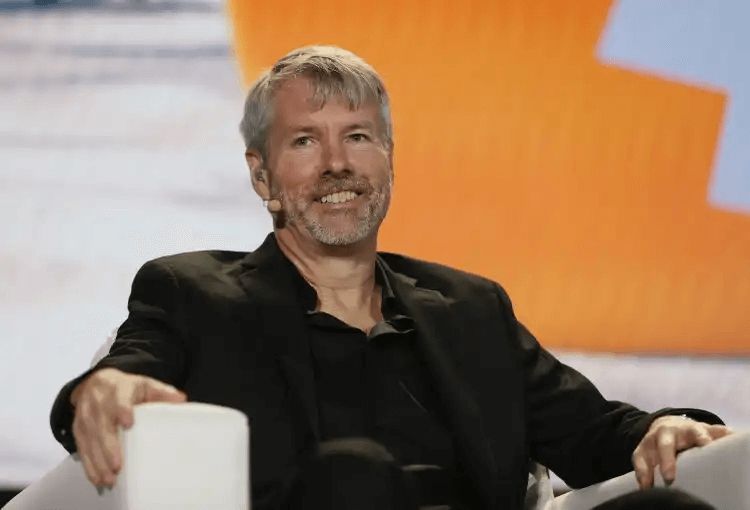

Michael Saylor, co-founder and Chairman of MicroStrategy, introduced plans to elevate $21 billion to purchase extra Bitcoin by providing extra MSTR shares at prevailing market costs. The quantity of shares issued would dilute the worth of present shares held by present shareholders.

Usually, this stage of dilution would lead to a major low cost in inventory worth to retain the identical total worth, which is manifest by a fall in inventory costs.

However, MicroStrategy’s inventory worth has not fallen considerably because the announcement, due largely to its cohort of shareholders, the efficiency of its inventory since 202, and its Bitcoin holding.

An overview of MicroStrategy’s Bitcoin purchases

MicroStrategy started shopping for Bitcoin in 2020, at a time when including Bitcoin to company steadiness sheets was not as accepted as it’s at the moment. Over the final 4 years, the corporate has issued company debt notes to fund its Bitcoin purchases and at the moment holds 252,220 Bitcoin (roughly 1% of the overall Bitcoins provide) value roughly $17.6 billion.

The firm’s most up-to-date buy was in September 2024, when it purchased 7,420 Bitcoin at a median worth of $61,750 per BTC, totalling $458.2 million, which it raised by providing senior debt notes.

Shareholders hope regardless of dilution issues

MicroStrategy is in a novel place as a result of the dimensions of its Bitcoin holdings creates a correlation between Bitcoin’s worth efficiency and that of its inventory. With every main Bitcoin buy, MSTR strikes nearer to being a quasi-Bitcoin spot ETF.

However, the overall price of MicroStrategy’s Bitcoin purchases hovers round $9.9 billion whereas the present worth of the corporate’s holding is 95% larger than the fee worth, a efficiency that has fueled the corporate’s inventory rally.

MSTR, which traded round $13 in 2020 when MicroStrategy started its Bitcoin shopping for technique, is at the moment buying and selling at $244.50. The share worth has grown 250% this 12 months alone, outpacing Bitcoin’s 60% efficiency.

MicroStrategy’s capital plans and Saylor’s projections

Michel Saylor’s plan to purchase $42 billion value of Bitcoin over the subsequent three years, fueled by a $21 billion fairness elevate and debt notes, might improve the corporate’s Bitcoin holdings by threefold, relying on the common purchase worth.

Saylor expects Bitcoin to attain between $3 million and $49 million within the subsequent 20 years and is subsequently constructing MicroStrategy right into a Bitcoin financial institution.

Bitcoin trades at $70,105 as of publishing after not too long ago testing the all-time highs of $73,000 reached in March 2024.