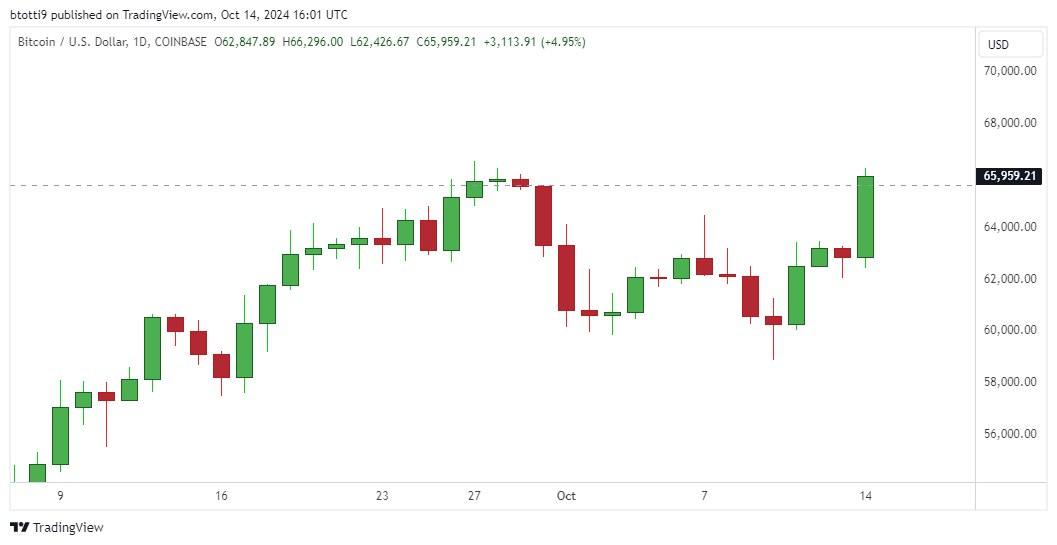

- Bitcoin value broke to above $66,000 for the primary time in practically three weeks

- Cypto analysts at QCP say ‘Uptober’ and the US election sentiment might push bulls greater

Bitcoin’s (BTC) value rose greater than 6% to break above $66,000 on Monday, October 14, 2024, as most cryptocurrencies recorded 24-hour positive aspects.

According to knowledge from CoinGecko, BTC’s value had reached highs of $66,173 throughout main crypto exchanges.

On Coinbase it hit $66,296. The positive aspects got here because the flagship cryptocurrency bounced from the uncertainties witnessed the earlier week, with Bitcoin bulls seeing a 4% flip in weekly value efficiency.

Bitcoin traded round $65,959 on Coinbase on the time of writing, suggesting a possible continuation amid positive aspects throughout the S&P 500. The problem of China’s stimulus package deal was additionally in dealer sentiment. In the crypto market, the general “Uptober” temper seemed to have swung in as altcoins additionally rose.

Bitcoin surges forward of US election

A forecast for BTC by the Singapore-based buying and selling agency QCP Capital suggests BTC is exhibiting value trajectories that mirror earlier US election cycles.

If this pattern continues, Bitcoin bulls may target further gains forward of the November election.

“Although there could be many factors that could explain today’s move, it is quite an interesting time if we look at historical price action. We are in the middle of October and just three weeks away from the US elections,” QCP mentioned in an update on Telegram.

The pattern in 2016 noticed Bitcoin rise from round $600 three weeks to the election to above $1,200 in early January. It occurred once more in 2020, when BTC rallied from $11k round mid-October to hit $42k in January 2021.

“After months of trading in the range, will history repeat itself? Today’s rally has definitely given the market a glimmer of hope just as Uptober optimism was fading,” QCP added within the be aware.

Bitcoin reached an all-time excessive of $73k in March, with the rally coming amid halving sentiment and the launch of spot Bitcoin exchange-traded funds (ETFs).