XRP noticed large shopping for by institutional traders because the U.S. Securities and Exchange Commission and Ripple agreed to proceed the authorized battle within the Second Circuit Court of Appeals. With Ripple’s current SEC lawsuit win in a district court docket and an higher hand within the circuit court docket, traders appeared extra upbeat about an enormous upcoming rally in XRP value.

Institutional Investors Buying XRP Heavily

XRP noticed $1.1 million in shopping for from institutional traders final week as in comparison with $0.3 million within the earlier week, as per CoinShares report on October 14. Thus, a 266% rise in shopping for exercise was recorded week-over-week as Ripple and the US SEC ready for appeals within the circuit court docket.

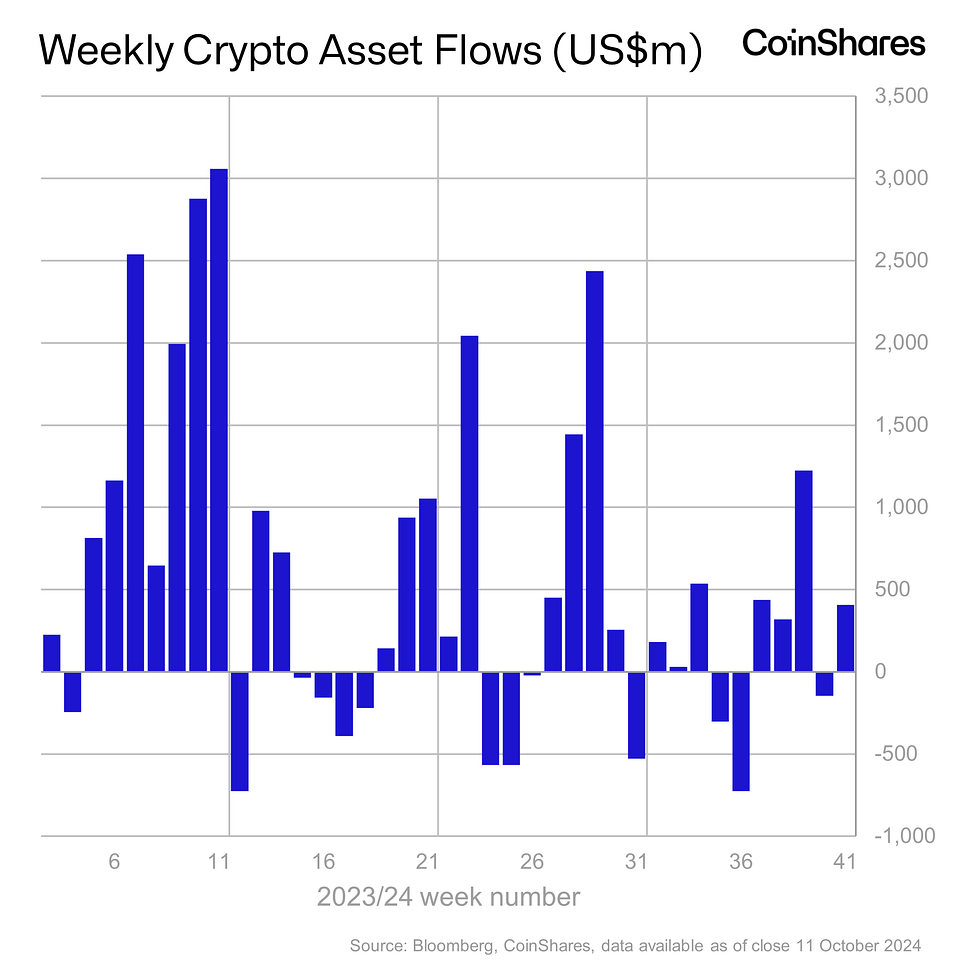

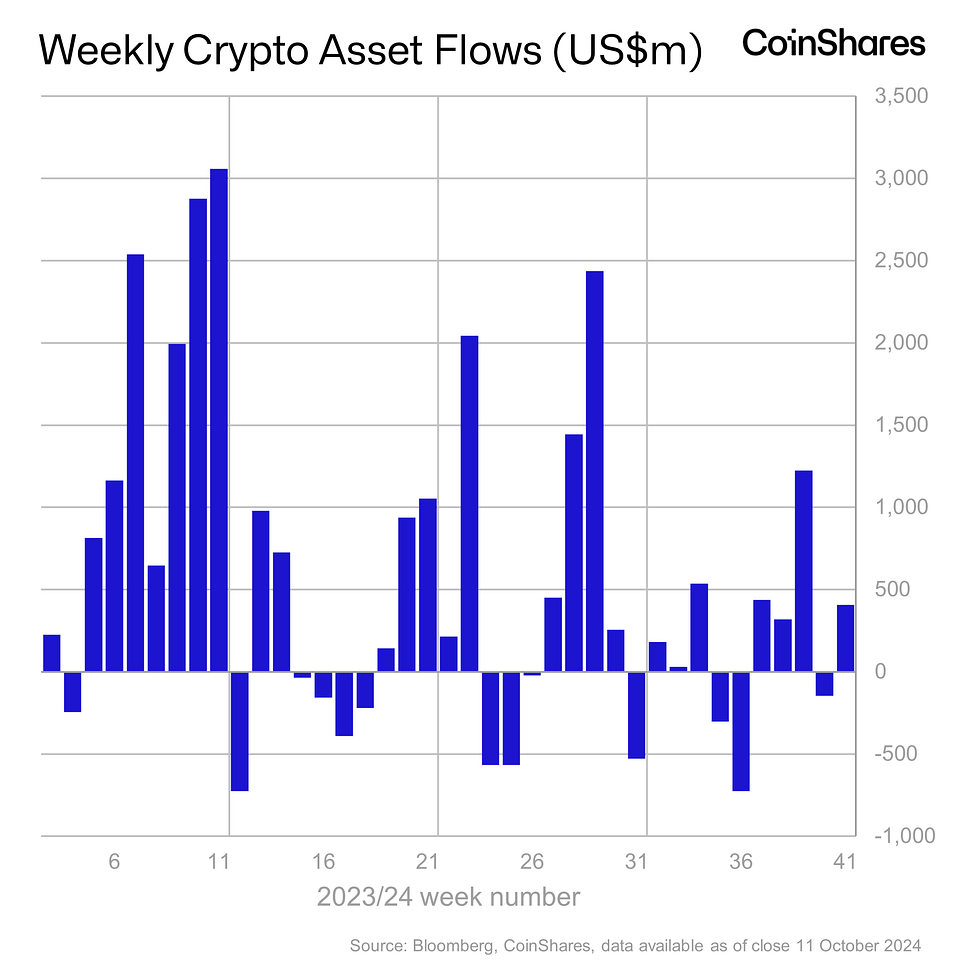

Digital asset funding merchandise witnessed $407 million in web inflows in per week as traders remained bullish on an ‘uptober’ rally, coinciding with upcoming US elections. Investors ignored the rise in CPI and PPI inflation in the U.S. to proceed shopping for the dips.

XRP price jumped greater than 1% prior to now 24 hours, with the value at the moment buying and selling at $0.54. The 24-hour high and low are $0.525 and $0.540, respectively. Furthermore, the buying and selling quantity has elevated by 45% within the final 24 hours, indicating curiosity amongst merchants.

XRP price jumped greater than 1% prior to now 24 hours, with the value at the moment buying and selling at $0.54. The 24-hour high and low are $0.525 and $0.540, respectively. Furthermore, the buying and selling quantity has elevated by 45% within the final 24 hours, indicating curiosity amongst merchants.

Amid the key XRP information, complete XRP futures open curiosity additionally climbed over 3% within the final 24 hours. The futures OI has reached 1.39 billion value $750.53 million.

Ripple Vs SEC Lawsuit Moved to Second Circuit Court

US SEC appealed towards Judge Torres’ $125 million penalty choice within the cures part, as an alternative of virtually $2 billion in fines solicited by the company. Form C and Form D filings with full particulars on the enchantment are due this week. The crypto group has slammed the SEC for interesting and stretching the long-running case.

Meanwhile, Ripple filed a notice of cross-appeal clearing its intention to oppose the SEC’s irrational enchantment of Judge Torres’ ruling. Ripple CEO Brad Garlinghouse added that the cross enchantment will seal the SEC’s destiny and at last put an finish to the regulation-by-enforcement agenda by the company below Chair Gary Gensler.

Former SEC attorneys similar to Marc Fagel and James Farrell consider the SEC will problem programmatic gross sales, in addition to secondary gross sales. US SEC has began suing and probing crypto-related corporations for secondary market gross sales, which Judge Torres didn’t handle in her landmark abstract judgment final 12 months.

Also, Bitnomial sued the U.S. SEC over the company’s declare that XRP is a safety regardless of readability from the court docket. Moreover, lawyer Bill Morgan questioned the SEC’s rationale behind treating the futures as safety futures contracts. He slammed the inconsistency in regulatory enforcement, particularly when evaluating XRP to related instances with Ethereum (ETH), the place the SEC had beforehand proven no objections to the futures contracts.

Disclaimer: The introduced content material might embrace the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability to your private monetary loss.