TIA, the native token of the modular blockchain undertaking Celestia, continues to face torrid intervals. Trading at $5.32, the worth represents a 12.37% decline in the final 30 days.

As time passes, indicators present that TIA might prolong its losses because it approaches an important level. Here’s what to anticipate.

Celestia Holders May Need to Deal With Another Decline

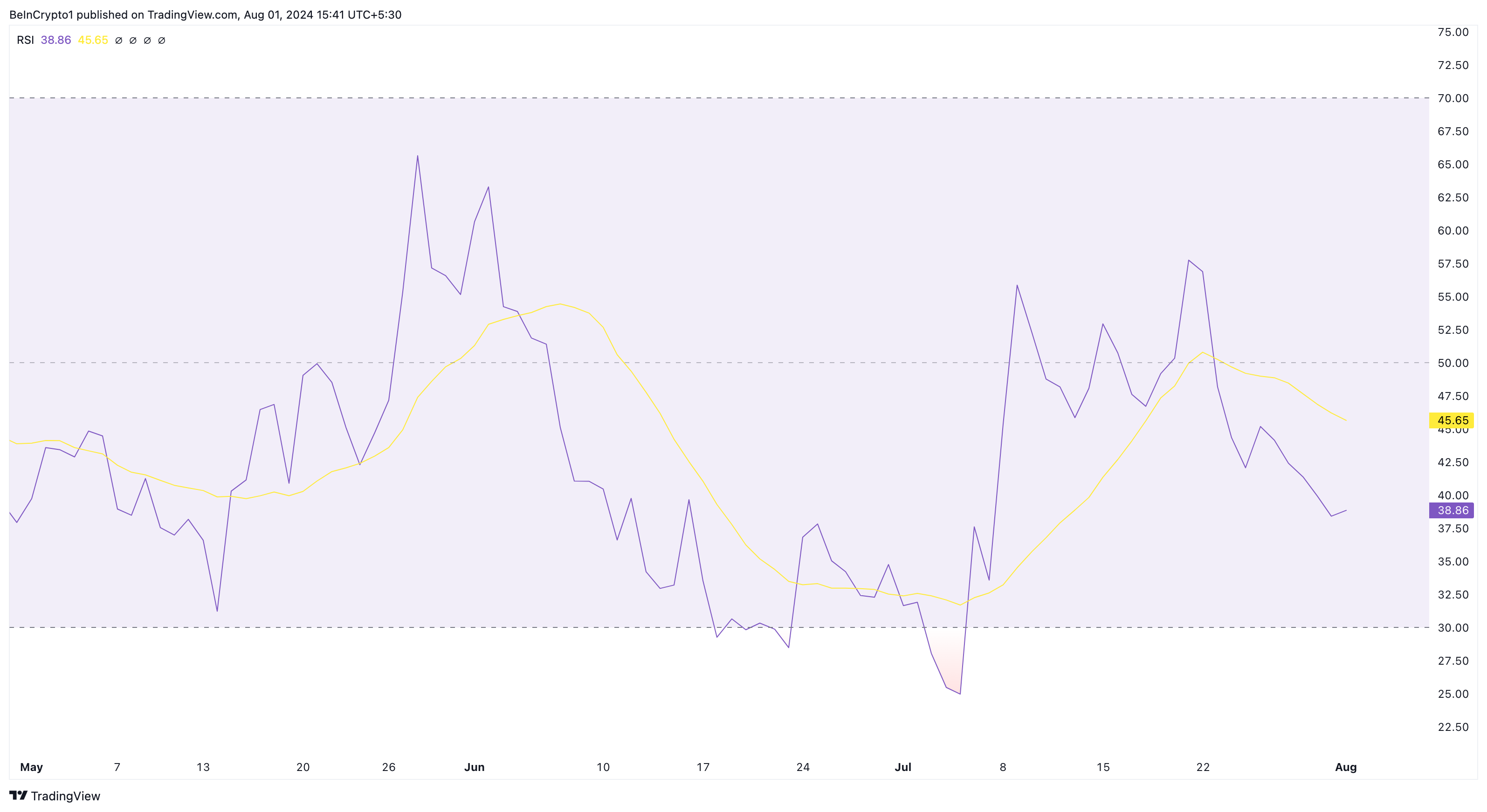

An analysis of the day by day chart reveals that the Relative Strength Index (RSI) studying is 38.86. The RSI is a technical indicator that measures the velocity and value adjustments of a cryptocurrency. Furthermore, the oscillator determines if an asset is overbought or oversold.

When the studying is 70.00 or above, the asset is overbought. But a studying at 30.00 or under factors to an oversold situation. Therefore, the RSI decline on Celestia’s chart signifies that the token might be heading towards the oversold zone.

If the momentum studying continues to slip, TIA’s value may proceed to fall. If that occurs, the cryptocurrency’s worth might drop under $5.

Read More: Top 9 Safest Crypto Exchanges in 2024

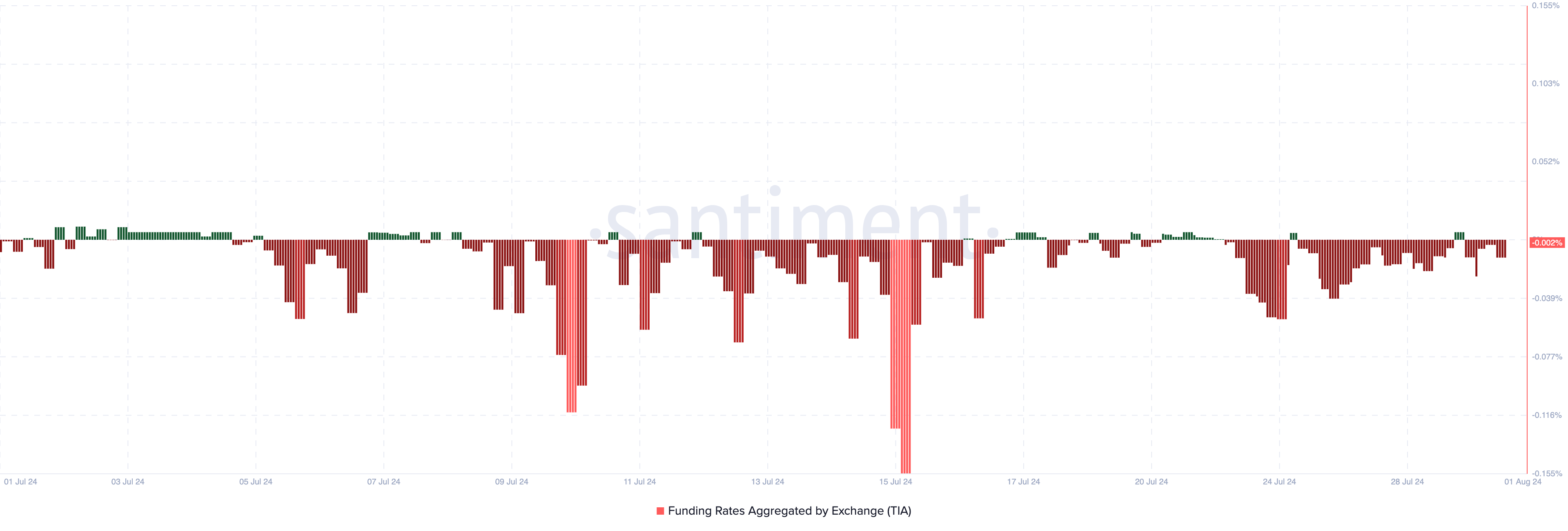

Consequently, the present state of the cryptocurrency has pushed merchants in the derivatives market to hold positions supporting a bearish bias. The Funding Rate, as proven by on-chain information, reveals this.

The Funding Rate represents the distinction between a cryptocurrency’s contract value and the spot value. A constructive worth signifies bullish expectations from merchants, whereas a destructive studying signifies that the perpetual value trades decrease than the spot value, suggesting a bearish bias.

At press time, TIA’s Funding Rate is in the destructive territory, reinforcing the notion that market individuals don’t anticipate a value bounce.

However, this was the case for many of final month, reflecting the doubt the broader market has round TIAA in the quick time period.

TIA Price Prediction: Will Liquidity Rise Spark a Bounce?

As of this writing, TIA has been buying and selling inside a descending triangle since July 22. In this sample, the worth retains hitting decrease highs whereas the flat assist line consolidates across the identical space.

Typically, this sample is bearish, and if the token lacks buying power, one other breakdown might happen. Additionally, the Fibonacci Retracement indicator offers an thought of ranges the place the worth might go subsequent as every ratio identifies assist and resistance zones.

The most necessary Fib ratios embrace 23.6%, 38.2%, 61.8% and 78.6%. From the chart under, TIA’s value has dropped under the 23.6% nominal pullback. Should promoting stress improve, the worth of TIA might drop to $4.13.

Read More: Which Are the Best Altcoins To Invest in August 2024?

However, the Money Flow Index (MFI) reveals that the Celestia token is beginning to expertise an increase in liquidity. If this continues, TIA’s value might rebound to $5.98, and the bearish thesis will probably be invalidated

Disclaimer

In line with the Trust Project pointers, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. Always conduct your personal analysis and seek the advice of with an expert earlier than making any monetary selections. Please observe that our Terms and Conditions, Privacy Policy, and Disclaimers have been up to date.