Emerging nations are the quickest rising areas in crypto adoption and the rising presence of neo-banks performs the largest role in this development. Could these modern platforms be the resolution to monetary inequalities and the lack of satisfactory banking companies for over one billion folks?

As Satoshi as soon as remarked in his now-stopped social messages, “Bitcoin would be convenient for people who don’t have a credit card or don’t want to use the cards they have”. Emerging nations whether or not in Africa, Latin America or South East Asia might resonate extra actually to this assertion than others. Over the previous half-decade, the development of neo-banks in creating international locations has triggered a revolutionary change in how the populous work together in their economies and a radical change in their monetary methods.

Crucially, the billions of unbanked and underbanked are lastly built-in into the international monetary methods, regardless of the lack of environment friendly banking buildings in their respective nations.

This article will break down how cryptocurrency is benefiting the unbanked (and underbanked) and the role neo-banks play in offering monetary companies to international locations with little hope of having a steady banking infrastructure. The piece additional appears to be like at the role creating international locations play in rising the crypto ecosystem and numerous technological developments in the trade consequently of fast adoption throughout Sub-Saharan Africa, Latin America and Southeast Asia areas.

Financial Inequality in Underserved Economies

According to World Bank studies, over 1.2 billion people across the world are either unbanked or underbanked. Developing international locations stay the most affected nations with over 50% of the inhabitants having little to no entry to stable banking infrastructure or primary monetary companies comparable to loaning amenities, financial savings accounts, and many others.

The creation of blockchain know-how and cryptocurrencies sparked a drastic change in the international monetary system, offering beforehand unavailable monetary methods to residents of these nations. The emergence of this decentralized trade is changing into a power in the international monetary panorama, redefining conventional forex, transactions, and monetary methods.

Cryptocurrencies, powered by blockchain know-how and cryptographic rules, are opening up the monetary world to creating nations, permitting beforehand unbanked and underbanked residents to take part in the monetary ecosystem. These property have opened up new avenues to transact and retailer worth by giving everybody entry to quick and low-cost digital money that may be spent wherever.

The Rise of Neo-Banks and Decentralized Finance (DeFi)

The international monetary disaster in 2008 introduced rise to a number of improvements in the trade, majorly the development of neo-banking. Neo-banks check with monetary know-how corporations which can be redefining how banking companies are delivered to shoppers, from seamless digital experiences to decrease transaction charges and accessibility through smartphones, and many others.

The most distinguished type of neo-banking arose in Kenya, with the launch of M-Pesa, a mobile-based monetary service that allowed anybody with a SIM card and a cellphone to ship and obtain cash. Over the years, such improvements have developed into formidable gamers in the monetary sector, as they revolutionize conventional banking and monetary companies.

Recently, decentralized finance (DeFi) apps have come to the fore, offering digital and decentralized alternate options that supply personalised user-centric companies that resonate with crypto-savvy shoppers. Notwithstanding, crypto alternate apps have sprouted quickly providing anybody throughout the world a chance to entry cryptocurrencies instantly on their smartphones. These apps guarantee superior safety measures, and seamless integration of fintech options, setting them other than conventional finance companies.

As such, developed international locations have been in a position to be a part of the international monetary methods, signifying a paradigm shift in the transformative energy of crypto for the trendy shopper.

Crypto Exchanges May Challenge The Status Quo

As alluded to, crypto exchanges are diversifying to wider markets, transferring from easy on-ramp and off-ramping enterprise fashions to changing into neo-banks and difficult the conventional finance system – international, low-cost and very accessible to the unbanked. Crypto adoption is changing into extra distinguished for the 1.2 billion and monetary companies and merchandise are extra refined and accessible. Could this pose a risk to the conventional banking methods?

The jury remains to be out on that however the options offered by these “decentralized neo-banks” are having an ideal impact on rising nations’ economies – monetary inclusion, low-cost remittance charges, and quick and safe transactions have pushed the development of crypto in these economies.

Boxwind, a digital asset alternate platform set to launch later in the 12 months, brings these options to the 1.2 billion who want such companies. From buying and selling to lending, saving, buying and selling, and a channel to affordably switch crypto cryptocurrencies into and round rising economies. The alternate is designed with superior functionalities for brand new and skilled traders, offering spot and derivatives buying and selling of over 300+ digital property, on-ramp and off-ramp options, staking companies, borrowing/lending and rather more.

The platform additionally options its brainchild, PIP World, a service that goals to empower customers through Edutech packages, gamified buying and selling, and AI-powered gaming. PIP Trader, one of the gamefied and educative platforms, permits customers to staff up, battle in buying and selling video games, and earn rewards on an AI-powered sport.

Looking Ahead

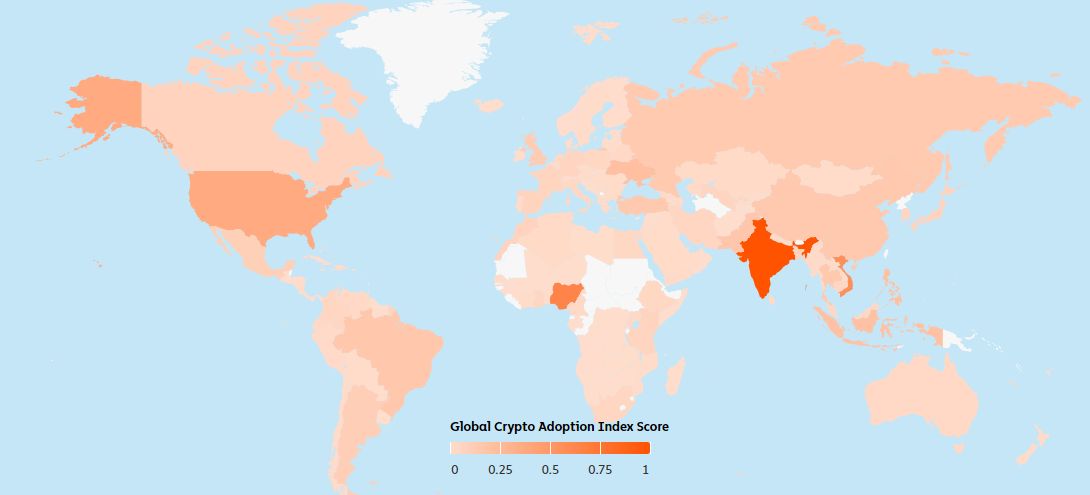

Chainalysis’ 2023 Crypto Report confirmed that over 40% of the world’s cryptocurrency customers reside in lower-middle-income international locations (LMICs), with the quantity rising yearly. This spectacular development is closely influenced by CEXs and the huge companies they provide. Regulated crypto exchanges may very well be the foremost driver of sustained adoption charges by facilitating neo-banking companies to the underbanked.

Crypto adoption in rising economies presents a novel alternative to empower people, improve abilities and monetary literacy, and present options to monetary inequalities. For the trade to essentially develop, nevertheless, a number of issues have to be put in place together with establishing safe platforms, regulatory compliance, customers’ funds safety, simply accessible platforms, and educating the lots on the know-how.