Bitcoin (BTC), the biggest cryptocurrency by market capitalization, began the third week of October with a 6% every day surge. BTC’s efficiency has fueled bullish sentiment amongst crypto traders and market watchers, who recommend it may be prepared to maneuver to $70,000.

Related Reading

Bitcoin Reclaims Key Support Levels

Bitcoin started the week reclaiming key resistance ranges after a 6% surge from Sunday’s worth. This efficiency noticed BTC transfer from the $62,000 assist zone to retest the $66,000 assist space on Monday morning.

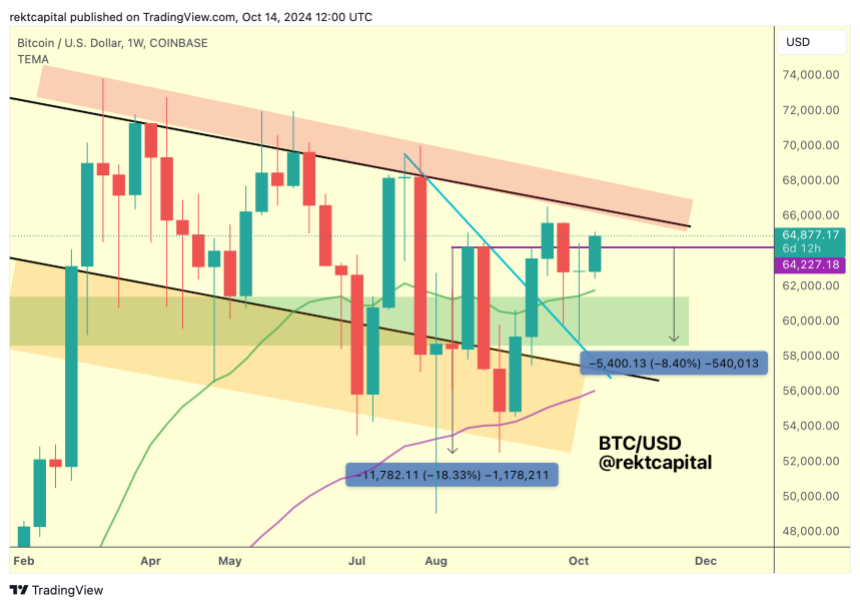

Following the current efficiency, Bitcoin’s October returns to date have turned inexperienced with a 3.17% month-to-month return, based on Coinglass knowledge. Crypto analyst Rekt Capital highlighted Bitcoin’s current actions, noting that BTC has been capable of reclaim a 2-month downtrend as assist.

Per the analyst, the flagship cryptocurrency has retested a downtrend line courting again to late July since October began. BTC efficiently retested and bounced from the trendline for 2 consecutive weeks, turning the vary into assist.

Additionally, the analyst identified that Bitcoin has carried out a number of profitable retests, together with a “volatile retest” of the 21-week Bull Market Exponential Moving Average (EMA).

“Notice how the bottom of the green boxed area is confluent with the July Downtrend retest and the retest of the 21-week EMA is confluent with the top of the green box,” the analyst added.

Similarly, Ali Martinez highlighted that BTC is presently making one other try to reclaim the 200-day Moving Average after 4 consecutive rejections up to now two months.

BTC Challenges August Highs

Rekt Capital famous that BTC has solidified the $58,000-$61,000 vary as a assist space all year long: “It has done so at a Higher Low compared to last month’s downside wicking lows as well as August’s downside wicking lows.”

Moreover, the analyst said that Bitcoin challenged August highs, at round $64,200, after the current retests of the important thing ranges. He prompt that BTC’s current actions are a “clear sign” that August’s degree is “weakening as resistance.”

Rekt Capital identified BTC is retesting the multi-month weekly downtrend channel prime, which can be weakening as resistance. The flagship cryptocurrency efficiently examined the channel’s vary lows as assist this month.

The vary lows have been 7-month confluent assist with the earlier all-time excessive (ATH) space. Nonetheless, the analyst noted that BTC will need to have a weekly shut above the downtrend channel’s prime to interrupt out of this sample.

A weekly shut above August highs, adopted by a profitable retest of this degree, would “pose a significant buy-side pressure on the Downtrending Channel Top,” which might be accelerated if BTC’s every day shut sits above $64,200.

Related Reading

Moreover, a every day shut above $65,000 and a profitable reclaim of the vary as a assist zone may ship BTC’s worth towards the $70,000 resistance zone. The analyst famous that at any time when Bitcoin closed the day above this degree, the cryptocurrency moved inside the $65,000-$71,350 vary within the following days.

As of this writing, BTC is buying and selling at $65,812, a 4% and 10.3% surge within the weekly and month-to-month timeframes.

Featured Image from Unsplash.com, Chart from TradingView.com