Crypto analyst Justin Bennett has predicted that the Bitcoin value might retrace to $63,000 following the current market rally. This prediction comes because the flagship crypto targets a brand new all-time excessive (ATH) following a weekly excessive of round $69,000, its highest stage since late July.

Why Bitcoin Price Could Retrace $63,000

Bennett acknowledged in an X publish that he wouldn’t be shocked to see BTC wipe out this week’s leveraged consumers with the restest of the month open at round $63,000. He made this assertion whereas highlighting a possible rising wedge creating alongside a bearish divergence. His accompanying chart confirmed that BTC might drop to round $63,276.

The analyst additionally famous that this week’s Bitcoin value rally was primarily pushed by the perpetual market, which he claimed isn’t “conducive” for a sustainable breakout, particularly with the open curiosity (OI) close to its late July highs.

Crypto analyst CrediBULL Crypto additionally warned concerning the spike in open curiosity and steered {that a} value correction was imminent. He famous that the OI has formally surpassed the extent it was at earlier than the final BTC value drop from $70,ooo to $49,000.

Like Bennett, CredibBULL Crypto had earlier within the week warned {that a} value correction was imminent primarily based on his claims that the derivatives market is what’s driving the current market rally. The analyst steered there might nonetheless be a Bitcoin price crash to $50,000 earlier than it surpasses its present ATH of $73,000.

However, amid these bearish predictions, market specialists have supplied a bullish outlook for BTC. As to short-term targets, Bitwise CIO Matt Hougan predicted that BTC might attain a brand new ATH earlier than the US election. Standard Chartered additionally predicted that the flagship crypto will surpass $73,000 earlier than the November 5 US presidential elections.

The Bull Run Is About To Kick Into Full Gear

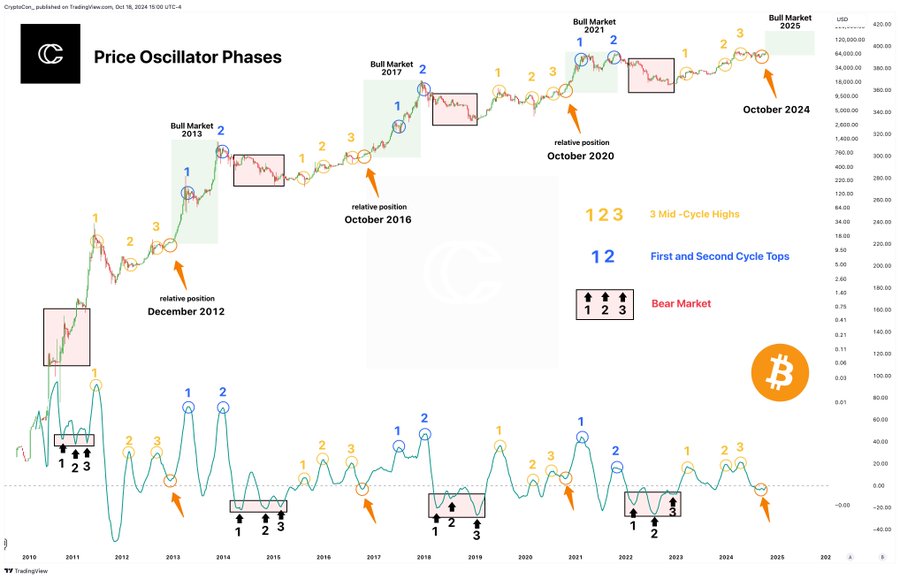

Crypto analyst CryptoCon indicated in a current X post that the Bitcoin bull is about to kick into full gear. The analyst additionally steered that the Bitcoin value will unlikely retrace to as little as $40,000 once more, as some would possibly anticipate. He additionally defined that the bull run means new ATHs and a “year of great price action for all crypto.”

CryptoCon is assured that the Bitcoin bull run is nearly right here due to the Price Oscillator, which he mentioned confirms that BTC has accomplished the entire native highs of the mid-cycle. In line with this, he reaffirmed that up subsequent is the bull market and the “first and final cycle tops.” His accompanying chart confirmed that the BTC value might attain a market prime of $120,000 someday subsequent yr.

Real Vision’s Chief crypto analyst Jamie Coutts predicted that the Bitcoin value might attain $110,000 between April 2025 and July 2025. He claimed this can occur as the worldwide cash provide rises to $500 trillion.

Matt Hougan can be assured that the BTC price will reach six figures. He cited components just like the US election, Spot Bitcoin ETFs, fee cuts, and elevated demand for the flagship crypto amongst whales as what’s going to drive this value surge.

Disclaimer: The introduced content material could embody the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability to your private monetary loss.