In his newest video evaluation titled “BITCOIN’S One Indicator Signaling LAST Major Dip,” Dan Gambardello, a famous crypto analyst with 370,000 subscribers on YouTube, delves into the most recent value motion of Bitcoin to forecast what may probably be the ultimate main dip. After dropping as little as $60,000 on Wednesday, the worry of one other deeper value crash has grabbed the Bitcoin market.

Why This Could Be The Final Leg Down For Bitcoin

Gambardello emphasizes the importance of the every day and six-hour charts. On the every day chart, Bitcoin is at present testing the 50-day shifting common, a degree that always serves as a litmus take a look at for short-term market sentiment.

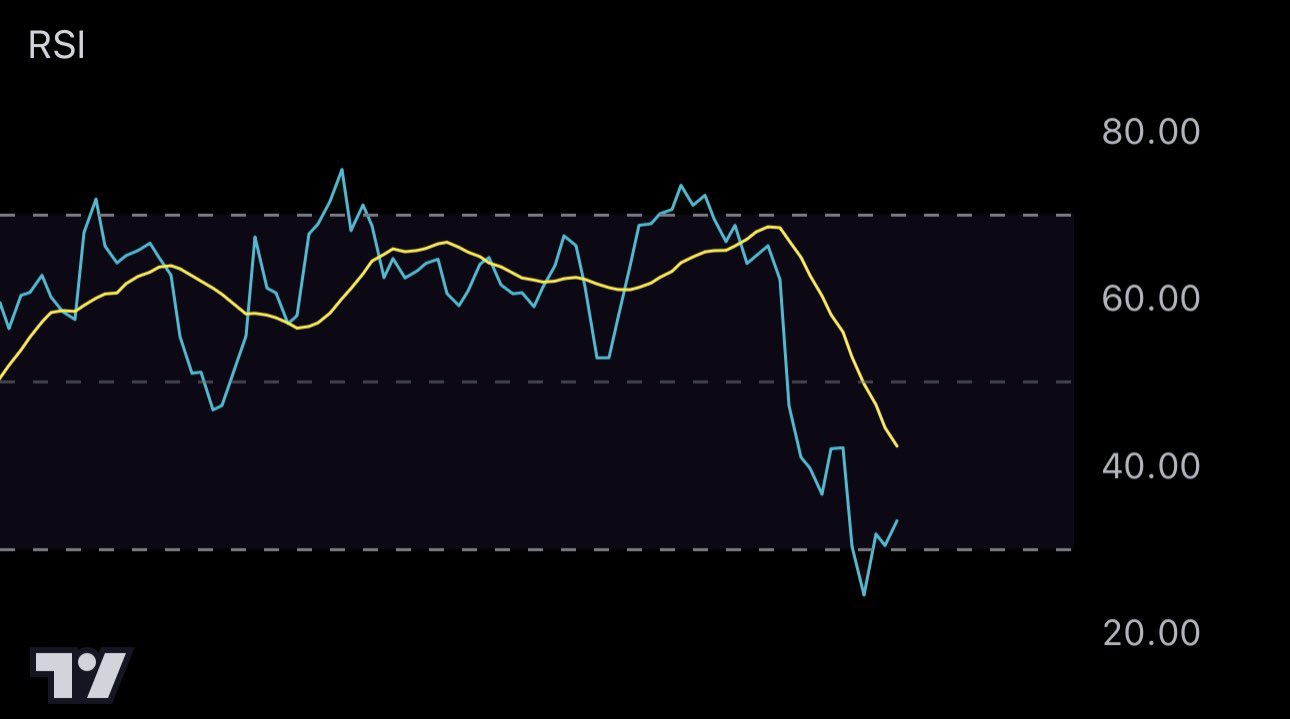

However, the analyst’s important focus is on the six-hour chart’s Relative Strength Index (RSI), a momentum oscillator used to measure the velocity and alter of value actions, which has hit oversold ranges. According to Gambardello, the RSI reaching oversold territory is historically considered as a bullish sign, probably indicating an approaching finish to the present value dip.

Related Reading

“The bottom is actually, I think, close. There could be some type of capitulation in the very short term, but I think there could be a very strong bounce after that happens,” Gambardello famous, suggesting that regardless of the speedy market turmoil following the Israel-Iran conflict news, the basics level in direction of an eventual strong restoration.

Via X, Gambardello added, “Nothing like a 6 hour oversold RSI at the beginning of bull season. Also great during bull season.”

This assertion is grounded in his evaluation of previous market behaviors throughout related situations, reinforcing the cyclical nature of Bitcoin’s market dynamics. Drawing parallels to historic information, Gambardello highlights the behavioral developments of Bitcoin in earlier Octobers, noting a sample of preliminary declines adopted by robust recoveries by the tip of the month.

“October will close green. It’s always [like this] with the dip. People are just freaking out. I guess that’s it, but this gives us a little time. We’re getting all these red candles going into October, give us another week, maybe even two and we could get a pump, a breakout to the upside to end October,” Gambardello claims.

Related Reading

Further deepening the evaluation, Gambardello discusses the potential situations round Bitcoin’s decrease pattern line, a recurrent help degree over the previous six months. He speculates that if Bitcoin approaches this pattern line once more, it may successfully function a sturdy help degree, probably marking the final vital downturn earlier than a sustained upward pattern.

Notably, one ultimate contact of the trendline may deliver down the BTC value as little as $50,000. However, Gambardello thinks that it is a much less doubtless situation because the 6-hour RSI has already hit oversold territory whereas BTC is at present bouncing off the 50-day shifting common.

Moreover, Gambardello refers to Bitcoin’s efficiency in previous halving years, that are sometimes adopted by bull markets, as seen in 2016 and 2020. Gambardello means that the present yr may comply with the same trajectory. “This is a Halving year. We’ve seen what’s happened in Halving years in 2020 and 2016 in October. Is it going to repeat?”

At press time, Bitcoin traded at $60,899.

Featured picture created with DALL.E, chart from TradingView.com