The Bitcoin worth might drop to as little as $57,000, in keeping with a latest prediction by standard analyst Justin Bennett. Israel’s imminent assault in opposition to Iran might be what results in this worth decline, contemplating how the flagship crypto dropped to $60,000 following Iran’s missile assaults in opposition to Israel. However, BTC’s long-term outlook remains to be bullish as a number of tailwinds lie forward on this fourth quarter.

Bitcoin Price To Drop To $57,000

Bennett predicted on his X platform that BTC might drop to $57,000. This got here following his assertion that the vary between $57,000 and $58,000 is the world to observe for Bitcoin to remain “constructive.”

The analyst additionally indicated that the flagship crypto was in bearish territory, stating that the one manner for the BTC worth to flip bullish is that if it reclaims $62,000. The analyst claimed that the bears are in management till then and that dropping under $60,000 is feasible.

The Bitcoin worth and altcoins are presently facing huge selling pressure due to the escalation within the Israel-Iran battle. Although BTC dropped to as little as $60,000 following Iran’s strike on Israel, it has since loved a reduction rally again above $61,000. However, Bennett warned market members to watch out with this rally.

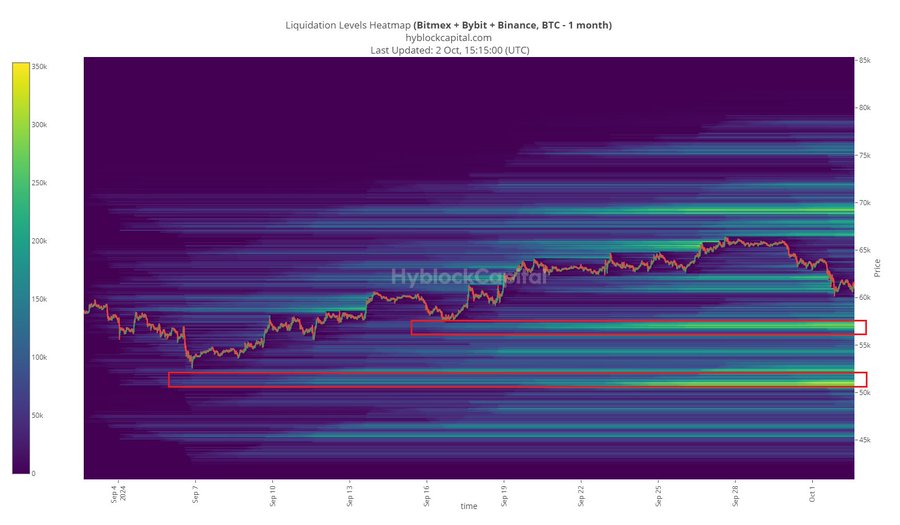

The analyst acknowledged that the failure at $64,700 has opened up a sell-side liquidity. He famous that the BTC worth already dropped to his first goal of $60,000 and remarked that $57,000 “remains open for business.” Interestingly, he added {that a} case might be made for a worth drop to $51,000, however he stated it’s unlikely in the intervening time.

Israel’s Imminent Strike Against Iran Could Spark Price Decline

Israel’s imminent strike in opposition to Iran might trigger the Bitcoin worth to drop to $57,000. Reports popping out of Israel are that the nation plans to answer the Iranian assault, which occurred on October 1. Israel’s Security Cabinet is claimed to have met and is planning an assault that might be worse than the one in April, which led to the killing of a high Iranian common in Syria.

Israel’s plan to assault Iran has additionally led to considerations that this might end in a full-blown struggle within the area. Such a improvement will result in extra worry and uncertainty out there, sparking a wave of sell-offs and inflicting costs to say no additional.

The Israel-Iran stress has already affected the crypto market rally, which was meant to start this ‘Uptober.’ Therefore, a strike from Israel will solely worsen issues and ship the Bitcoin worth tumbling, with the broader crypto market additionally struggling an identical destiny.

Long-Term Outlook Is Still Bullish

BTC’s long-term outlook remains to be bullish, contemplating a number of occasions might act as tailwinds for the flagship crypto. For occasion, on the macro facet, the US Federal Reserve might nonetheless minimize rates of interest by one other 50 foundation factors (bps) earlier than the yr ends. China is already injecting liquidity into its economic system. Global liquidity is surging thanks to those financial easing insurance policies, which is a optimistic for the Bitcoin worth.

Furthermore, FTX will distribute $6 billion as a part of buyer repayments. These customers will obtain their repayments in money and will once more pump this liquidity into BTC and the broader crypto market.

Meanwhile, the US presidential election is 34 days away. The aftermath of the election has traditionally been bullish for the BTC worth because it offers certainty to the market. Irrespective of who wins between Donald Trump and Kamala Harris, the flagship crypto might hit a brand new excessive as soon as the election ends.

Disclaimer: The introduced content material could embrace the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty in your private monetary loss.