Bitcoin ETFs ended final week on one other constructive word with $997.70 million in internet inflows and demand reaching its highest level in six months. Undoubtedly, these ETFs have marked the turning level for Bitcoin and different cryptocurrencies because the starting of the 12 months, because it opened up the cryptocurrency to inflows from each aspect.

Related Reading

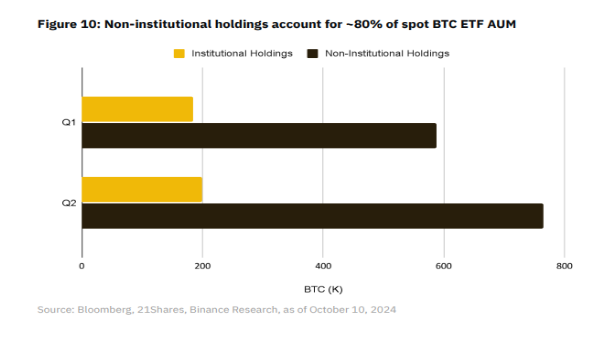

Interestingly, information has proven that retail traders are accountable for a lot of the demand for Spot Bitcoin ETFs, accounting for 80% of the full belongings below administration.

Bitcoin ETFs Changing The Narrative

According to Bloomberg data, Bitcoin ETFs have dominated the ETF panorama in 2024, claiming the highest 4 positions for inflows amongst all ETFs launched this 12 months. Specifically, out of the 575 ETFs launched so far, 14 of the highest 30 are new funds specializing in Bitcoin or Ethereum. The standout performer is the BlackRock IBIT fund, which has attracted over $23 billion in year-to-date inflows.

Last week was one other instance of the constructive efficiency in Spot Bitcoin ETFs, regardless of the coin’s consolidation beneath the $68,000 value stage. According to flow data from SosoValue, weekly inflows began on a constructive word on Monday, October 21, with $294.29 million getting into the funds and ended the week with $402.08 million in inflows on Friday, October 25.

Interestingly, Spot Bitcoin ETFs now maintain about 938,700 BTC in 10 months since launch and are steadily approaching the 1 million BTC mark. Although these ETFs have opened doorways for institutional traders, a recent report from crypto alternate Binance signifies that retail traders are the first drivers of this surge in demand, accounting for 80% of the holdings in Spot BTC ETFs.

Originally meant to supply institutional traders entry to BTC, Spot Bitcoin ETFs have now turn into the popular selection for a lot of particular person traders seeking to make the most of the regulatory readability they provide. Nonetheless, there was a gradual demand from the institutional aspect, with institutional holdings rising by 30% since Q1.

Among institutional traders, funding advisers have emerged because the fastest-growing social gathering, with their holdings growing by 44.2% to succeed in 71,800 BTC this quarter.

What’s Next For Spot Bitcoin ETFs?

Thanks to the fast development of Bitcoin exchange-traded funds, a formidable 1,179 establishments, together with monetary giants corresponding to Morgan Stanley and Goldman Sachs, have joined the crypto’s cap desk in lower than a 12 months. For comparison, Gold ETFs have been solely in a position to entice 95 establishments of their first 12 months of buying and selling.

Related Reading

This upward trajectory of institutional investments in Bitcoin is poised to continue into the foreseeable future, which bodes nicely for the general value outlook of Bitcoin. As these ETFs entice extra institutional capital, they’re more likely to produce second-order results like elevated BTC dominance, improved market effectivity, and decreased volatility that might considerably profit the cryptocurrency ecosystem.

At the time of writing, Bitcoin is buying and selling at $67,100.

Featured picture from Reuters, chart from TradingView