Ethereum is agency when writing however continues to underperform versus Bitcoin. Though ETH is floating above $2,400, and will even break above $3,000 within the coming years, the speedy strengthening of the world’s most precious coin, alternatively, would possibly push the ETH/BTC ratio to multi-month lows.

ETH Struggling Versus Bitcoin, ETH/BTC Ratio Drops To A 40-Month Low

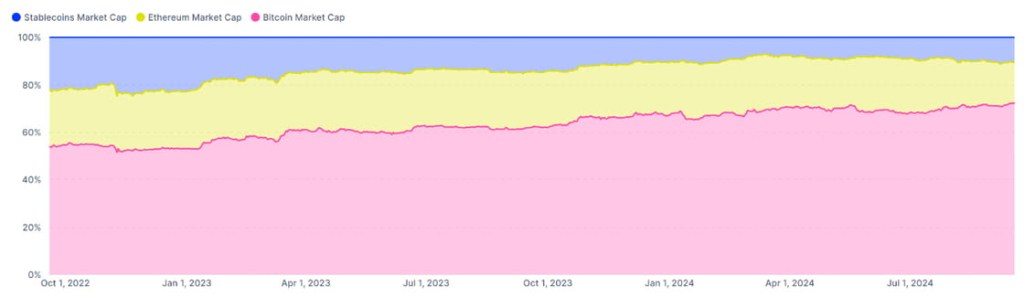

As of September 20, IntoTheBlock information reveals that ETH is buying and selling on the lowest degree versus Bitcoin in over 40 months. This pattern clearly exhibits that the market, even with the engagement of establishments, is bullish on BTC.

Interestingly, ETH continues to underperform regardless of the approval of spot Ethereum ETFs for buying and selling in July 2024. The approval of those complicated derivatives allowed establishments to get publicity to the second most precious coin throughout the legislation’s confines whereas not breaking the financial institution as they did.

Previously, establishments within the United States searching for to purchase ETH might solely achieve this by buying Grayscale ETHE shares. The drawback is that charges have been larger when the monetary world didn’t know the regulatory standing of ETH. Although nothing has modified, the approval of spot Ethereum ETFs, stopping issuers from staking cash purchased by shoppers, was seen as a win.

The United States Securities and Exchange Commission (SEC) has but to subject an official assertion endorsing ETH as a commodity much like Bitcoin. However, the Commodity Futures Trading Commission (SEC) has repeatedly acknowledged that ETH is a commodity.

With ETH sliding versus BTC, IntoTheBlock analysts are satisfied that institutional traders are assured of Bitcoin’s prospects. Specifically, they pointed to Bitcoin’s relative stability in comparison with Ethereum, an asset with the next risk-reward profile.

Will Ethereum Find Support?

Even with this evaluation, it needs to be famous that Bitcoin stays a transactional layer, using on its first-mover benefit. On the opposite hand, Ethereum is the primary good contracts platform, and hosts numerous improvements starting from DeFi, NFTs, and is now driving tokenization.

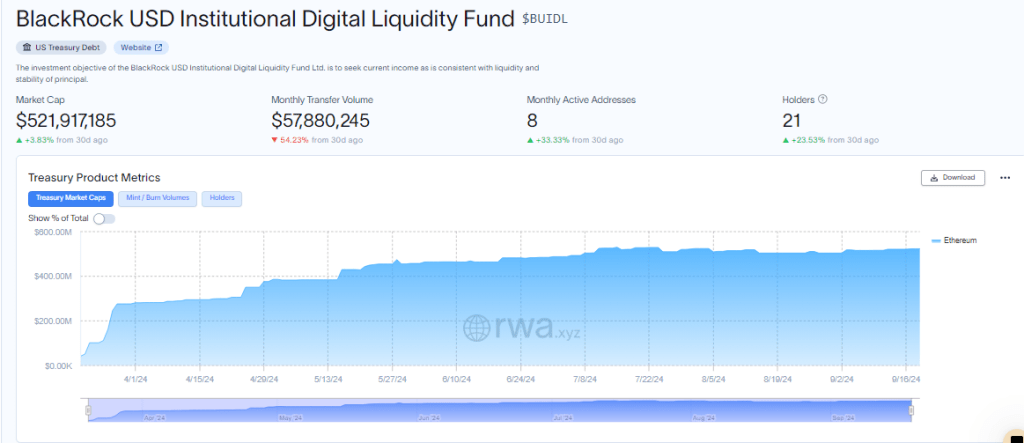

Earlier on, Larry Fink, the CEO of BlackRock, mentioned real-world asset (RWA) tokenization, most of which is finished on Ethereum, will rise to command a trillion in market cap. BlackRock has issued BUIDL, a product tokenizing United States Treasuries, on Ethereum.

It stays to be seen whether or not ETH will recuperate versus BTC. Looking on the each day chart, the pattern seems to be shifting, a minimum of within the rapid time period. The double-bar bullish formation of September 18 and 19 has been confirmed right now.

At the identical time, ETH appears to be strengthening, turning the nook from the 61.8% Fibonacci retracement degree of the 2020 to 2021 commerce vary.