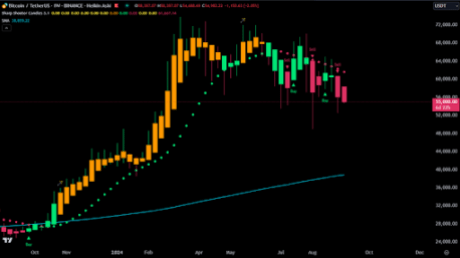

Crypto analyst Jesse Olson has highlighted the second consecutive Heikin Ashi sign on the Bitcoin (BTC) weekly chart. This comes regardless of Bitcoin’s latest rise to as high as $58,000, which suggests {that a} bullish reversal could be on the horizon.

What The Heikin Ashi Signal Means For Bitcoin

While highlighting the second consecutive Heikin Ashi on Bitcoin‘s weekly chart, Olson additionally famous that there was no wick to the upside, which means that the draw back development is prone to proceed. The crypto analyst had additionally beforehand defined how the absence of a wick to the upside indicators a power in momentum to the downside.

Related Reading

Based on Olson’s accompanying chart, Bitcoin might undergo additional downward stress and drop to as low as $40,000. This bearish evaluation comes amid Bitcoin’s restoration as its value rose to $58,000 within the final 24 hours. Although it stays to be seen whether or not it’s a reduction bounce or a bullish reversal, Olson’s evaluation means that it’s extra seemingly a reduction bounce.

However, crypto analyst Daan Crypto has suggested that Bitcoin must efficiently break above $60,000 to attain a bullish reversal and purpose for brand spanking new highs in this market cycle. Meanwhile, opposite to Olson’s bearish evaluation, crypto analyst Mikybull Crypto has offered a extra bullish outlook for Bitcoin.

In an X (previously Twitter) post, the crypto analyst acknowledged that Bitcoin has accomplished the bullish diamond formation. In line with this, Mikybull Crypto remarked that he believes the underside is in for Bitcoin if the bull market remains to be on.

In one other X post, Mikybull Crypto highlighted a bullish divergence just lately fashioned on Bitcoin’s chart, just like one in September 2023. Following the bullish divergence in September 2023, BTC skilled a major rally, which in the end paved the best way for reaching a new all-time high (ATH) in March earlier this 12 months. As such, one thing comparable might occur once more as Bitcoin tries to achieve new highs.

BTC’s Price Rally Could Begin After September

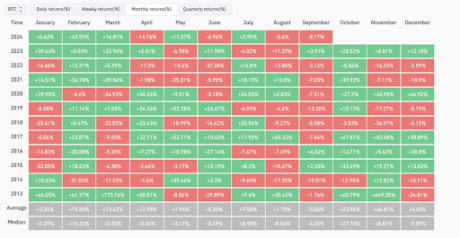

Considering Bitcoin’s historical bearish trend in September, the crypto neighborhood is optimistic that BTC might start its long-awaited value rally as soon as this month is over. In a latest evaluation, crypto analyst Rekt Capital defined why the flagship crypto would seemingly document huge positive aspects in October.

Related Reading

The crypto analyst famous that Bitcoin’s solely month-to-month losses in October have been in 2014 and 2018, when it recorded month-to-month losses of -12.95% and -3.83%, respectively. He added that these have been bear markets. However, Bitcoin is in a halving year, traditionally ushering within the bull market. As such, BTC might get pleasure from a bullish trip in October and even to the top of the 12 months, particularly with the upcoming US presidential elections in November.

At the time of writing, Bitcoin is buying and selling at round $56,600, up over 3% within the final 24 hours, based on information from CoinMarketCap.

Featured picture created with Dall.E, chart from Tradingview.com