Bitcoin’s bullish development continues for one more day, breaking the $73,000 barrier, as a number of market situations appear to favor the world’s largest cryptocurrency. According to knowledge, Bitcoin jumped by 6% to hit $73,544 late Tuesday, its highest market worth since March 14th. With this newest worth surge, Bitcoin’s October acquire is up by 13%, higher than the highest performers within the S&P with a median 1% enhance.

Related Reading

Aside from Bitcoin, different prime digital property confirmed strengths, with Ethereum surging by 4% and the Binance Coin up by 2%. And with appreciable inflows to Bitcoin ETFs in current days and the US elections simply days away, many anticipate an even bigger worth surge for Bitcoin.

A Bullish Bitcoin Ahead

Bitcoin’s bounce to $73,500 throughout US buying and selling hours Tuesday narrowly missed its all-time excessive set on March 14th. However, just a few developments and favorable market situations can assist push Bitcoin to higher highs within the subsequent few days.

Firstly, Bitcoin has lastly snapped its seven-month downtrend. For weeks, the highest crypto has consolidated at simply above the $68,000 degree, and this stability motivated merchants and buyers to push the value.

B I T C O I N $BTC

There are quite a few methods to find out targets. One variable is whether or not semi-log or linear scale is used

Target of 94,000 is measured transfer of triangle projected from breakout degree on semi-log

⬇️ 🧵 1/3 pic.twitter.com/VI0n7OAvia— Peter Brandt (@PeterLBrandt) October 29, 2024

Just this Monday, Bitcoin topped the psychological $70,000 assist earlier than getting an even bigger push from inflows from ETFs and trades by whales. Many market analysts, together with skilled dealer Peter Brandt, set an excellent bolder target: Bitcoin will attain $94,00 to $160,000 quickly.

Second, the value motion has liquidated loads of quick positions and successfully handed promote partitions between $65,000 and $71,000. This improvement established a optimistic temper by leaving quick merchants on the sting. Thirdly, its trade domination is now at 60%, its highest since March 2021.

Related Reading

Institutional Interest In Bitcoin Rising

The ongoing massive inflows into the Bitcoin exchange-traded funds accredited in January additionally play a serious position within the current spike of the cryptocurrency. Based on Bernstein’s knowledge, prior to now few months the highest BTC ETFs have drawn billions of inflows from companies and institutional buyers. These funds’ complete property below administration as of October twenty eighth already surpass $68 billion and are additional more likely to rise.

Then, with about $43 billion of curiosity, there’s additionally growing curiosity in crypto futures. This rise in buying and selling quantity factors to optimistic perspective amongst merchants and demonstrates elevated curiosity of market gamers.

All Eyes On The US Elections

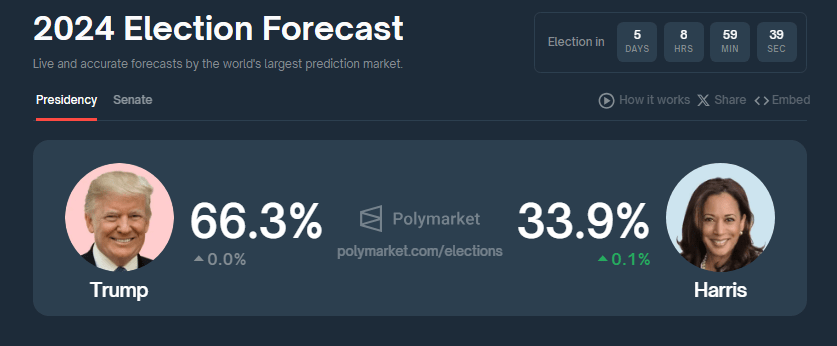

Perhaps the largest driver of Bitcoin’s worth is subsequent Tuesday’s scheduled US elections. The rise in worth has coincided with Trump’s growing odds of profitable the presidential elections.

Initially a “crypto skeptic,” Republican Trump has emerged as a pro-crypto and Bitcoin candidate, calling for a strategic stockpile of the token for the nation.

All these components helped Bitcoin’s current worth surge and may energy the highest crypto to a brand new all-time excessive.

Featured picture from Dall-E, chart from TradingView