Latest knowledge from crypto asset supervisor CoinShares has proven a noticeable comeback within the crypto market. In its newest ‘digital asset fund flows weekly report,’ the asset supervisor revealed that final week marked a major uptick in investor confidence, as digital asset funding merchandise noticed $176 million in inflows.

According to James Butterfill, head of analysis at CoinShares, this surge in influx alerts a robust, “unanimous” optimistic sentiment throughout the board, with specific consideration to Ethereum-based funds.

Related Reading

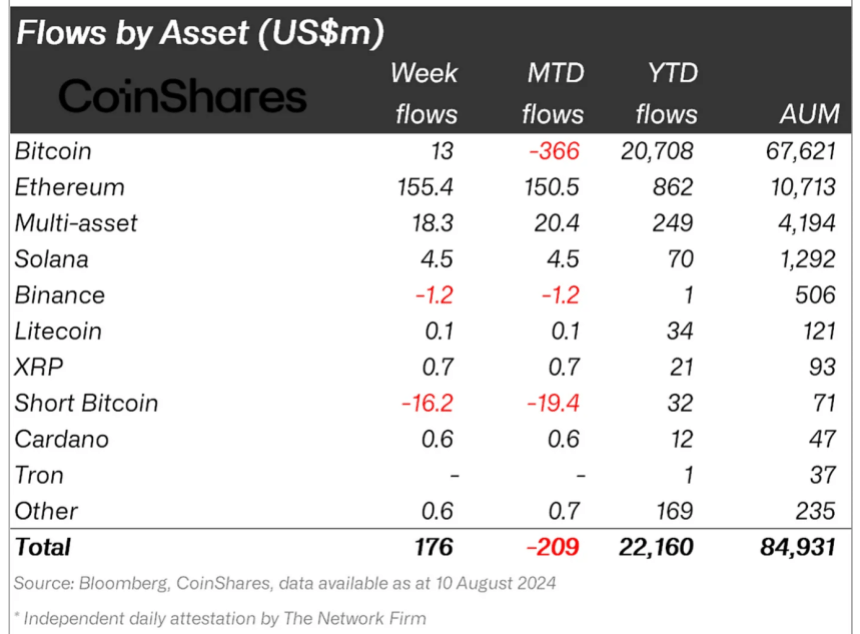

Dissecting The Crypto Fund Flows

Delving into the report, Butterfill revealed that Ethereum merchandise have “distinctly” stood out, attracting $155 million of the entire inflows, the very best year-to-date consumption since 2021.

This inflow highlights the market’s renewed curiosity in Ethereum, particularly with the current introduction of spot Ethereum exchange-traded funds (ETFs) within the United States, based on Butterfill.

Notably, the profitable dwell buying and selling of those funds has not solely boosted Ethereum’s place within the international crypto market but in addition seems to have performed a pivotal position within the overall increase in its market cap and funding product choices.

As for Bitcoin, Butterfill revealed within the report that regardless of seeing outflows earlier within the week, Bitcoin may nonetheless finish the week with a positive total inflow of roughly $13 million.

On the opposite hand, Short Bitcoin ETPs, as reported, “saw their largest outflows since May 2023, totaling $16m (23% of AuM), reducing AuM for short positions to its lowest level since the start of the year, indicating a substantial investor exit.”

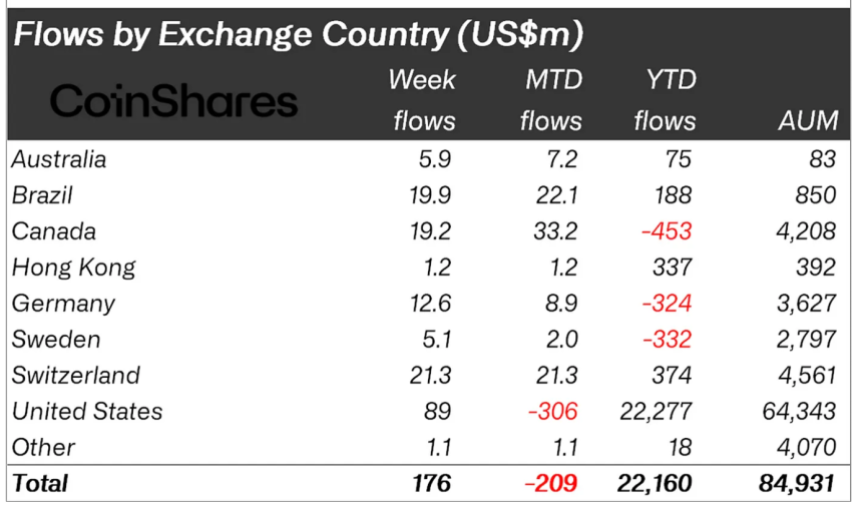

Furthermore, Coinshares disclosed that regardless of the preliminary volatility, the general market sentiment has been “overwhelmingly” optimistic. The report highlights that the inflows weren’t simply remoted incidents however a part of a broader, international optimistic reception to digital belongings.

Notably, areas such as the United States, Switzerland, Brazil, and Canada have been entrance runners, injecting substantial capital into the market. It is price noting that this international participation in inflows highlights a collective bullish outlook regardless of earlier main dips.

Market Performances: ETH And BTC

Bitcoin and Ethereum are struggling to defeat the bears, with each belongings nonetheless sustaining their worth mark above main key ranges.

Related Reading

For occasion, Ethereum nonetheless trades above $2,500 on the time of writing, with a present buying and selling worth of $2,689. This worth mark comes towards the asset’s notable improve of greater than 11% prior to now week and the prolonged bullishness of a 1.6% surge prior to now day.

Bitcoin has additionally seen fairly a surge prior to now week, growing by 11.4%. Although the asset has witnessed a decline of 0.4% prior to now day, it’s nonetheless sustaining its worth under $60,000.

Featured picture created with DALL-E, Chart from TradingView