Crypto analyst Mikybull Crypto has supplied a bullish outlook for the Bitcoin value, predicting that the crypto will, by late October, take pleasure in a breakout following a wave 5 impulsive transfer to the upside. His prediction comes amid a few exterior elements that threaten to ship BTC beneath $60,000 because the detrimental begin to ‘Uptober’ continues.

Bitcoin Price Breakout To Happen This Month

Mikybull Crypto predicted in an X put up that the BTC value breakout will occur this month. Specifically, he acknowledged that the breakout into wave 5 growth ought to occur on the “estimated 22nd of this month.” He added that for now, market contributors should survive the wave 4 inconveniences of prolonged correction. He additionally suggested buyers to not get shaken out because the breakout is already close to.

The accompanying chart he shared confirmed that Bitcoin may attain between $95,000 and $120,000 when this wave 5 growth happens. This implies that the flagship crypto could possibly be set to hit a brand new all-time excessive (ATH) this month. However, the analyst didn’t say if it will mark the cycle prime for the Bitcoin value.

His prediction aligns with that of 10x Research founder Markus Thielen, who predicted that BTC will reach a new ATH by late October. However, Thielen gave a extra conservative prediction, highlighting $75,000 as the worth goal that BTC may attain by late October. This remains to be above Bitcoin’s present ATH of $73,000.

The Wave 4 Extended Correction Could Lead To Lower Prices

The wave 4 prolonged value correction, which Mikybull Crypto talked about, may result in decrease costs for BTC. The Bitcoin value is already vulnerable to dropping to $57,000 amid Israel’s imminent attack. Therefore, there’s a chance that the flagship crypto may quickly lose its essential assist degree at $60,000.

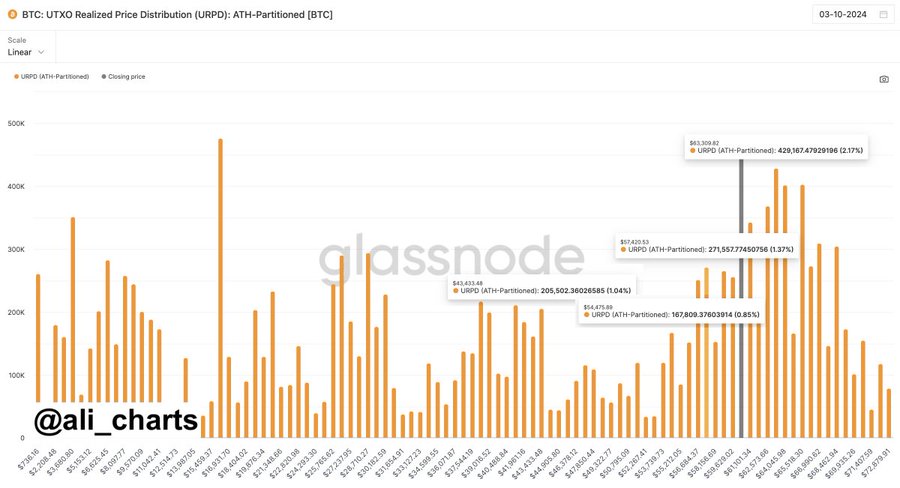

Crypto analyst Ali Martinez additionally supplied insights into how BTC may drop to $57,000. The analyst acknowledged that $60,365 is the important thing degree to look at. He added that the crypto may fall to $57,420 if there’s a breakdown beneath $60,365. However, if Bitcoin holds above this degree, he remarked {that a} rebound to $63,300 is on the desk.

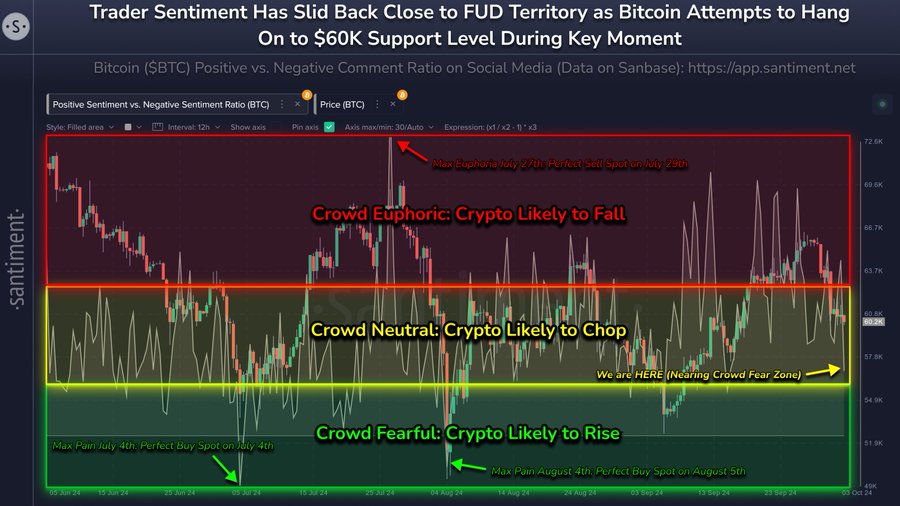

The on-chain analytics platform Santiment prompt {that a} additional value correction could possibly be good for the Bitcoin value. The platform famous that the group had significantly cooled its pleasure towards the crypto market since BTC retraced from its native excessive of $66,400 recorded on September 27. According to Santiment,

This change in temper is encouraging, contemplating markets usually all the time transfer the other way of the group’s expectation.

The Macro Side Is Still One To Keep An Eye On

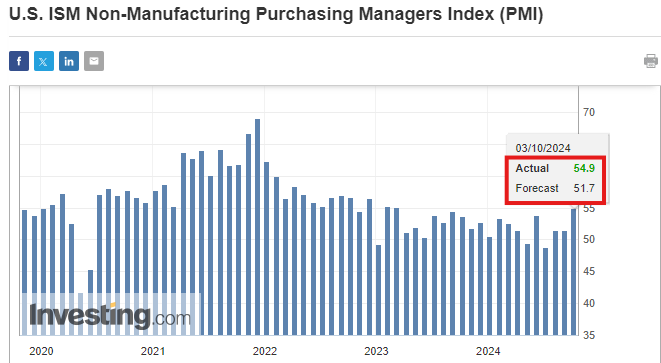

Amid these projections for the Bitcoin value, the macro aspect remains to be one to regulate because it may decide BTC’s trajectory. Market commentator The Kobeissi Letter lately talked about that nothing provides up out there in the meanwhile as a result of the info and the Fed’s narrative don’t align. They additionally remarked that the market appears to be beginning to value in one other rebound in inflation.

The Kobeissi Letter cited the ISM Non-Manufacturing PMI knowledge, which got here in hotter than anticipated. This was the most popular studying since January 2023. Therefore, there’s the likelihood that the US economic system isn’t as wholesome as Fed Chair Jerome Powell has made it look to this point. All eyes will probably be on the Jobs report knowledge, which can come out on October 4.

The jobs report will present if the labor market is certainly stable, as Powell has indicated to this point. It will present insights into the Fed’s doubtless steps throughout its subsequent FOMC assembly in November.

The US Central Bank has hinted that there could possibly be extra fee cuts earlier than year-end. However, they may nonetheless maintain again if the incoming inflation knowledge doesn’t align with their expectations.

Disclaimer: The offered content material could embody the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability in your private monetary loss.