- Bitcoin briefly tests $49k earlier than rebounding to $51k amid a $270 billion crypto market selloff.

- Concerns over the US recession and Japan’s fee hike set off market turmoil.

- FBI warns of rising crypto scams throughout elevated market volatility.

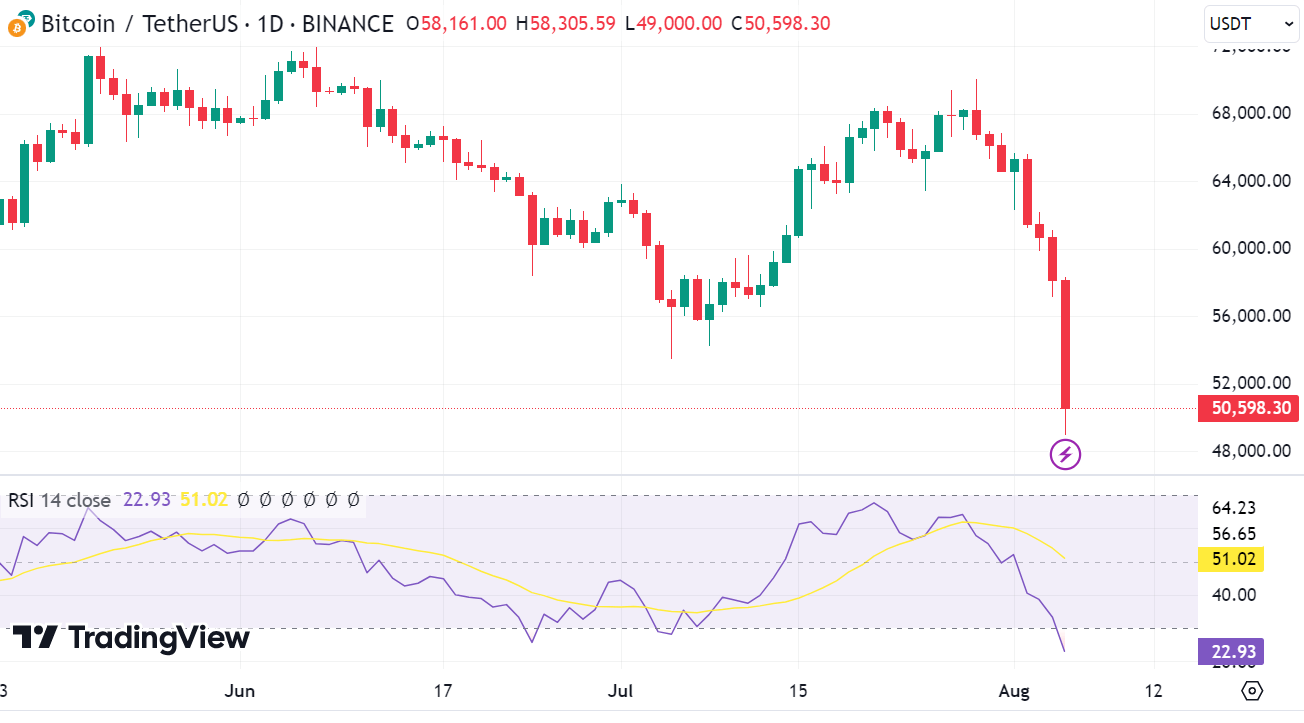

The cryptocurrency market has skilled a big downturn at the moment, shedding roughly $270 billion in worth over 24 hours in response to CoinGecko data. Leading this decline, Bitcoin plummeted by nearly 20%, reaching $49,121, its lowest degree since February at $53,091.

Ether additionally suffered a considerable drop of 21%, falling to $2,300, erasing its good points for the 12 months. Other cryptocurrencies like Binance’s BNB and Solana have additionally suffered vital losses.

Bank of Japa hikes its benchmark rate of interest

This dramatic downturn within the crypto market coincided with a broader selloff in equities, significantly in Asia-Pacific markets, exacerbated by Japan’s Nikkei 225 falling by as a lot as 7%.

The Bank of Japan’s determination to hike its benchmark rate of interest to the best degree in 16 years triggered this selloff, sending shockwaves by means of monetary markets.

The sharp rise within the JPY/USD is inflicting an enormous unwind of Yen carry commerce positions and contributing to the sharp decline in US shares. For those that don’t perceive how this works, a short rationalization

1) Many merchants had been borrowing Jap Yen (JPY) at low rates of interest,… pic.twitter.com/sfi0Hva56M

— Adam Khoo (@adamkhootrader) August 5, 2024

The US Nasdaq additionally slid into correction territory, marking its worst three-week stretch since September 2022, additional contributing to the decline in dangerous belongings, together with cryptocurrencies.

The market’s response was influenced by Japan’s financial tightening and the US Federal Reserve’s current actions.

Although the Fed opted to carry its benchmark fee regular, it didn’t point out a fee reduce in September, which many market consultants had anticipated.

This uncertainty added to the market’s anxiousness, inflicting merchants to cost in a 100% probability of decrease US base charges in September.

Concerns of a possible US recession

The selloff displays rising issues a few potential US recession, triggered by softer financial knowledge and rising geopolitical tensions.

Tony Sycamore, a market analyst at IG, highlighted that Bitcoin and different cryptocurrencies are danger belongings and are extremely prone to market volatility. He famous that Bitcoin is presently testing essential help ranges and should maintain the $53,000 mark to stop additional declines.

However, at press time Bitcoin was buying and selling at $51,657, effectively beneath this help degree, regardless of making a comeback from round $49k.

FBI points warning

The cryptocurrency market’s volatility has additionally heightened safety issues. The FBI has issued a warning about scammers exploiting the market crash to steal customers’ funds.

The FBI suggested customers to be cautious of unsolicited messages or calls indicating account issues and urged them to confirm any points by means of official channels. The company’s warning comes amid a big enhance in crypto-related fraud and hacking incidents.

In the primary half of 2024, hackers stole almost $1.4 billion price of crypto, greater than double the quantity stolen in the identical interval in 2023.

This enhance is attributed to the rising worth of varied tokens, together with Bitcoin, Ethereum, and Solana. Ari Redbord, international head of coverage at TRM Labs, famous that whereas the safety of the cryptocurrency ecosystem has not basically modified, the upper worth of tokens has made them extra engaging targets for criminals.

As Bitcoin and different cryptocurrencies navigate these turbulent occasions, traders and customers ought to stay vigilant about market circumstances and potential safety threats.