The US Federal Reserve Chair Jerome Powell has maintained a dovish stance on with the ability to convey inflation all the way down to their goal of two%. While talking on the 66th NABE annual assembly, Powell additionally hinted that any extra potential charge cuts this 12 months could be primarily based on the incoming inflation information. This growth is critical contemplating how a lot the Fed’s quantitative easing (QE) measures will have an effect on the Bitcoin worth.

Jerome Powell Is Confident That They Can Bring Inflation To 2%

Powell said on the 66th NABE annual meeting that they’re assured that inflation is on a sustainable path to dropping to their goal of two%. He additional talked about that they’re assured that the US economic system is robust total.

The labor market is an space that has drawn considerations that the US economic system won’t be as wholesome because it appears. However, the Fed chair said that the labor market is stable, having cooled off from its risky state two years in the past. He added that they don’t consider they should see extra cooling within the labor market to be assured that they’re on observe to reaching the two% inflation goal.

Meanwhile, Jerome Powell additionally steered that the Fed is in no hurry to chop rates of interest any additional this 12 months. At the September FOMC assembly, the Fed Chair had said that there could be two extra 25 foundation factors (bps) charge cuts this 12 months.

However, in his newest speech, he warned that additional charge cuts this 12 months will rely on the incoming inflation information. He mentioned that they might proceed to evaluate the US economic system meeting-by-meeting. The constructive is that Jerome Powell is assured that the economic system is on target. He additionally assured that they received’t hesitate to chop charges if the inflation information is favorable.

Powell mentioned there might be one other 50 bps charge reduce this 12 months if these inflation information are favorable. This aligns with Federal Reserve’s Raphael Bostic, who hinted that he may favor one other 50 bps reduce this 12 months.

Will The Bitcoin Price Continue To Rally

Despite Jerome Powell not asserting that there might be extra charge cuts this 12 months, the Bitcoin worth nonetheless boasts a bullish outlook and will proceed its rally. The buying and selling agency QCP Capital just lately alluded to international financial easing insurance policies from international locations like China whereas stating that they anticipate BTC to profit from such measures, given its standing as a risk-on asset. Moreover, Bitcoin is coming into the fourth quarter, when it data its most returns within the 12 months.

It is price mentioning that BTC is heading for a constructive month-to-month shut in September. Historically, each time that occurs, the flagship crypto additionally closes in October, November, and December within the inexperienced. Therefore, the Bitcoin worth is anticipated to increase its rally in October. Moreover, the crypto has solely recorded adverse returns in October twice.

QCP Capital steered that Bitcoin wants to interrupt above $70,000 to achieve new highs. 10x Research founder Markus Thielen predicted that BTC could reclaim $70,000 within the subsequent two weeks. Thielen additionally predicted that the flagship crypto will attain a brand new all-time excessive (ATH) by late October.

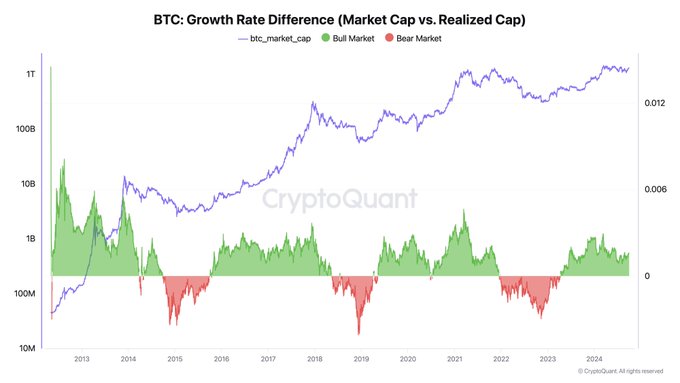

Whatever occurs in October, the BTC worth worth nonetheless boasts a bullish outlook in the long run. Cryptoquant’s CEO Ki Young Ju just lately said that the crypto continues to be in the course of a bull cycle. He accompanying chart confirmed that the Bitcoin nonetheless has some room to maneuver to the upside earlier than its worth peaks on this bull run.

Disclaimer: The introduced content material might embody the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability on your private monetary loss.