Bitcoin worth continues to stay underneath strain after it fell greater than 5% to underneath $66,000 degree on Tuesday. The transfer comes primarily because of the U.S. authorities transferring $2 billion in bitcoins, sparking issues of an extra decline in adverse sentiment. Traders anticipate consolidation will proceed forward of the US Federal Reserve rate of interest determination.

Despite an total sentiment on the Fed fee cuts in September, the inventory and crypto market merchants are bracing for pullbacks within the coming days. US inventory market futures are buying and selling larger at press time. CME FedWatch reveals a 90% chance of the Fed fee reduce of 25 bps in September.

Traders Took Cues From U.S. Government Selloff and Mt. Gox

Traders instantly offered BTC after the U.S. authorities transferred greater than $2 billion value of Bitcoin from the stash it seized from Silk Road darkish net market. According to Arkham Intelligence, a U.S. Government: Silk Road DOJ Confiscated Funds labeled pockets moved 29,800 BTC in two transactions.

However, Bloomberg analyst James Seyffart prompt {that a} custody cope with Coinbase was behind the latest $2 billion Bitcoin switch by the US Marshals Service. Meanwhile, take a look at switch by Mt. Gox turned merchants cautious, stopping any rebound in Bitcoin worth right now. Mt. Gox holds 80.128k BTC, which is valued at $5.35 billion.

Notably, Coinglass knowledge signifies the crypto market noticed $170 million in complete liquidations within the final 24 hours, with $147 million in longs liquidated. BTC recorded $70 million in longs liquidation and $7 million briefly positions liquidation.

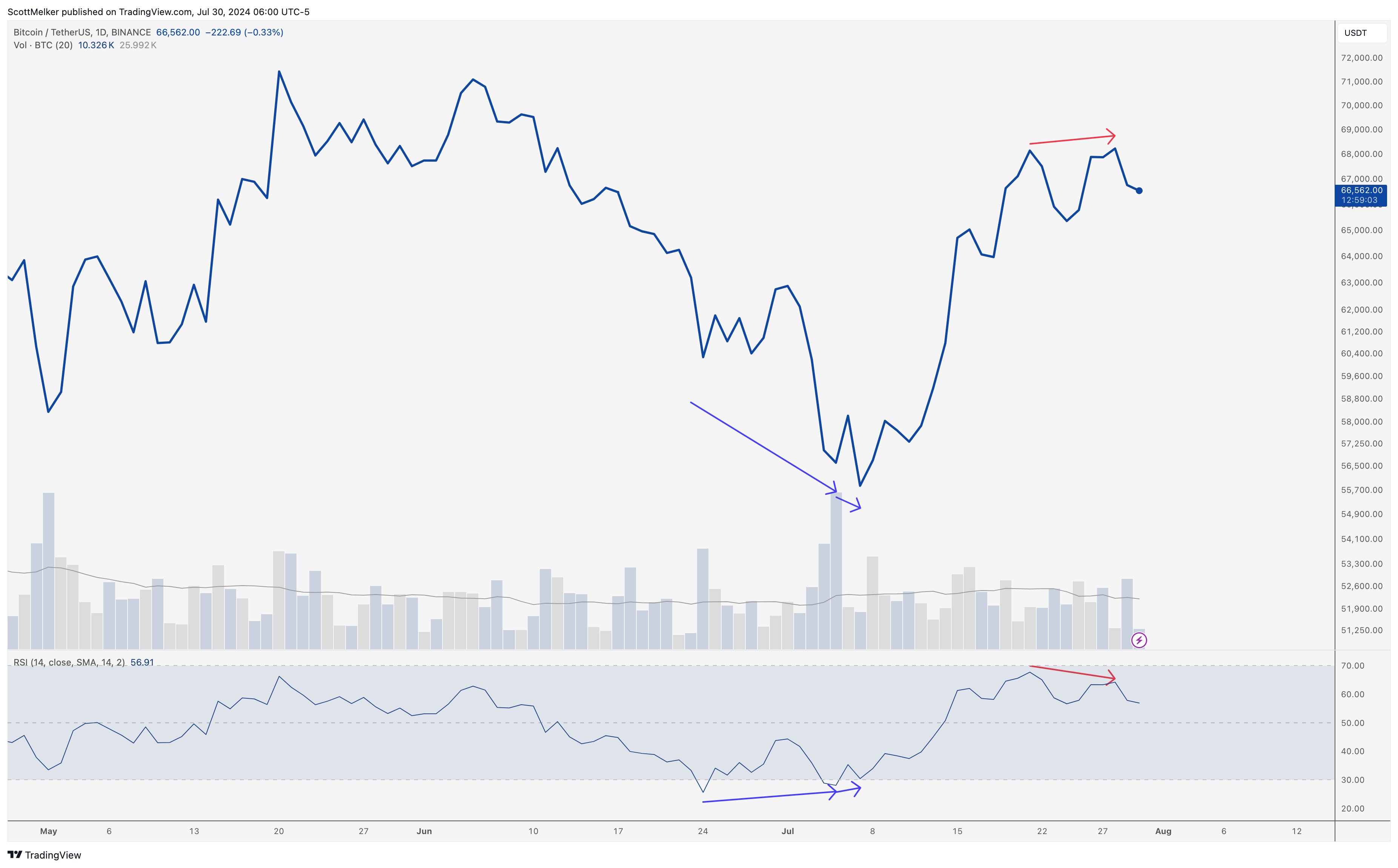

Scott Melker, generally known as The Wolf of All Streets, predicts BTC worth motion at present is just not ideally suited for the time being. BTC shaped a bearish divergence with RSI on the day by day chart and most decrease time frames. He recommends anticipating hidden bullish divergence.

BTC price at present trades at $66,443, with a 24-hour high and low of $65,894 and $69,987, respectively. The buying and selling quantity has witnessed a 67% improve over the past 24 hours.

Also Read: Mt. Gox Readies Transfer of Remaining 80.5K Bitcoins, BTC Faces Pressure

Donald Trump-Driven Bitcoin Price Rally Fades

Crypto Fear and Greed Index dropped from 74 to 67 as traders brace for potential losses attributable to volatility forward of the FOMC meeting. Uncertainty has soared within the markets amid heightened geopolitical tensions within the Middle East and expectations of a fee reduce in September.

Bitcoin worth right now has pared principally all weekly good points. BTC worth slumped after it hit $70,000 amid Donald Trump’s speech on the Bitcoin Conference in Nashville, Tennessee final week. Donald Trump spoke about making Bitcoin a strategic reserve and firing anti-crypto SEC Chair Gary Gensler.

The 10-year Treasury held its latest decline additional under 4.2%, shifting close to its lowest degree since March. On the opposite, the U.S. Dollar Index (DXY) has soared above 104.73, inflicting some strain on Bitcoin worth.

Moreover, Wall Street giants Morgan Stanley and Goldman Sachs predicted three cuts this yr beginning in September. “Considerable progress on inflation allows the Fed to inch closer to rate cuts. Chair Powell should emphasize increased confidence,” mentioned Morgan Stanley.

Also Read: US SEC Amends Binance Lawsuit, No Longer Consider Solana As Security

Disclaimer: The offered content material might embody the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability to your private monetary loss.