The Fed minutes for its September assembly have additional dampened hopes for a 50 foundation factors (bps) fee minimize in November. This offers a bearish outlook for the Bitcoin value, contemplating the market was already pricing right into a 50 bps fee minimize following Fed Chair Jerome Powell’s dovish speech following the September FOMC assembly.

Fed Minutes For September Meeting To Cause More Uncertainty

The Fed September minutes will trigger extra uncertainty available in the market, which doesn’t favor the Bitcoin value. Before now, market members confidently predicted that the US Federal Reserve would minimize rates of interest by one other 50 bps at its November FOMC assembly.

However, the September FOMC minutes present that market members can’t be too assured a few fee minimize, a lot much less a 50 bps fee in November. The Fed officers said on the FOMC assembly that they might proceed to watch the “implications of incoming information for the economic outlook” in assessing the suitable stance of financial coverage.

The Committee added that they might be ready to regulate financial coverage as applicable if any dangers arose that would impede their aim of reaching 2% inflation.

According to the Fed minutes, the Committee’s assessments will take into account a variety of knowledge. This will embrace readings on “labor market conditions, inflation pressures and inflation expectations, and financial and international developments.”

Part of the knowledge that the Fed will give attention to consists of the Consumer Price Index (CPI) inflation information, which is able to come out tomorrow. The US CPI information was already in focus, as the US Jobs information, which got here out final week, dampened hopes a few 50 bps fee minimize.

The Fed September minutes have solely additional dampened these hopes, leaving merchants unsure about whether or not to allocate extra capital to the flagship crypto. Such market uncertainty isn’t good for the Bitcoin value since traders can be apprehensive about investing throughout this era.

Upcoming US Presidential Elections Also Another Factor

The fast-approaching US presidential can be contributing to the present uncertainty available in the market. Besides the Fed minutes and whether or not or not there can be fee cuts in November, traders are additionally cautious concerning the potential consequence of the elections.

The market usually witnesses numerous volatility throughout this era, which explains why many traders might go for capital preservation. Interestingly, Bernstein analysts predict the Bitcoin value may take pleasure in an upward development forward of the elections if Donald Trump’s possibilities on the polls improve.

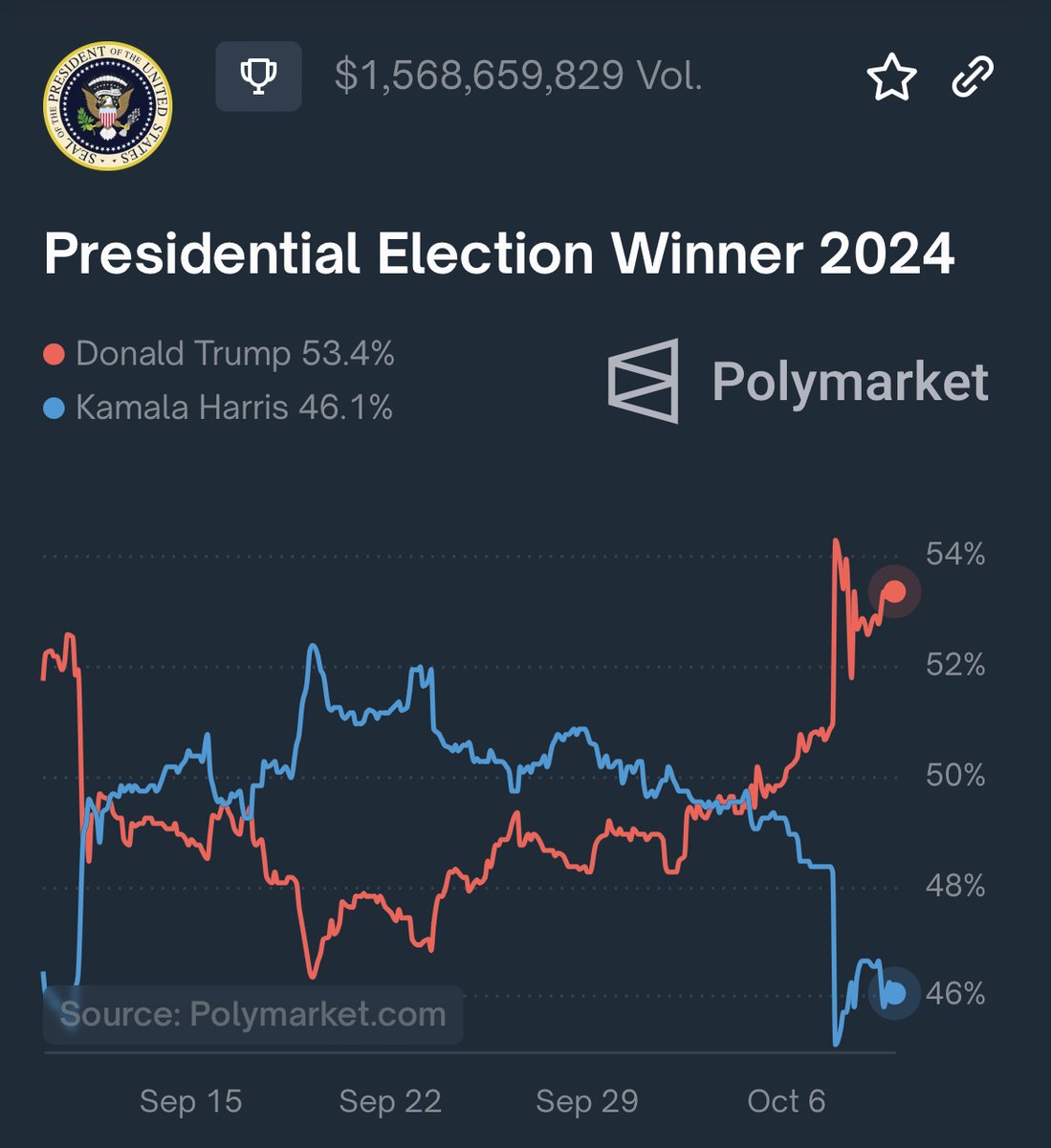

The newest Polymarket odds present that Donald Trump is up by over 7%, with the previous US president boasting a 53% likelihood of changing into the subsequent US president, whereas Kamala Harris’s odds are at 46%. These Berstein analysts say that the BTC value may attain as excessive as $90,000 if Trump ultimately wins.

However, historical past means that BTC will attain a brand new all-time excessive (ATH) after the elections, no matter who wins the elections. According to the Fed minutes, the November FOMC assembly will begin on the sixth, only a day after the US elections.

Meanwhile, it’s price mentioning that veteran dealer Peter Brandt predicted a BTC rally to $135,000 by August or September 2025. This is across the interval BTC may peak on this market cycle.

Disclaimer: The introduced content material might embrace the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability to your private monetary loss.