According to data from CoinMarketCap, Bitcoin has skilled a turbulent finish to August, dropping 7.75% of its market worth within the ultimate week. This worth decline underscores the general destructive efficiency of the crypto market chief within the final month, with a recorded month-to-month worth decline of 10.64%. Interestingly, amidst this downtrend, the asset’s historic worth knowledge signifies that the bears might retain market management within the coming weeks.

September Popular For Negative Returns, Analyst Says

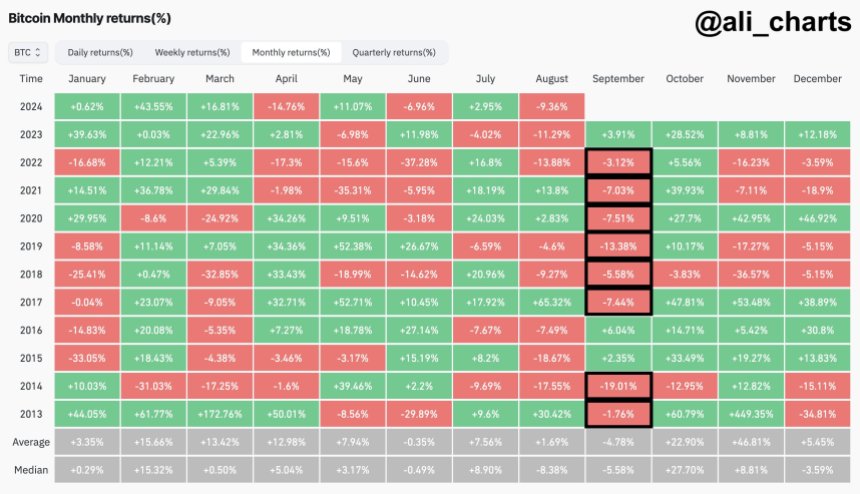

In an X post on Friday, famend crypto analyst Ali Martinez has nudged Bitcoin traders to brace up for what could possibly be a “tough” interval in September. Based on historic worth knowledge, Martinez notes that Bitcoin generally data a cumulative destructive efficiency in September as seen in eight of the final 11 years.

Over this era, Bitcoin has skilled a median and median worth lack of 4.78% and 5.58% in September, respectively. Therefore, traders may count on the premier cryptocurrency to commerce as little as $55,618 to 56,105 within the subsequent 4 weeks.

Interestingly, this era of potential worth loss may function a possibility for massive BTC accumulation. According to Bitcoin month-to-month returns, the crypto market chief has beforehand produced vital worth positive factors in This autumn, with recording a cumulative constructive efficiency in October of 9 of the final 11 years.

Meanwhile, the month of November could also be an investor favourite having recorded internet positive factors of 42.95% (2020) and 53.48% (2017) prior to now two bull cycles. Generally, November exhibits a lot potential for a big worth enhance, with a median worth acquire of 46.81% since 2013.

However, traders might need to train warning in December. While Bitcoin has beforehand recorded positive factors as excessive as 46.92% (2020) in December, there have additionally been vital losses to the tune of 34.81% (2013). Notably, on this final month of the yr, the premier cryptocurrency has proven a twin efficiency to just about the identical extent, recording a median worth acquire of 5.45% and a median worth lack of 3.59%.

Bitcoin Price Outlook

At the time of writing, Bitcoin trades at $59,218 with a 0.84% decline within the final day. Meanwhile, the asset’s buying and selling day by day quantity has recorded a 3.05% acquire and is at present valued at $33.38 billion

According to BTC’s day by day chart, the crypto market chief is present process a worth consolidation, a breakout from which may end in an increase to the $65,400 worth zone. However, knowledge from the relative energy index signifies that Bitcoin is much from its oversold zone and could possibly be set for additional losses. In such a case, traders may put together for a possible fall to round $53,800.

BTC buying and selling at $59,230 on day by day chart | Source: BTCUSDT chart on Tradingview.com