Crypto market maker Jump Trading has began promoting extra Ethereum holdings, as per on-chain knowledge platforms. This transfer could carry a correction in ETH value, just like a greater than 20% crash final week.

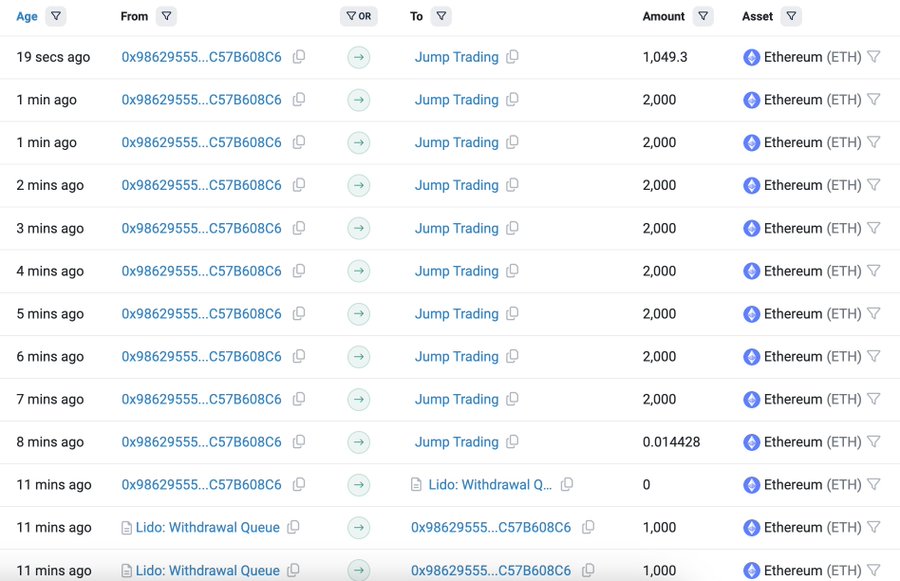

Lookonchain in a put up on August 14 reported that outstanding crypto buying and selling agency Jump Trading has began promoting ETH as soon as once more. The agency claimed 17,049 ETH price $46.44 million from liquid staking protocol Lido. It then transferred the cash to the pockets handle “0xf58“. Notably, the agency makes use of the pockets for promoting to crypto exchanges.

The crypto market maker at the moment holds 21,394 wstETH, which is valued at $68.58 million.

Spot On Chain revealed that the crypto agency continued to redeem the final 21,394 wstETH for 25,156 stETH not too long ago. However, Spot On Chain claims the crypto agency didn’t request to withdraw immediately from Lido like earlier than.

Jump Trading nonetheless holds practically $148M price of Ethereum. This contains 24,993 ETH in pockets 0xf58 and 29,093 stETH staked with Lido Finance.

The selloffs picked tempo after Kanav Kariya introduced his departure from Jump Crypto after serving because the agency’s president for practically three years. It occurred after the CFTC launched an investigation into Jump Crypto in June.

Jump Trading Can Trigger Another ETH Price Crash

Last week, ETH value dropped greater than 20% after Jump Trading liquidated $300 million to crypto exchanges. It began with 17,576 ETH price $46 million dumped centralized exchanges, however the buying and selling agency is shifting a bigger quantity of ETH as in comparison with the previous week.

ETH price at the moment buying and selling greater than 3% prior to now 24 hours, with the value at the moment buying and selling at $2,725. The 24-hour high and low are $2,613 and $2,750, respectively. Furthermore, the buying and selling quantity has decreased by 28% within the final 24 hours, indicating a decline in curiosity amongst merchants.

Ethereum witnessing a sudden promoting exercise within the derivatives market. Total ETH futures open curiosity fell greater than 1% on some exchanges within the final 4 hours, as per Coinglass knowledge. The futures open curiosity is at $29.92 billion, up 5% within the final 24 hours.

Meanwhile, CoinGape stories a possible liquidation of Threshold (T) by Jump Trading after the current $300 million Ethereum dump.

Disclaimer: The introduced content material could embrace the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty on your private monetary loss.