In a latest evaluation, a high skilled predicts a possible BTC rally to $135,000, sparking market optimism. This prediction comes amid a flurry of latest bullish forecasts for Bitcoin value, which have additional fueled discussions available in the market. However, it’s price noting that the skilled has additionally issued a warning, which has caught the eyes of the traders, particularly because the flagship crypto fell under the $62K mark right this moment.

Top Expert Foresees BTC Rally To $135K

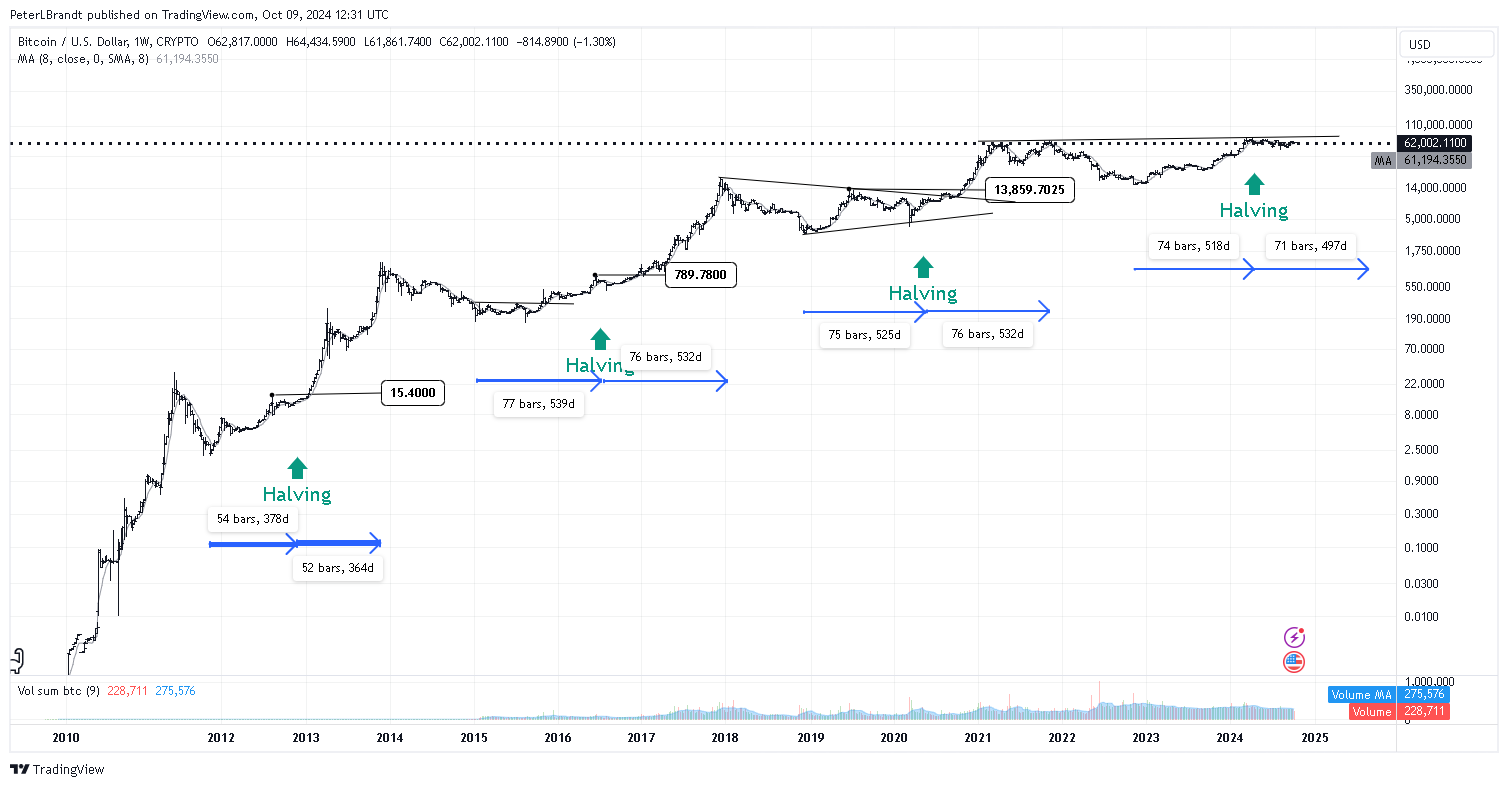

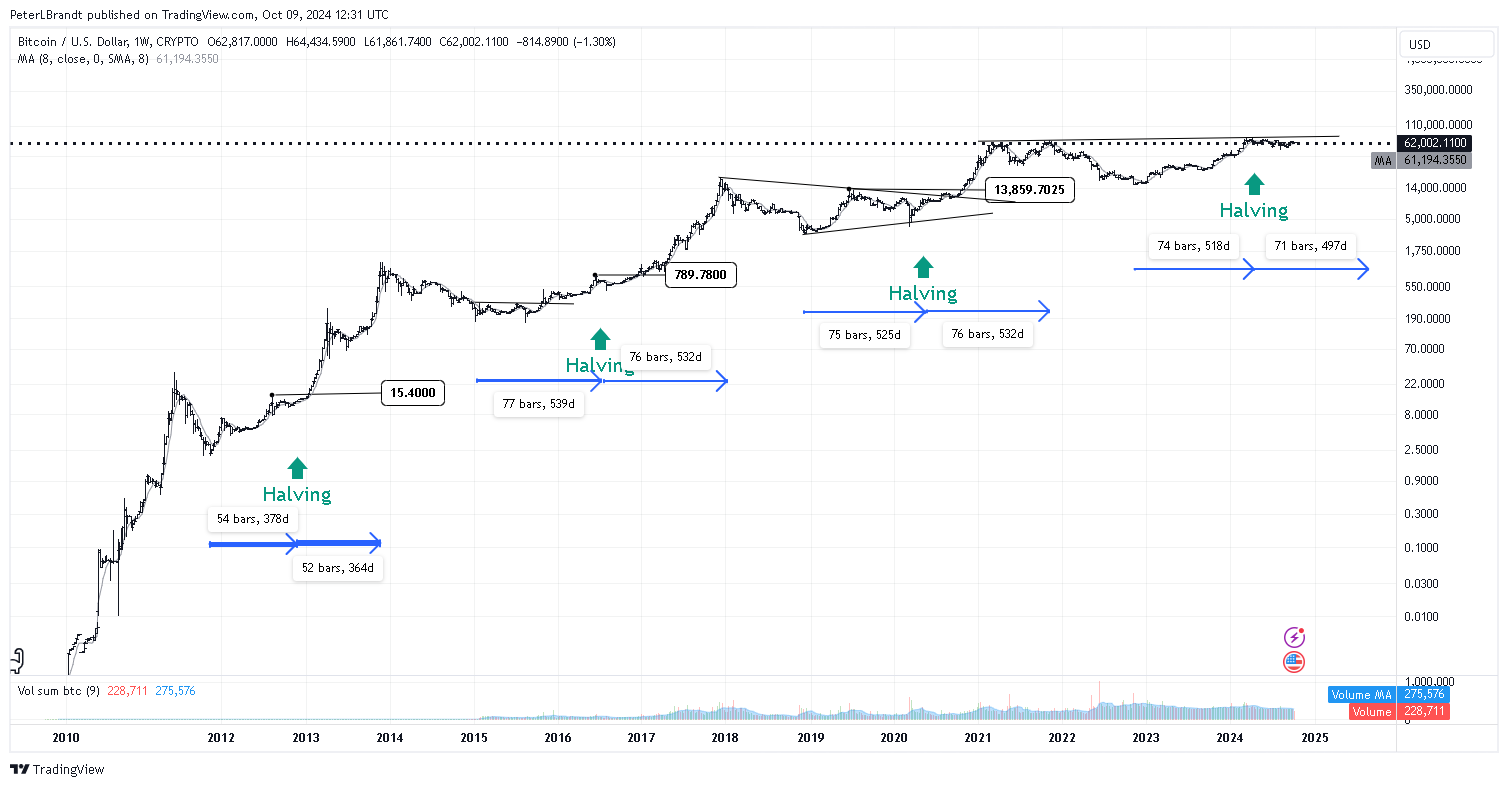

In a latest X publish, veteran crypto dealer and skilled Peter Brandt shared a bullish outlook suggesting a possible BTC rally. In his publish, Brandt highlighted key observations from Bitcoin’s macro image, noting that important features sometimes happen within the latter half of halving cycles. He believes the present interval, ranging from March 2024, is merely a quick pause within the ongoing upward pattern.

Meanwhile, Brandt predicts that Bitcoin value will hit $135,000 by August or September 2025. This daring forecast has sparked discussions within the crypto market over a possible rally within the crypto’s value.

However, he cautioned {that a} shut under $48,000 would invalidate his chart evaluation. This warning means that the $48,000 stage serves as a vital help threshold for Bitcoin’s continued progress.

Meanwhile, Brandt’s forecast aligns with the broader optimism amongst crypto fanatics, underscoring the potential for substantial features within the close to future. For occasion, one other fashionable crypto market analyst, Bob Loukas predicts a BTC rally to $150,000 on this bull cycle, echoing Brandt’s bullish forecast.

What’s Next For Bitcoin Price?

During writing, BTC price fell over 1.2% and exchanged palms at $61,934, whereas its buying and selling quantity fell 16% to $26.14 billion. Notably, the crypto has touched a excessive of $63,174.31 and a low of $61,724.88. Besides, CoinGlass information confirmed that Bitcoin Futures Open Interest rose barely right this moment regardless of the worth decline, indicating the market’s regaining confidence in the direction of the flagship crypto.

In addition, in a latest report, Bitwise CIO Matt Hougan predicts a BTC rally to $80,000 within the fourth quarter, citing a number of causes. For occasion, he stated that the upcoming US election and potential Fed fee cuts would help the rally within the final quarter of the yr.

Meanwhile, this additionally comes in step with the market expectations over a possible rally within the fourth quarter. Historically, Bitcoin and different top altcoins have a tendency to offer a optimistic efficiency within the closing quarter of the yr, in addition to in October. Besides, a latest Bitcoin price analysis hints that crossing a quick help stage would set off a rally to $70K for the crypto within the coming days.

Disclaimer: The offered content material could embrace the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability in your private monetary loss.