Following the Bitcoin value surge again to $64,000, crypto analyst Rekt Capital is predicting a serious breakout transfer within the coming weeks. In a brand new video evaluation, the analyst forecasts a major market motion round October 2024, primarily based on historic precedents and present chart patterns.

Will October Be Bullish For Bitcoin Again?

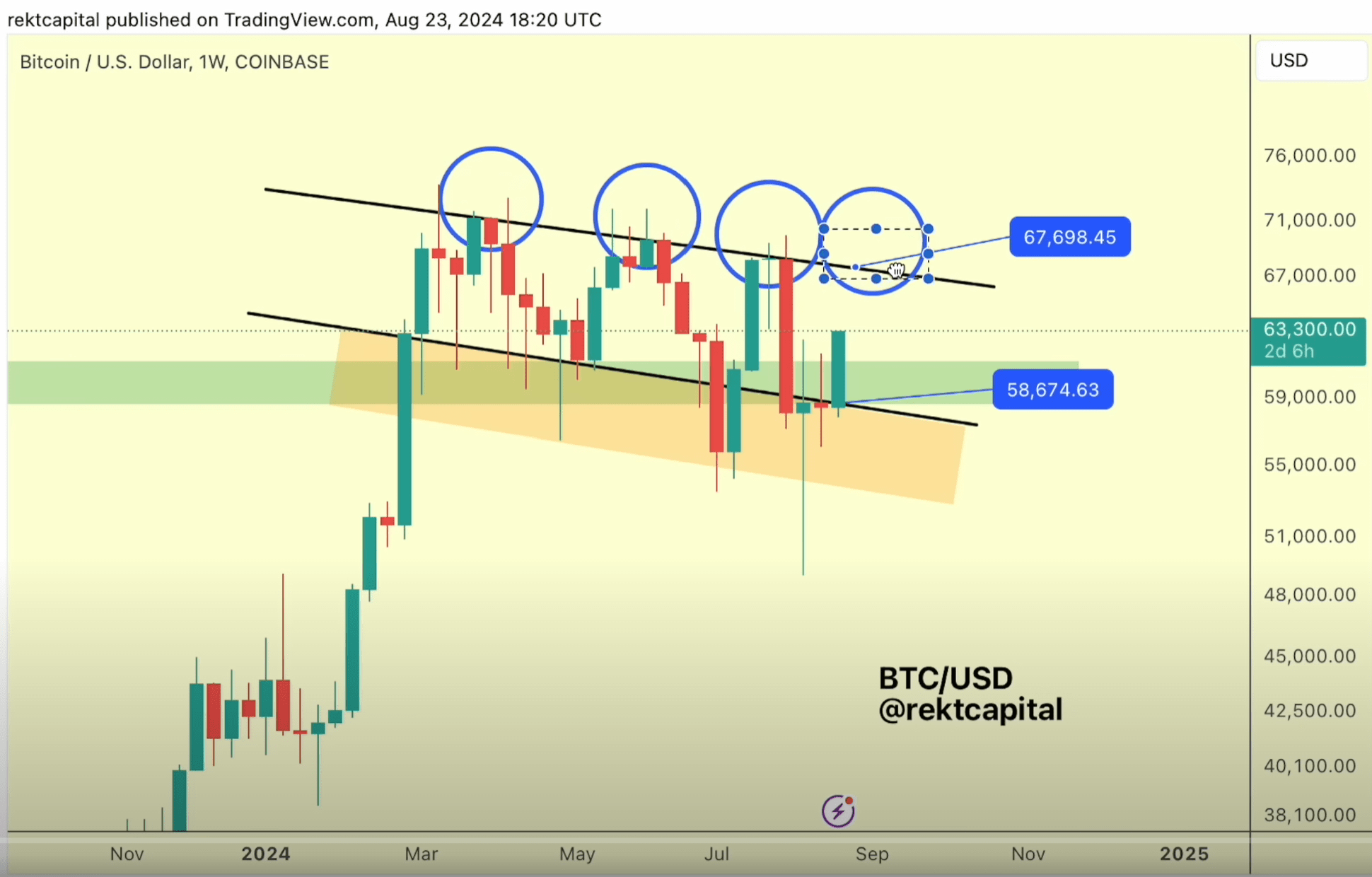

Looking on the weekly chart, Rekt Capital identifies a downtrending channel. Over the previous 4 weeks, BTC has been deviating beneath this channel, looking for help that will allow a value enlargement above the channel’s backside. This motion has been met with a “fantastic recovery,” signaling potential for a return to the channel high at round $67,000 within the coming weeks.

“The channel bottom rebound is crucial as it has historically taken price from the channel bottom to the top in approximately two weeks on average,” Rekt Capital defined. He highlighted the significance of weekly candle closes above particular ranges, notably at $67,500 and finally at $71,500, which might mark a break from the reaccumulation vary excessive established post-halving.

Related Reading

“The consistent pattern of bouncing from the channel bottom to the top typically spans an average of two weeks, but in the current context, we are observing a potentially elongated consolidation phase at these lower levels,” defined Rekt Capital. This commentary means that whereas the rebound trajectory follows historical patterns, the consolidation at decrease costs might afford traders cut price shopping for alternatives.

Focusing on the technical thresholds, Rekt Capital emphasised the criticality of a number of weekly candle closes above pivotal value factors. Firstly, an in depth above $66,000 would reconfirm the reaccumulation range’s decrease boundary as a newfound help, setting the stage for additional upward motion. More importantly, a decisive weekly shut above $67,500 would signify a breach of the persistent decrease highs pattern that has dominated since March of this 12 months.

Related Reading

“The weekly close above these specific levels is not merely a technical achievement but a psychological victory for market participants, indicating a weakening of sell-side pressure and a regain of bullish momentum,” famous Rekt Capital.

Historically, Bitcoin exhibits a bent to provoke main rallies roughly 150 to 160 days following a halving occasion. Drawing parallels from the post-halving periods of 2016 and 2020, the analyst prompt that related circumstances are presently forming, with Bitcoin being round 133 days submit the most recent halving.

“This cyclical observation aligns well with the current market dynamics, where Bitcoin is methodically testing and, in some cases, breaching important technical barriers,” he remarked. This comparability is just not solely primarily based on temporal patterns but additionally on the qualitative nature of market conduct throughout these durations.

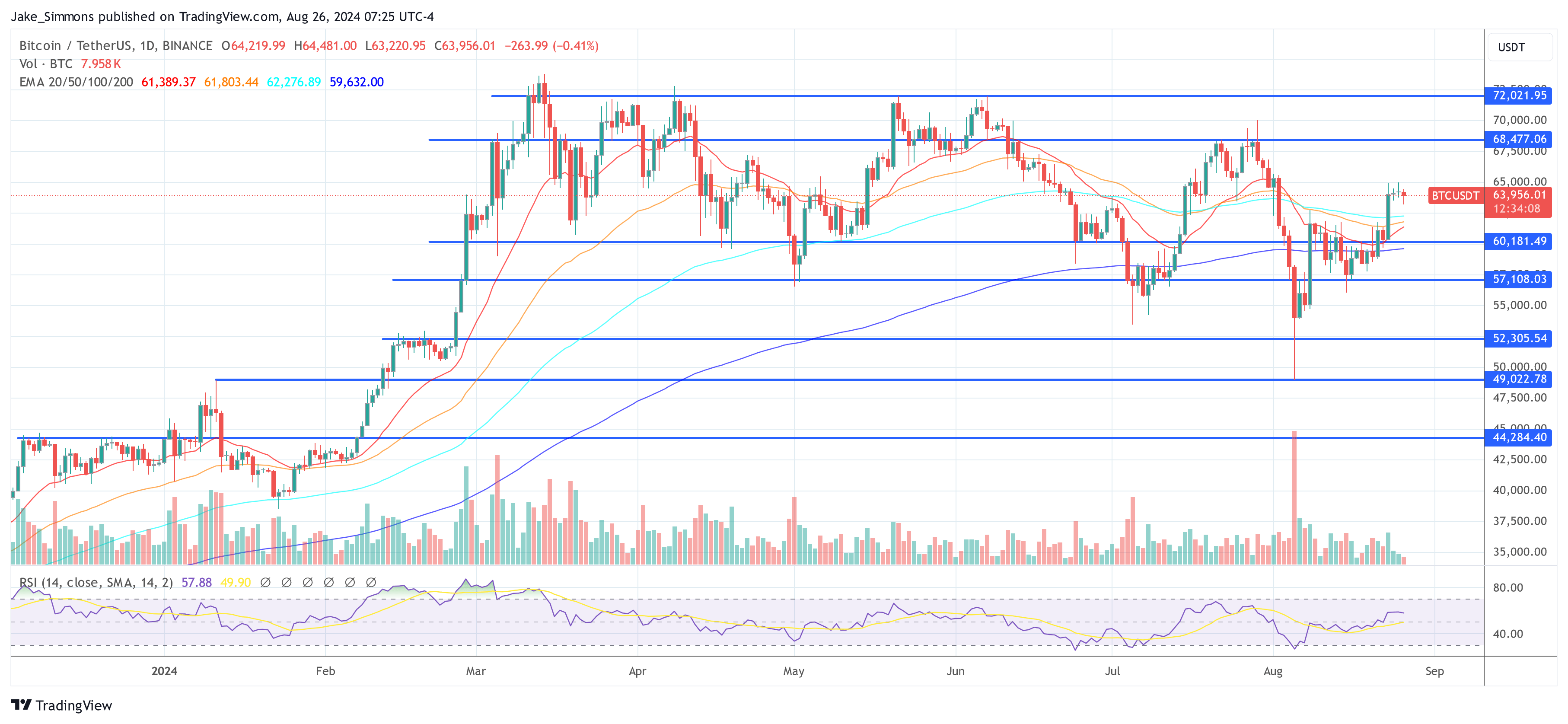

A major level of study was the 21-week EMA, a key indicator typically thought to be the bull market barometer. Rekt Capital highlighted its historic significance, noting, “Deviations below the 21-week EMA in bull markets typically offer lucrative buying opportunities, as seen in the 2021 cycle. Currently, Bitcoin is oscillating around this EMA, providing mixed signals that require vigilant interpretation.”

Looking forward, the analyst initiatives that for Bitcoin to embark on a brand new parabolic part main to cost discovery and doubtlessly new all-time highs, it should first consolidate above the $71,500 degree—representing the reaccumulation vary excessive. This degree has beforehand acted as a formidable resistance, and a weekly shut above it will seemingly catalyze a serious bullish part.

“In the coming weeks, the market’s ability to uphold these critical supports and break through resistance levels with conviction will be paramount. This will determine the feasibility of a breakout aligning with historical patterns observed post-halving,” Rekt Capital concluded, suggesting that October may very well be pivotal for Bitcoin’s trajectory.

At press time, BTC traded at $63,956.

Featured picture created with DALL.E, chart from TradingView.com