Ethereum, the second-largest cryptocurrency by market capitalization, has but to reclaim the $3,000 value degree since early August. Since the start of September, Ethereum has principally traded under $2,600, however this week introduced a glimmer of hope for buyers because it lastly managed to interrupt above the $2,600 threshold.

Now that this resistance threshold has been damaged, the next outlook is a continued surge up till the $3,000 value degree. An evaluation on the CryptoQuant platform factors to a possible catalyst for this transfer to the upside. Notably, this evaluation identifies an rising bullish pattern in Ethereum’s funding charges as a vital catalyst.

Bullish Shift In Funding Rates

According to an ETH analysis on CryptoQuant by ShayanBTC, Ethereum’s 30-day transferring common of funding charges has seen a slight however noticeable bullish shift after an prolonged interval of decline. This change means that merchants are as soon as once more becoming more confident in Ethereum’s value efficiency, significantly after the recent Fed interest rate cut.

ETH Funding charges seek advice from the periodic funds made between merchants to keep up the worth of perpetual futures contracts close to the spot value of the cryptocurrency. When the funding charges shift positively, it typically signifies that lengthy positions are extra dominant, which might create upward value strain.

The significance of the funding charges was emphasised by the analyst, particularly contemplating the prospect of a bullish fourth quarter of the 12 months. Notably, they echoed that for Ethereum to proceed its restoration and goal increased value ranges, the demand within the perpetual futures market should hold rising within the coming weeks. A small decline within the funding charges might cascade right into a fall in bullish momentum.

Ethereum Staging A Return To $3,000?

Ethereum’s latest breakout above $2,600 is the primary sign of a significant shift in market sentiment. After weeks of buying and selling under, the $2,600 value degree appears to have now change into a vital assist zone for the cryptocurrency. Interestingly, this breakout units the stage for the return of ETH to $3,000, with the funding charges enjoying a vital half.

At the time of writing, Ethereum is buying and selling at $2,610 and is up by 8% prior to now seven days. Notably, this value enhance is extra noticeable from a low of $2,171 on September 6, reflecting a 20% enhance since then.

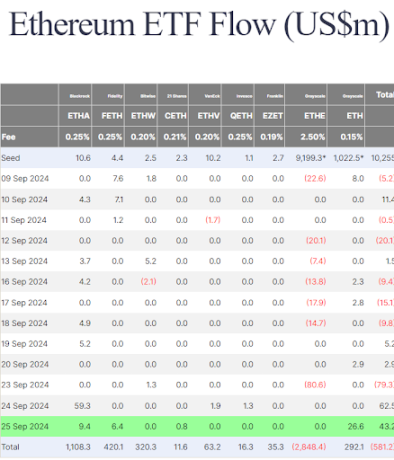

The optimistic sentiment surrounding Ethereum can be transferring in direction of institutional buyers, which is mirrored through Spot Ethereum ETFs. According to stream knowledge, the ETFs, which initially began the week with a internet outflow of $79.3 million on Monday, have now witnessed two consecutive days of $62.5 million and $43.2 million, respectively, on Tuesday and Wednesday. The mixture of those inflows might play a big function in whether or not Ethereum can breach the $3,000 value degree and maintain above within the coming weeks.

Featured picture created with Dall.E, chart from Tradingview.com