Telegram-based venture Toncoin (TON) has seen its market dominance subside regardless of outperforming Bitcoin (BTC) for a lot of the 12 months. Before the most recent bounce, TON encountered a difficult two-week interval as the value fell by 15%.

Trading at $6.79 at press time, this evaluation proves that the token might not be out of the woods simply but. Here are the explanations.

Whales Dump Toncoin, Raising Market Concerns

The main rationale behind Toncoin’s potential decline is the motion of whales. Whales are entities or people that maintain a considerable amount of a cryptocurrency’s circulating provide. Because of this, their actions and inactions affect costs.

According to IntoTheBlock, TON Large Holders’ Netflow has decreased by a whopping 97.05% within the final seven days.

This is in contrast to the large inflows some weeks again. Netflow is the distinction between the big influx and outflow. If the ratio is optimistic, it means whales have gathered greater than they’ve offered.

However, a adverse ratio implies in any other case, which is true with TON. Furthermore, a cautious examination exhibits that whales offered 1.4 million TON tokens between July 21 and 28. If this continues, the value of TON could erase a few of its latest delicate good points.

Read More: What Are Telegram Bot Coins?

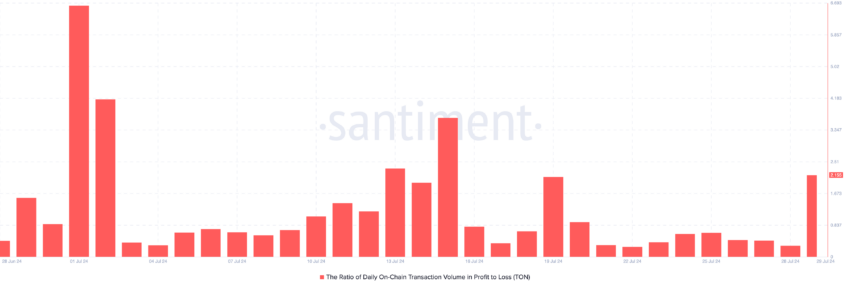

As a results of TON’s worth bounce, the ratio of day by day on-chain transactions in revenue to loss reached its highest degree since July 19. This metric exhibits whether or not token holders are realizing losses or earnings. When it’s adverse, there are extra realized losses than good points.

In Toncoin’s state of affairs, the price increase has led to a rise in profit-taking. However, profit-taking often results in a decline, particularly if the promoting strain will increase. Therefore, if the ratio of on-chain transactions in earnings to loss rises, TON’s uptrend could possibly be halted.

TON Price Prediction: The Bounce Is Not Strong Enough

According to the day by day chart, Toncoin’s worth improve isn’t backed by very important indicators. For instance, the Awesome Oscillator (AO) is adverse. The AO measures market momentum and determines early modifications in a cryptocurrency’s worth.

When the AO is optimistic, momentum will increase upward. However, if the indicator’s studying is adverse, as it’s with TON, momentum decreases. Another oscillator with an identical bearish bias is the Moving Average Convergence Divergence (MACD).

At press time, the MACD is down within the purple area, reinforcing the possibility of a downtrend. If this continues, the value of TON could fall to $6.57. However, if promoting strain will increase, the worth may drop to $6.02.

Read More: 6 Best Toncoin (TON) Wallets in 2024

But if whales start to build up extra TON in distinction to what’s at present taking place, the worth may rebound. If this had been true, Toncoin’s worth may soar to $6.90 and ultimately attain $7.18.

Disclaimer

In line with the Trust Project pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. Always conduct your individual analysis and seek the advice of with an expert earlier than making any monetary selections. Please observe that our Terms and Conditions, Privacy Policy, and Disclaimers have been up to date.