Only a couple of altcoins have been in a position to outperform Bitcoin (BTC) this yr. But if there’s one which has repeatedly remained in that fold, it’s Kaspa (KAS), the mission that makes use of the identical Proof-of-Work (PoW) mechanism as Bitcoin.

While KAS worth has elevated over 400% within the final twelve months, latest knowledge reveals it could wrestle to regain the momentum.

Kaspa Faces Imminent Breakdown Due to Wipeout Positions

Kaspa’s present place under the Exponential Moving Average (EMA) helps the above level.

This indicator highlights worth modifications and gives insights right into a cryptocurrency’s quick—and long-term developments. This evaluation focuses on the short-term EMA—particularly, the 20 EMA (blue).

For most of July, KAS traded above the EMA, indicating a bullish development. This was one motive the worth reached $0.18 earlier. At press time, the cryptocurrency trades under the 20 EMA, suggesting a bearish development. The final time KAS’ worth dropped by 20%, it reached $0.13.

Read More: Kaspa (KAS): A Detailed Guide to What It Is and How It Works

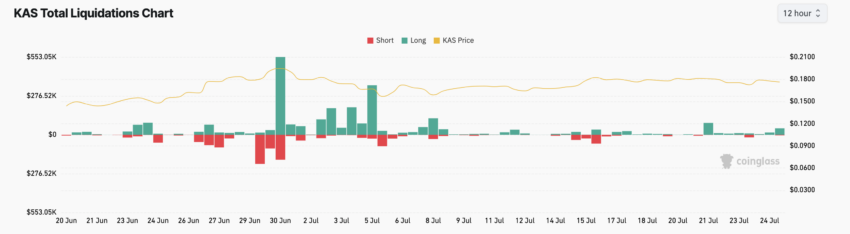

Following the recent decline, lengthy liquidation available in the market is fifteen instances that of shorts. Liquidation happens when an alternate forcefully closes a buying and selling place. This is as a result of there isn’t any longer sufficient margin to cowl the place, that means the commerce must be settled.

Therefore, the rise in lengthy liquidations proves that the KAS decline negatively affected merchants who positioned bets on a worth enhance. However, it’s value noting that liquidation also can have an effect on worth developments.

From a buying and selling standpoint, an increase in lengthy liquidation dumps into the underlying assist. As such, Kaspa’s subsequent transfer could possibly be a notable breakdown under the press time worth.

KAS Price Prediction: A Pullback to $0.15 Could Be Next

Further evaluation of the every day KAS/USD chart reveals weak point within the bullish development. This is the indication the Directional Movement Index (MDI) reveals. The DMI merely measures the power and path of a development.

As of this writing, the +DMI (inexperienced) is down, whereas the – DMI (pink) is making an attempt to rise above -17.22. If the unfavourable finish rises above the positive directional strength, the worth of KAS could drop as it gives extra energy to the downtrend.

In addition, the Average Directional Index (ADX) yellow signifies that the general cryptocurrency development is weak. Typically, a studying of 25 or above for the ADX (yellow) suggests sturdy directional motion.

Read More: Kaspa (KAS) Price Prediction 2024/2025/2030

But at press time, it’s decrease. Thus, KAS’ worth could both consolidate or development downward. Should promoting strain enhance, the chart above reveals that the crypto could expertise a nominal pullback to the 38.2% Fibonacci retracement degree, which is at $0.15.

However, BeInCrypto observes that the Kaspa hash rate has been increasing lately. When the hash price will increase, miner prices additionally enhance, which boosts investor confidence and demand for cryptocurrency. If sustained, the bearish bias could possibly be invalidated, and KAS worth could bounce to $0.19.

Disclaimer

In line with the Trust Project tips, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. Always conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please observe that our Terms and Conditions, Privacy Policy, and Disclaimers have been up to date.