Duo Nine, a outstanding crypto educator and analyst, posed a query nobody desires to listen to. “What if altcoin season never comes?,” he requested, with a number of information to again his rhetoric.

An altcoin season is an off-the-cuff time period describing a part the place investing in altcoins offers higher returns than pouring capital into Bitcoin (BTC).

Analyst Explains Altcoin Season Delay

After the fourth Bitcoin halving, the crypto market’s subsequent main focus, except for Ethereum ETFs (exchange-traded funds) approvals and launches, was the anticipation of an altcoin season. Several key occasions usually lead as much as this part.

First, recent capital enters the cryptocurrency market, initially flowing into stablecoins, Bitcoin, or Ethereum. These belongings are prioritized on account of their perceived stability in comparison with smaller market cap cryptocurrencies. Next, this inflow of capital triggers a market rally.

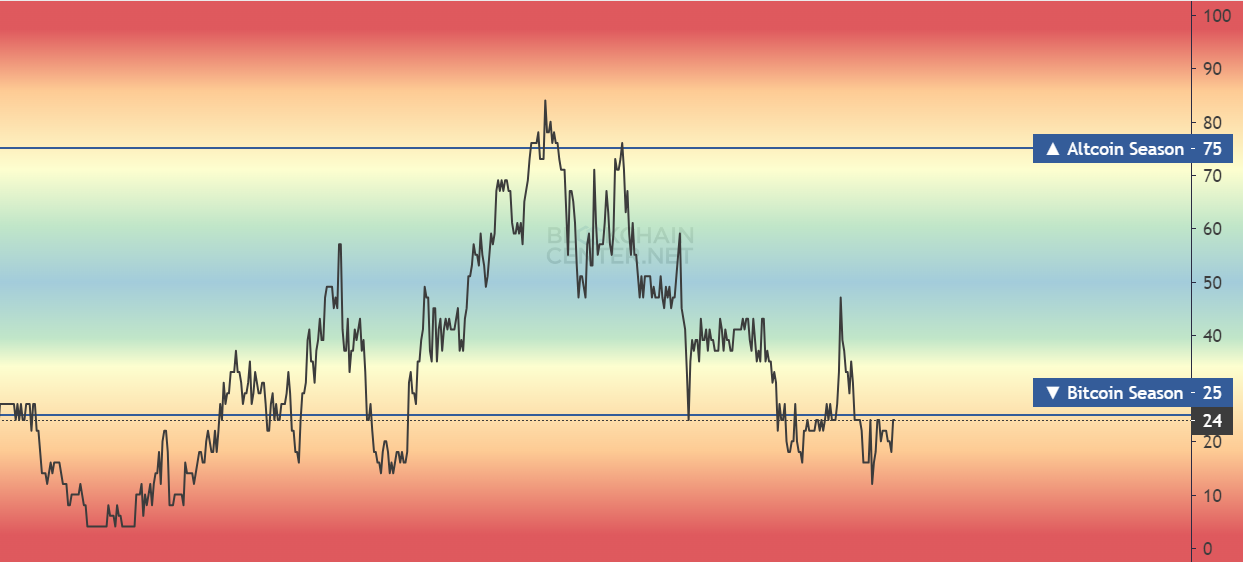

Finally, income from these belongings, together with extra capital, start to circulate into altcoins. This capital rotation is what units off an altcoin season. According to the altcoin season index, the crypto markets are at present nonetheless within the Bitcoin season.

Negative Flows for Ethereum ETFs

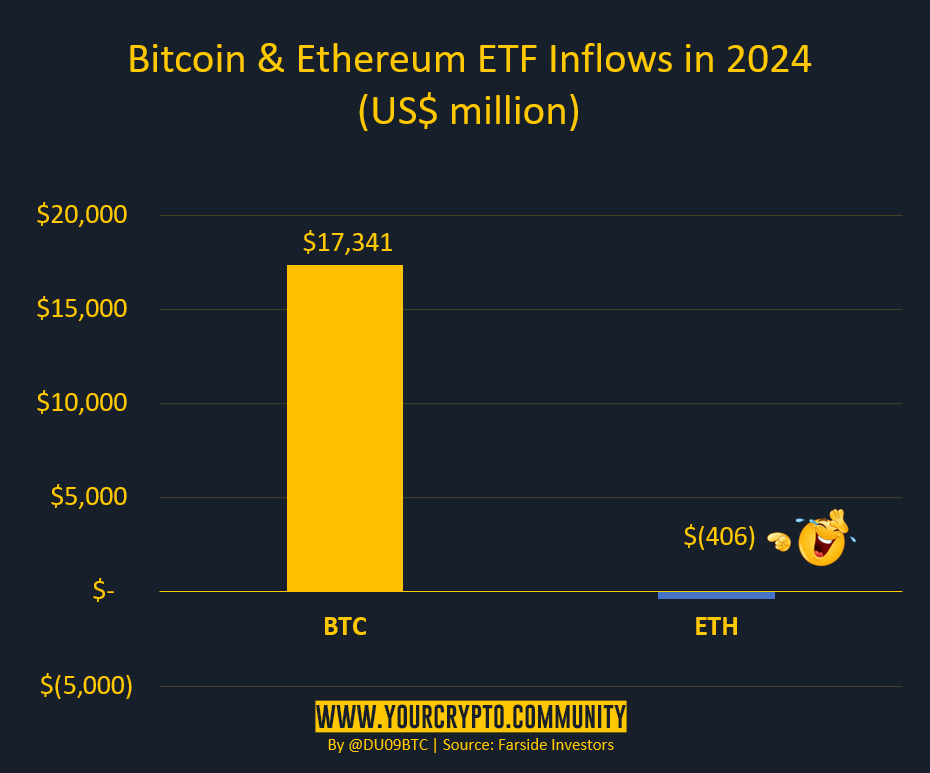

Duo Nine outlines a situation the place the sequence resulting in an altcoin season hasn’t absolutely materialized. He means that investing totally in altcoins is perhaps problematic, pointing to unfavourable flows for Ethereum ETFs as a regarding signal.

“Since January 2024, the Bitcoin ETFs managed to attract over $17 billion in net investments after Grayscale sales. Ethereum’s ETF went live in July. Net balance on that? -$406 million,” the analyst wrote.

Read extra: What Is Altcoin Season? A Comprehensive Guide

The unfavourable flows for Ethereum ETFs come amid ongoing Grayscale customer redemptions following the conversion of its belief to ETFs. Before the approval of spot ETFs, the Grayscale Bitcoin Trust (GBTC) was permitting traders to redeem shares for worth in US {dollars}. Now, with BTC and ETH ETFs out there, prospects are opting to redeem their shares by promoting Bitcoin and Ethereum, contributing to the unfavourable flows.

Per the analyst, whereas Grayscale’s prospects bought $2.3 billion in ETH since July, ETF purchase strain has not been sufficient to offset this sell-off. Duo Nine sees no distinction for an altcoin season if a Solana ETF launches.

However, it’s essential to acknowledge that the ETH ETF market continues to be in its early levels. Given this context, it’s essential to grasp that whereas the short-term outlook for spot Ethereum ETFs could also be bearish, the mid- and long-term prospects stay bullish.

In hindsight, it took a while earlier than Bitcoin rallied following spot BTC ETF launches on January 11. The pioneer crypto chopped horizontally for barely over a month earlier than extending north.

“The reason that investor buying of the new Bitcoin ETFs isn’t pushing up the price of Bitcoin is that the outflows from GBTC plus selling of BTC exceed the combined inflows into all of the other ten Bitcoin ETFs. Once the initial ETF demand wanes, I expect a bigger price drop,” economist Peter Schiff said on the time.

Since the launch of Ethereum ETFs on July 23, barely a month has handed, leaving ETH with ample time for worth discovery. Once Grayscale buyer redemptions ease, ETH ETF flows might stabilize within the constructive, with capital inflows into Ethereum rotating into altcoins.

Bitcoin Dominance Breakout

The analyst additionally bases his ‘no altcoin season’ thesis on the breakout seen within the Bitcoin dominance chart. This means BTC outperforms altcoins, suggesting a insecurity within the latter. Based on CoinGecko information, BTC dominance at present sits at 53.8%.

This turnout is probably going ascribed to prevailing market uncertainty amid international geopolitical tension, political frenzy within the US, and recession fears, amongst different volatility-inducing narratives. These immediate traders to rally behind Bitcoin, a flight to security, as BTC is taken into account a greater haven than altcoins.

Nevertheless, some traders view excessive Bitcoin dominance as a possibility to build up altcoins at decrease costs. When Bitcoin’s dominance is excessive, altcoins could also be undervalued relative to Bitcoin, presenting a shopping for alternative for many who consider within the long-term potential of particular altcoins.

Read extra: 11 Cryptos To Add To Your Portfolio Before Altcoin Season

Based on the chart above, whereas Bitcoin dominance continues to rise, it approaches vital resistance, which might see altcoins make headway. However, amid the skepticism for an altcoin season, some say even when it does come, it might fail to be as rigorous as that of 2017 and 2020.

“This narrative comes every cycle by Bitcoin maxis and never worked. Eventually, a portion of the bitcoin supply flows into ALTs when the dominance starts plummeting. There comes a time when dominance goes below 45% and it would happen this cycle as well,” one other X consumer added.

Altcoin season delays however, analysts are already watching some altcoins this month, with some rekindling hope that delay could not essentially imply complete absence.

Disclaimer

In adherence to the Trust Project tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. However, readers are suggested to confirm info independently and seek the advice of with knowledgeable earlier than making any choices primarily based on this content material. Please be aware that our Terms and Conditions, Privacy Policy, and Disclaimers have been up to date.