Veteran Trader Peter Brandt lately turned bearish on Bitcoin, sparking considerations among the many crypto market fanatics. The crypto market, identified for its correct market predictions prior to now, pointed in direction of a collection of decrease highs and lows within the BTC value development. Besides, he highlighted a scarcity of momentum out there.

This downbeat sentiment has fueled discussions over additional corrections within the flagship crypto.

Peter Brandt Reveals Bearish Signs For Bitcoin

In a latest X put up, Peter Brandt shared his considerations concerning the present market construction of Bitcoin. He stated that the continued collection of decrease highs and lows of the crypto indicators a bearish development. In addition, he famous that the downward slope of the crypto’s lows displays a scarcity of vitality and shopping for curiosity, which is uncommon for the crypto, particularly in a post-halving section.

According to the market skilled, this sluggish value motion marks the longest time with no new all-time excessive in BTC’s post-halving historical past. Notably, the veteran dealer stated that he had measured the crypto cycles in a different way than most analysts.

In a separate put up, he stated that he began his cycle from the earlier bear market low, which was in November 2022, and tracks the height which came about in March 2024, earlier than the halving. He factors out that “not only has this high not been violated”, however Bitcoin’s inflation-adjusted excessive from the earlier bull cycle stays intact, including to his bearish outlook.

Meanwhile, his feedback have sparked debates amongst traders, with many in search of readability on the long run efficiency of the crypto. Notably, in accordance with Brandt’s evaluation, the flagship crypto is likely to be heading for extra draw back, if the market fails to regain momentum quickly.

What’s Next For BTC?

Adding to the bearish temper sparked by Peter Brandt’s evaluation, crypto skilled Ali Martinez additionally highlighted a vital technical sign for the flagship crypto. In a latest X put up, Martinez famous a development reversal on the Stochastic RSI, which shifted from bullish to bearish on the crypto’s 2-month chart.

He warned that traditionally, this sign has preceded important corrections of as much as 75.50% over the previous decade. Notably, this technical chart has additional intensified fears that the crypto could possibly be dealing with a considerable drop if previous patterns repeat.

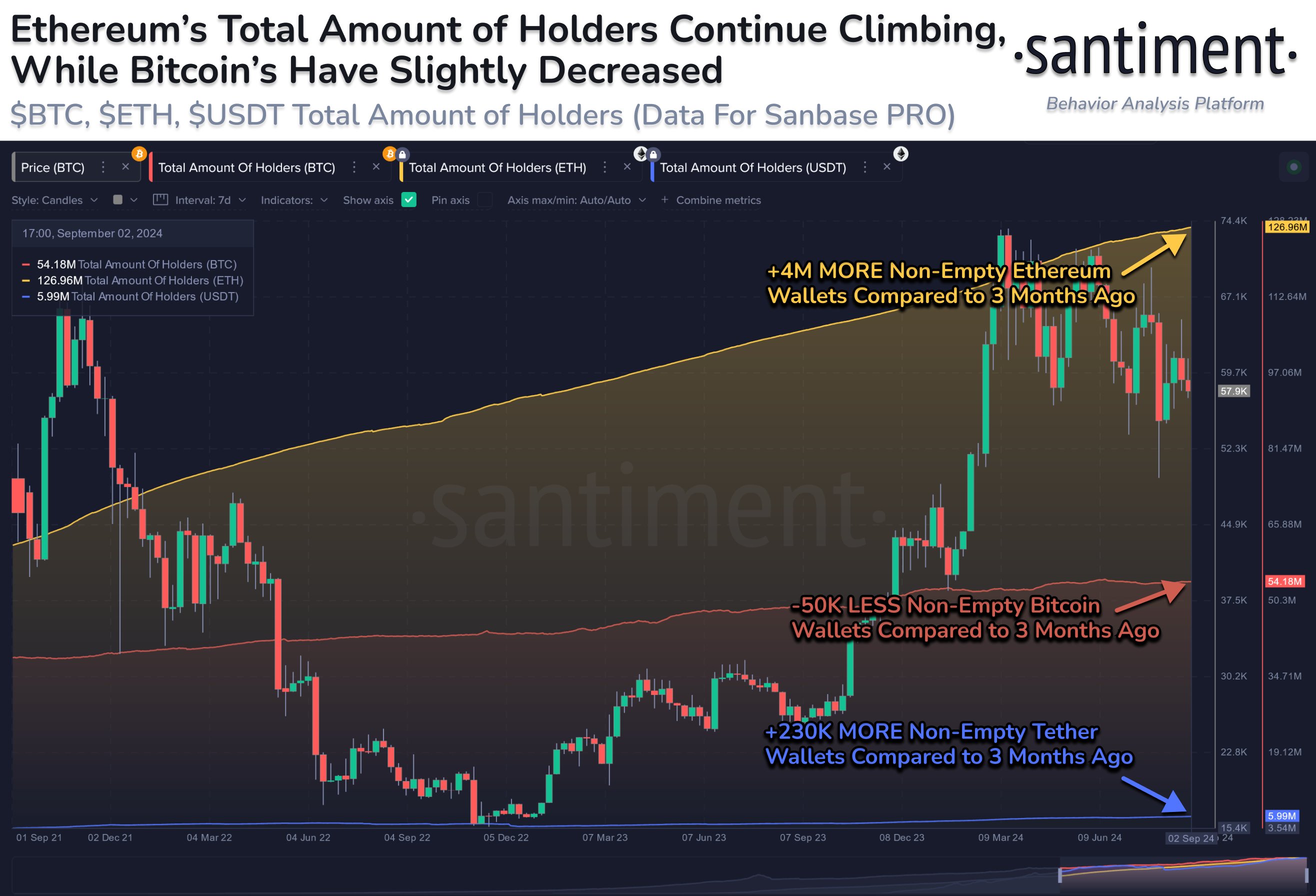

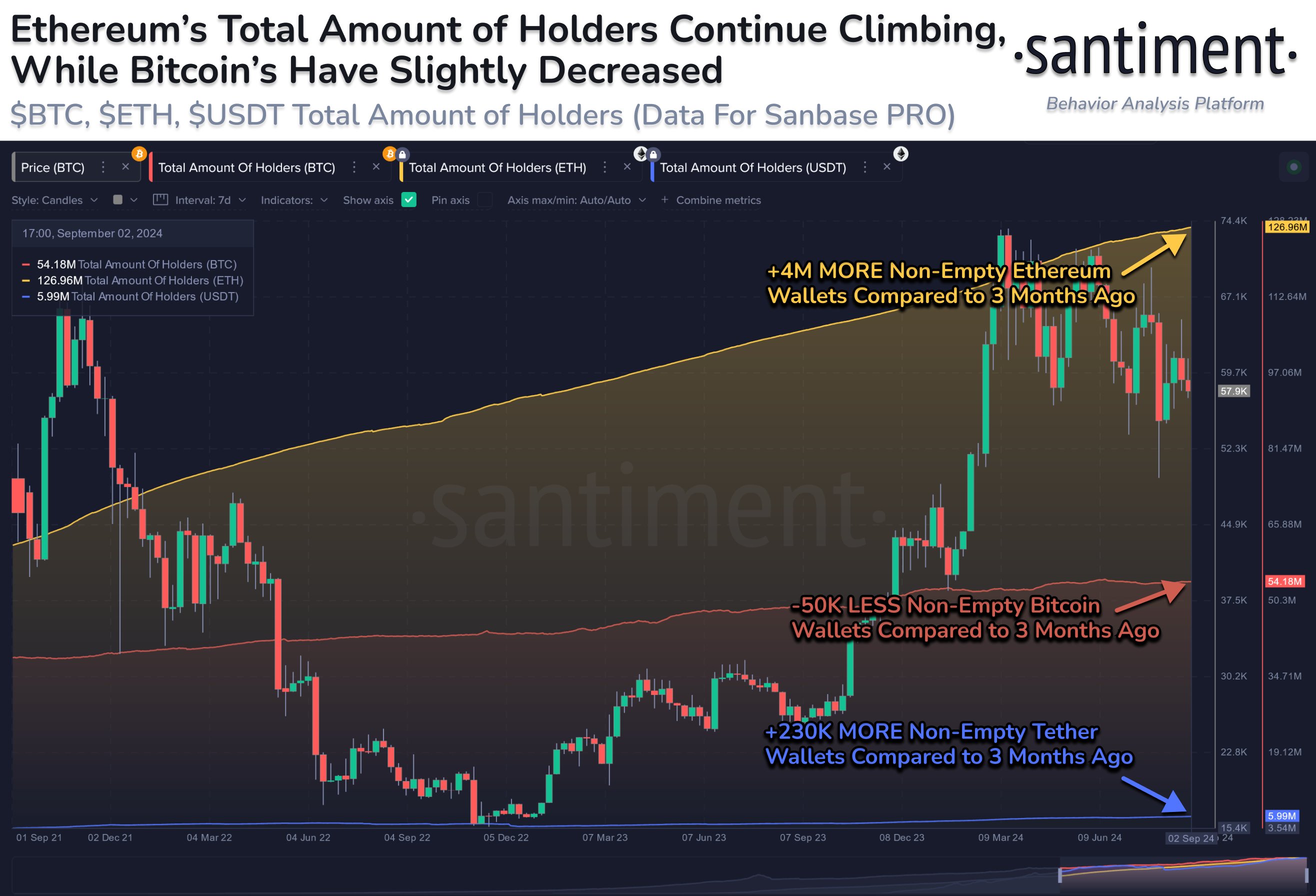

In addition, the most recent pockets development information, which reveals a divergence between the flagship crypto and different main cryptocurrencies, has additional weighed on market sentiment. According to a report from Santiment, the whole holders of the biggest crypto by market cap have declined by 0.1% over the previous three months, whereas Ethereum and Tether have seen important will increase in pockets development.

This development signifies a shifting investor choice in direction of different digital belongings, including stress on BTC’s value outlook.

Meanwhile, historic information additionally means that the crypto normally witnessed gloomy buying and selling in September. Despite that, some market consultants are nonetheless optimistic a couple of reversal development for BTC price, given the latest market traits. Optimism surrounding a possible 50 foundation factors price minimize by the US Federal Reserve has supplied some hope amongst traders.

However, contrasting financial indicators, such because the Bank of Japan hinting at an rate of interest hike, might negatively affect market sentiment, additional influencing BTC value trajectory. As of writing, Bitcoin value was down 1.02% to $57,840, with its buying and selling quantity declining 3.22% to $26.90 billion.

Disclaimer: The introduced content material might embody the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability in your private monetary loss.