Yesterday, Bitcoin (BTC) spiked over 6% following Federal Reserve Chairman Jerome Powell’s announcement that they’re adjusting its coverage and hinting at a possible 25bps charge reduce on the subsequent assembly on September 18. This sudden information has fueled Bitcoin’s current volatility, with costs swinging unpredictably up to now weeks.

Related Reading

Crucial on-chain information from CryptoQuant is offering a glimmer of optimism. According to the information, merchants are positioning for additional value appreciation.

As the market digests the Fed’s new stance, all eyes are on Bitcoin to see if this might mark the start of a brand new bullish section.

Bitcoin Data Showing Market Optimism

Bitcoin is buying and selling above $63,000 and gaining momentum because it prepares to interrupt previous the important $65,000 mark.

On-chain information from CryptoQuant reveals rising market optimism, highlighting a big pattern that would drive costs larger. Specifically, Bitcoin exchange reserves on centralized exchanges have plummeted to an all-time low. Since the top of July, the provision of BTC on exchanges has decreased from over 2.75 million to roughly 2.67 million, representing a 3% drop in simply 30 days.

This decline signifies that much less BTC is obtainable for buying and selling on exchanges, which might create a provide shock, a scenario the place demand outstrips provide, resulting in a possible value surge. As Bitcoin’s availability on exchanges diminishes, the chance of a value enhance grows.

With Bitcoin beginning to achieve energy, the market is intently monitoring this pattern, probably pushing Bitcoin into new bullish territory.

BTC Price Action: $65,000 Next?

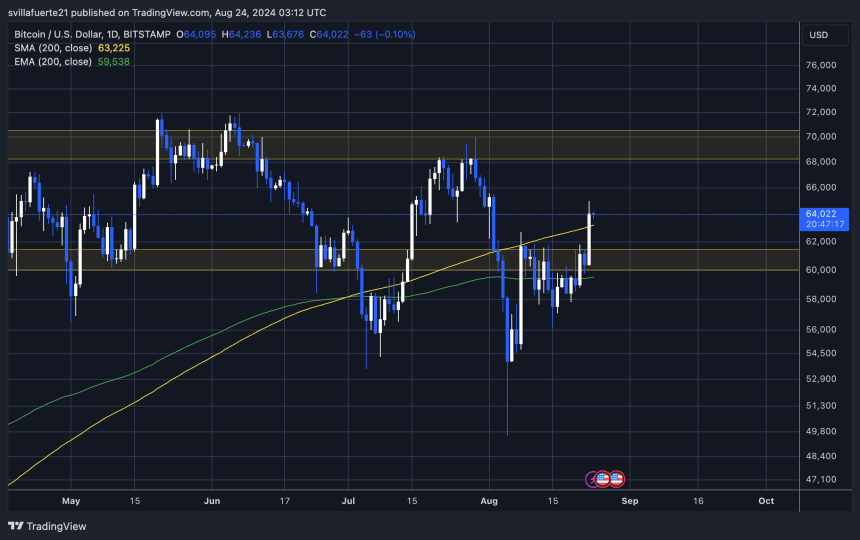

After two weeks of volatility and consolidation, Bitcoin is at present buying and selling at $64,100 on the time of writing, holding above the essential day by day 200 Moving Average (MA).

This stage is crucial for bulls to take care of the uptrend in the next time-frame. For the worth to interrupt previous the $65,000 mark, it should affirm its bullish construction by holding above the $57,500 stage. Ideally, staying above the day by day 200 Exponential Moving Average (EMA), which sits at $59,538, is preferable.

These ranges are important for establishing continued upward momentum. Holding above them would sign energy out there, reinforcing confidence amongst merchants and buyers. The information of declining Bitcoin change reserves and the central financial institution’s coverage announcement have been met with optimism. Investors are more and more anticipating a Bitcoin rally within the coming months, fueled by these bullish indicators.

Cover picture from Dall-E, chart from TradingView.