PAAL AI (PAAL), the Telegram coin developed on the Ethereum blockchain, has seen its worth drop by 10% in 24 hours. At press time, it trades at $0.19.

The worth represents a 77.50% lower from its all-time excessive in March. This on-chain analysis examines the elements accountable for the latest drawdown and its doubtless subsequent motion.

Crypto Whales Ditch PAAL AI

BeInCrypto’s findings reveal that PAAL suffered from notable promoting strain resulting from the resolution of one among its notable stakeholders. The buyers concerned on this decline are whales, a key cohort whose motion and inaction can drastically affect costs.

According to IntoTheBlock, PAAL AI’s giant holders’ netflow dropped by 72% in the final seven days and has remained this way for the last 30 to 90 days. Large Holders’ netflow is the distinction between their Inflow and Outflow.

When this distinction will increase, it signifies that whales are accumulating extra cash than they’re distributing. In most circumstances, this rise in cash bought foreshadows a worth enhance.

However, a internet damaging on this regard means that distribution is larger. As that is the case with PAAL, the worth prolonged its losses.

Read extra: What Are Telegram Mini Apps? A Guide for Crypto Beginners

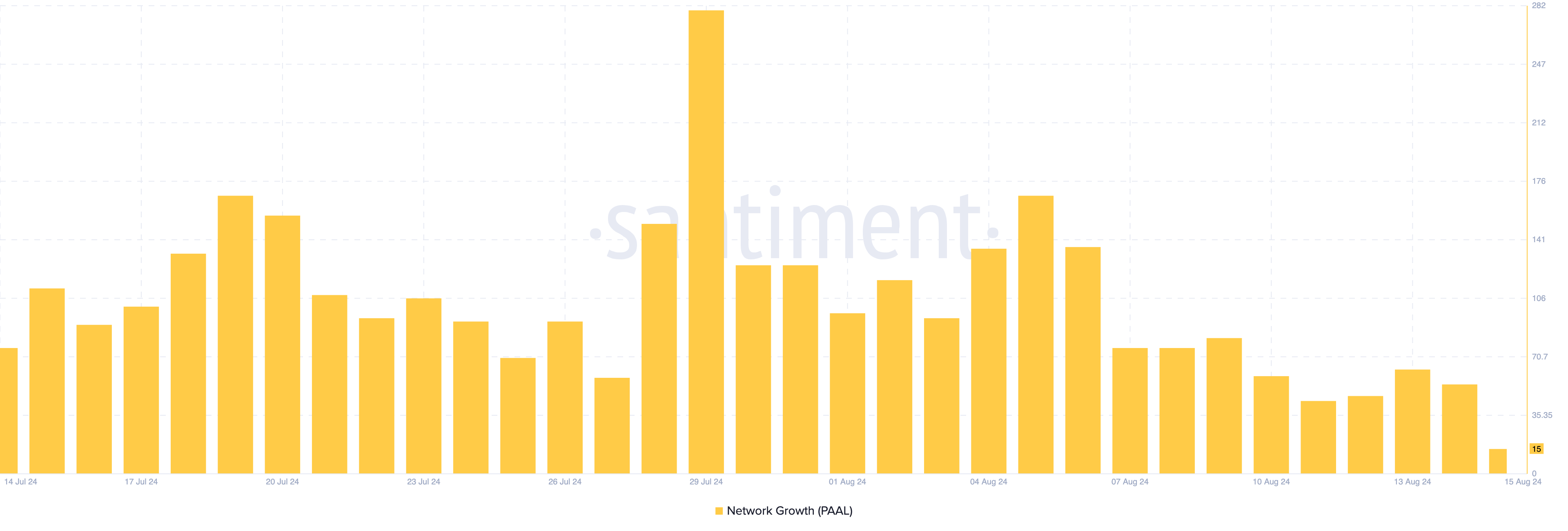

If crypto whales carry on liquidating their PAAL holdings, the price may continue to decline. Beyond this promoting strain, on-chain information from Santiment exhibits a big drop in the mission’s community progress.

Network progress measures the variety of new addresses interacting with a cryptocurrency for the first time.

When this quantity will increase, it implies an inflow of latest members making their first profitable transaction. However, a lower suggests a drop level to a dearth in traction and lack of adoption.

For PAAL AI, the latest lower infers that crypto at the moment faces a shortfall in the required demand to assist the worth get well. If sustained, the worth of PAAL might lower once more, as talked about earlier.

PAAL Price Prediction: The Coin Struggles Continue

Based on the day by day chart, PAAL has fashioned a rounding prime sample. Also referred to as an inverted rounding backside, this sample is characterized by an initial uptrend, after which the rally loses steam and the worth declines.

Oftentimes, bearish affirmation happens when the worth slips under the neckline proven on the chart. From the chart under, PAAL’s neckline is at $0.1965. However, the worth has dropped under the area, suggesting {that a} bearish continuation might be subsequent.

This bias is additional strengthened by the Bull Bear Power (BBP), an indicator used to measure the energy of patrons relative to sellers. Usually, if the BBP is constructive, bulls are in management, and costs can enhance.

However, the indicator’s studying for PAAL is damaging, suggesting that bears might proceed to push the worth additional down. In this case, PAAL’s worth might drop to $0.1724, but when bulls fail to defend this area, it may slip towards $0.1499.

Read extra: Top 7 Telegram Tap-to-Earn Games to Play in 2024

On the opposite, the cryptocurrency’s worth might reverse to the upside if whale accumulation and shopping for quantity in the spot market enhance. Should this be the case, PAAL might retest $0.2037. If sustained, the worth can lengthen to $0.2462.

Disclaimer

In line with the Trust Project tips, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. Always conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please be aware that our Terms and Conditions, Privacy Policy, and Disclaimers have been up to date.