Bitcoin is at the moment experiencing unstable and unsure worth motion, with the newest 10% correction elevating issues amongst buyers. While this decline is smaller than the 30% retracements seen in current months, it’s inflicting considerably extra harm to market sentiment as buyers develop more and more weary of the continued market dynamics.

The common temper is shifting, with many feeling the pressure of this extended uncertainty. Prominent buyers and analysts are expressing that BTC is now at a vital stage. Data from CryptoQuant’s head of analysis, Julio Moreno, means that if the value drops beneath $56,000, it might set off a deeper correction, doubtlessly resulting in a extra extended bearish section.

This sentiment has fueled warning amongst market contributors, who’re carefully watching the subsequent strikes in Bitcoin’s worth to gauge whether or not this assist stage will maintain or give method to additional declines, which might exacerbate the present market pressure.

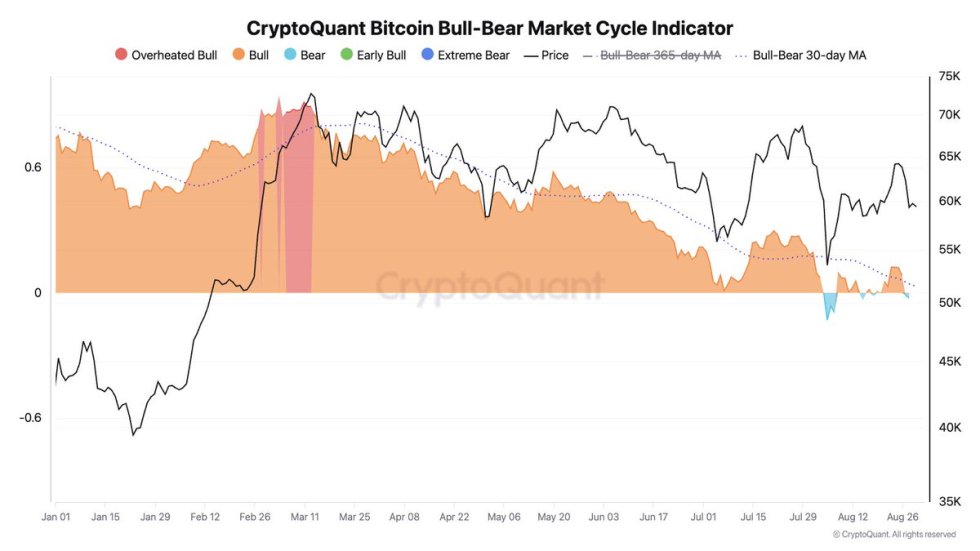

Bitcoin Market Cycle Indicator In Bear Phase

CryptoQuant’s head of analysis just lately shared a detailed Bitcoin chart on X, highlighting a regarding pattern: the BTC market cycle indicator has as soon as once more shifted into the Bear section. This indicator is crucial for merchants and buyers because it defines the market’s total energy and course, providing insights into potential worth actions based mostly on historic worth motion. According to the evaluation, Moreno factors out that $56,000 is a vital assist stage that the value should keep to keep away from a deeper and extra damaging correction.

The present market situations are more and more complicated and dangerous, with buyers struggling to maintain tempo with the quickly shifting dynamics of Bitcoin’s worth. The current volatility, coupled with this vital assist stage, has led to heightened uncertainty amongst market contributors. The unpredictable surroundings makes it difficult for merchants to determine on their subsequent strikes, including to the general market volatility.

If Bitcoin fails to carry the $56,000 stage, the opportunity of a extra vital downturn turns into more and more doubtless. This potential drop would additional pressure buyers already grappling with the turbulent worth motion seen in current weeks.

As the market continues to navigate these unsure waters, Bitcoin’s potential to carry this significant stage will probably be a key focus for each analysts and buyers. The consequence at this stage might decide the subsequent main transfer for Bitcoin, both stabilizing the market or resulting in a deeper correction that would lengthen the present bear section.

BTC Price Action

Bitcoin is at the moment buying and selling at $58,467, following a pointy 10% decline from its native excessive of $65,103. This drop has positioned BTC beneath the 4-hour 200 exponential transferring common (EMA), which stands at $60,895. For bulls to regain management and push the value larger, it’s essential for Bitcoin to interrupt previous and retake this EMA stage. Failure to take action might sign continued weak spot and additional declines.

On the draw back, the $56,138 stage is a vital assist that have to be defended. Losing this stage might set off a capitulation occasion, not only for Bitcoin however for the complete cryptocurrency market. Such a transfer would doubtless result in panic promoting and a deeper correction throughout the board. Given the present market dynamics, buyers are carefully monitoring these key ranges as they will outline the subsequent section of Bitcoin’s worth motion.

Cover picture from Dall-E, Charts from Tradingview.