Bitwise CEO Hunter Horsley has defended the Spot Bitcoin ETFs following criticism that these funds are chargeable for the BTC promoting strain that has induced the flagship crypto to remain beneath its present all-time excessive (ATH). This comes amid the Bitcoin ETFs closing in on Satoshi Nakamoto’s 1.1 million BTC holdings after witnessing three consecutive weeks of inflows.

Bitwise CEO Says Spot Bitcoin ETFs Aren’t Selling

Hunter Horsley remarked in an X submit that these funds aren’t those promoting regardless of criticisms from the crypto neighborhood that they is likely to be chargeable for why the flagship crypto hasn’t reached a brand new ATH regardless of different belongings just like the inventory markets and Gold reaching new highs.

The Bitwise CEO’s assertion got here as he highlighted that the Bitcoin ETFs are near holding one million BTC in belongings underneath administration (AuM). He claimed that the truth that the worth isn’t larger regardless of that exhibits that there’s a “pocket of existing holder selling.”

Horsley added that nobody needs to boost their arms concerning the Bitcoin promoting strain however it’s not the ETFs. Bloomberg analyst Eric Balchunas additionally echoed an identical sentiment to the Bitwise CEO as he prompt that the Bitcoin ETFs aren’t chargeable for the promoting strain that’s holding the Bitcoin price down.

In an X post, he said that the “HODLers” are promoting regardless of the quantity of inflows which are coming into the Bitcoin ETFs. He added,

I personally don’t get it however hey it’s a free market.

However, crypto natives can simply rebut this criticism that the “HODLers” are those promoting. CoinGape lately reported that Bitcoin has the longest HODL period amongst crypto buyers, with a mean interval of 4 years and 4 months.

Bitcoin ETFs Are Closing In On Satoshi Nakamoto

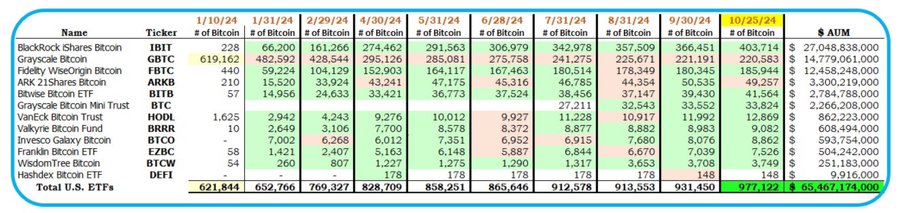

As highlighted by the Bitwise CEO, these Bitcoin ETFs maintain nearly one million BTC and at the moment are closing in on Satoshi Nakamoto’s net worth of 1.1 million BTC. Specifically, HODL15Capital data exhibits that these ETFs maintain $65.25 billion price of Bitcoin (977,122 BTC), which quantities to 4.93% of the flagship crypto’s circulating provide.

BlackRock stays the issuer with the most important BTC holdings with $26.98 billion in belongings underneath administration for its IBIT Bitcoin ETF. The world’s largest asset supervisor is adopted by Grayscale, Fidelity, and Ark Invest in that order. Meanwhile, Bitwise is available in fifth with internet belongings of $2.78 billion for its BITB ETF.

These Bitcoin ETFs are at present having fun with large demand having witnessed three consecutive weeks of influx. Their greatest outing this week got here on October 25 after they recorded a internet influx of $402 million. However, amid this improvement, there stays the chance that the Bitcoin price could drop beneath $60,000. This could be as results of elements just like the Tether investigation which may spark a widespread crypto selloff from each Bitcoin ETFs and “HODLers.”

Disclaimer: The offered content material could embody the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty in your private monetary loss.