Ethereum (ETH) has seen a ten.3% drop from final week’s highs following the current market downturn. Its efficiency has frightened many analysts and traders, contemplating ETH could possibly be close to one other correction.

Related Reading

Ethereum Whales Send Millions To Exchanges

Ethereum has struggled to reclaim some key resistance ranges because the October 1 correction. On Tuesday, the cryptocurrency noticed its value nosedive from the $2,600 zone to the $2,300 mark, hovering between the decrease and better vary of that assist degree for the previous few days.

Since then, information of a number of traders shifting their tokens has hit the trade, alarming the group. On-chain analytics agency Lookonchain revealed that an Ethereum Initial Coin Offering (ICO) participant bought their tokens because the market bleed.

Per the report, the whale deposited 12,010 ETH, value $31.6 million, to Kraken every week in the past after being inactive for 2 years. The identical tackle bought one other 19,000 ETH two days in the past, round $47.54 million.

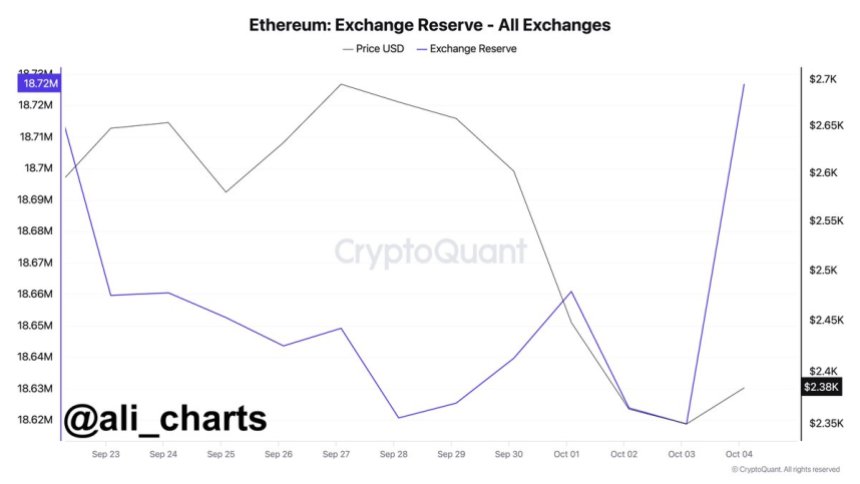

Today, crypto analyst Ali Martinez highlighted that on October 3, roughly $259.2 million value of ETH had been despatched to crypto exchanges. According to the CryptoQuant information shared by Martinez, 108,000 ETH have been despatched to exchanges within the final 24 hours, considerably rising from the day earlier than.

The information continued to gas the bearish sentiment amongst many group members, who’re upset about Ethereum’s efficiency and worry ETH’s value may quickly face vital promoting strain.

Will ETH Revisit Lower Levels Soon?

Crypto investor Ted Pillows noted that ETH has been “one of the most underperforming cryptos in 2024.” Despite the approval of Ethereum spot ETFs (exchange-traded funds), the crypto has “underperformed almost every large cap.”

He additionally identified that ETH surged alongside Bitcoin every time the market was up however dropped considerably more durable when the market struggled. “Whenever BTC has pumped 5%, ETH has pumped 3%, but whenever BTC has dumped 5%, ETH has dumped 12%-15%,” he remarked.

However, Ted defined that each time Ethereum was thought of “dead,” like in 2020-2021, it has finally outperformed BTC. Based on this, the investor believes that ‘the king of Altcoins’ may face “one last flush” to $2,200 earlier than the reversal.

Similarly, dealer Crypto General suggested that the cryptocurrency may retest the $4,000 by subsequent month as he expects ETH to bounce from the present ranges. However, he asserted that if the value breaks the trendline, “we can easily see the price touching the $2100 level.”

Related Reading

Other market watchers identified that Ethereum should reclaim the $2,400 resistance degree to see a possible bounce towards $2,800. Previously, Daan Crypto Trades set the $2,850 resistance degree as one of many key levels to watch.

The analyst considers that reclaiming this degree would sign a pattern reversal for the cryptocurrency. This zone corresponds with the horizontal degree that began the February-March run to ETH’s yearly excessive of $4,090.

As of this writing, ETH has seen a optimistic value soar, presently buying and selling at $2,431. This efficiency represents a 4.3% surge within the each day timeframe.

Featured Image from Unsplash.com, Chart from TradingView.com