- Bitcoin ETFs have attracted $5B internet inflows whereas Ether ETFs have seen $500M internet outflows.

- BlackRock’s IBIT leads with over $224M in a single day, at present holding over 350,000 BTC.

- Ether ETFs are struggling on account of liquidity points and Grayscale’s $2.5B outflows.

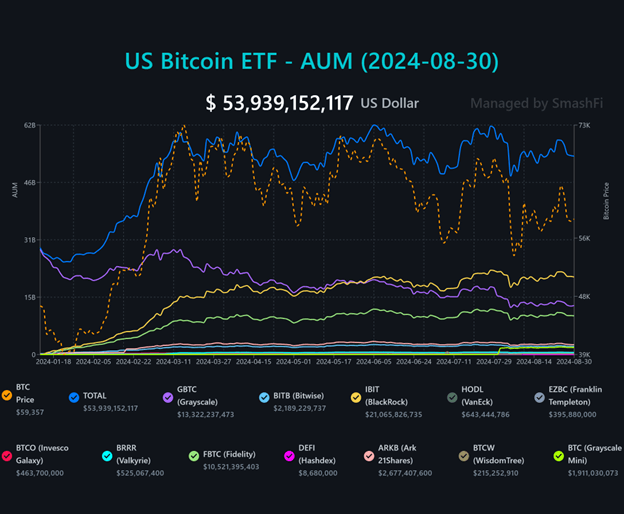

Recent traits within the cryptocurrency exchange-traded funds (ETF) market have highlighted a big divergence within the efficiency of Bitcoin and Ether ETFs.

Comparing Bitcoin ETF Flow data to Ethereum ETF Flow data on Farside Investors, Ether spot ETFs have underwhelmed in comparison with their Bitcoin counterparts. Since their launch, Ether ETFs have skilled internet outflows of roughly $500 million, a stark distinction to the $5 billion internet inflows recorded by BTC ETFs throughout an analogous interval following their debut.

Several elements contribute to this disparity. To begin with, Bitcoin’s “first mover advantage,” greater liquidity, and lack of staking alternatives in Ether ETFs have made Bitcoin extra interesting to institutional buyers.

Additionally, sudden outflows from Grayscale’s Ethereum Trust (ETHE), amounting to $2.5 billion, far exceeding the financial institution’s preliminary $1 billion estimate, have additional dampened Ether ETF efficiency. To counter these outflows, Grayscale launched a mini-Ether ETF, but it surely has solely managed to draw $200 million in inflows.

In distinction, BTC ETFs have proven resilience and strong efficiency with US-based BTC ETFs recording a formidable eight-day successful streak, with internet inflows totalling $202 million led by BlackRock’s iShares Bitcoin Trust (IBIT).

On August 26 alone, IBIT attracted over $224 million in internet inflows bringing its whole Bitcoin holdings to over 350,000 BTC, solidifying its dominance out there.

Competing funds such as these managed by Franklin Templeton and WisdomTree additionally noticed constructive inflows, whereas others, together with Fidelity, Bitwise, and VanEck, reported damaging flows. Notably, Grayscale’s Bitcoin Trust (GBTC) noticed a decline in redemptions over the previous two weeks, indicating stabilization out there.

As investor confidence in Bitcoin ETFs grows, asset managers are more and more exploring mixed ETFs that provide publicity to each Bitcoin and Ethereum, reflecting the evolving dynamics of the cryptocurrency funding panorama.