The MSTR inventory has outperformed all firms on the S&P 500 because the MicroStrategy Bitcoin adoption started in 2020. The software program firm has continued to build up the flagship crypto due to its former CEO and co-founder, Michael Saylor. This transfer has paid off up to now, contemplating MSTR’s efficiency since then.

MSTR Stock’s Performance Since MicroStrategy Bitcoin Adoption

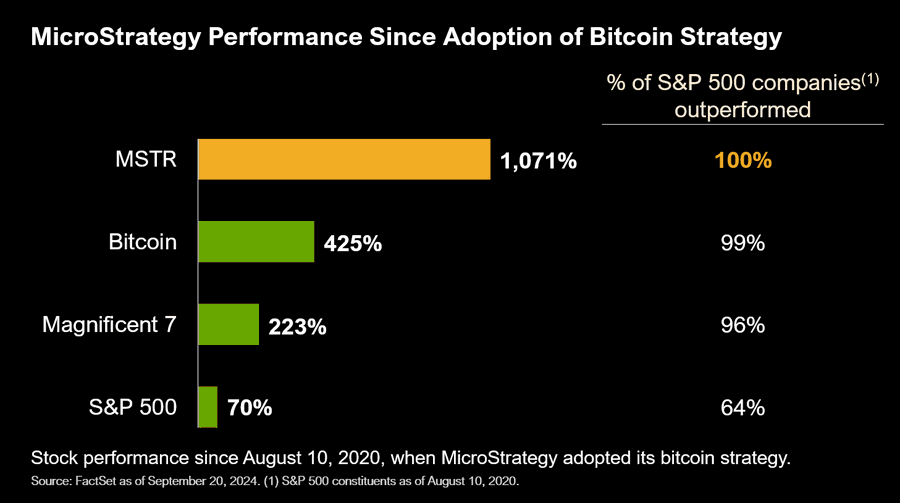

In an X publish, Micheal Saylor highlighted MSTR’s efficiency because the software program firm adopted Bitcoin in 2020. Based on the information he shared, MicroStrategy’s inventory has outperformed 100% of the S&P 500 firms since they started buying BTC.

Interestingly, the MSTR stock price has additionally outperformed Bitcoin over the past 4 years. Since MicroStrategy Bitcoin adoption, the corporate’s inventory has surged by over 1,000%. Meanwhile, BTC and the S&P 500 have surged by 425% and 70%, respectively.

MicroStrategy’s co-founder, Michael Saylor, pushed for the software program firm to start shopping for the flagship crypto, and his guess on BTC has undoubtedly paid off. Thanks to this Bitcoin technique, many institutional traders have lengthy regarded the corporate as an avenue to realize publicity to the flagship crypto. This explains how the MSTR inventory has achieved such immense development.

There have been projections that MicroStrategy was going to lose its Bitcoin edge following the launch of the Spot Bitcoin ETFs. However, that hasn’t been the case, with MSTR boasting a year-to-date (YTD) achieve of over 120%.

Meanwhile, MicroStrategy Bitcoin adoption has continued to develop. The company recently bought 7,420 BTC ($458.2 million). Before this buy, it had additionally purchased $1.11 billion value of Bitcoin, its single largest purchase so far. The agency presently holds 252,220 BTC at a median value of $39,266 per Bitcoin.

Michael Saylor Expects Institutional Adoption To Grow

Michael Saylor lately claimed that the approval of choices buying and selling for BlackRock’s Spot Bitcoin ETF will “accelerate” Bitcoin adoption. The SEC approved options for the IBIT ETF on the Nasdaq trade, which is anticipated to develop the Bitcoin ETF market and additional entice extra institutional traders, similar to Saylor predicts.

Bloomberg analyst Eric Balchunas shared the same sentiment, remarking that the choices buying and selling will “attract more liquidity, which will in turn attract more big fish.”

Binance CEO Richard Teng additionally lately acknowledged that the institutional adoption witnessed up to now is simply the tip of the iceberg. He expects extra institutional traders to allocate crypto quickly sufficient as soon as they’ve accomplished their due diligence.

However, it stays unlikely that any of those establishments can match MicroStrategy Bitcoin funding. For context, the corporate holds virtually 1.2% of BTC’s complete provide.

Disclaimer: The introduced content material could embody the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability on your private monetary loss.