PCE Inflation: Stock and crypto market merchants look forward to the discharge of the US Federal Reserve’s most well-liked inflation gauge PCE for additional bullish cues. The U.S. Bureau of Economic Analysis to launch the non-public consumption expenditure (PCE) worth index immediately and economists see PCE inflation slowing for a second consecutive month to 2.5% from 2.6%, making the FOMC to debate rate of interest cuts.

Federal Reserve officers have just lately shared their dovish outlook on financial coverage, hinting at a pivot to charge cuts. The market expects the primary charge reduce by the U.S. Fed in September.

Wall Street Estimates On PCE Inflation Data

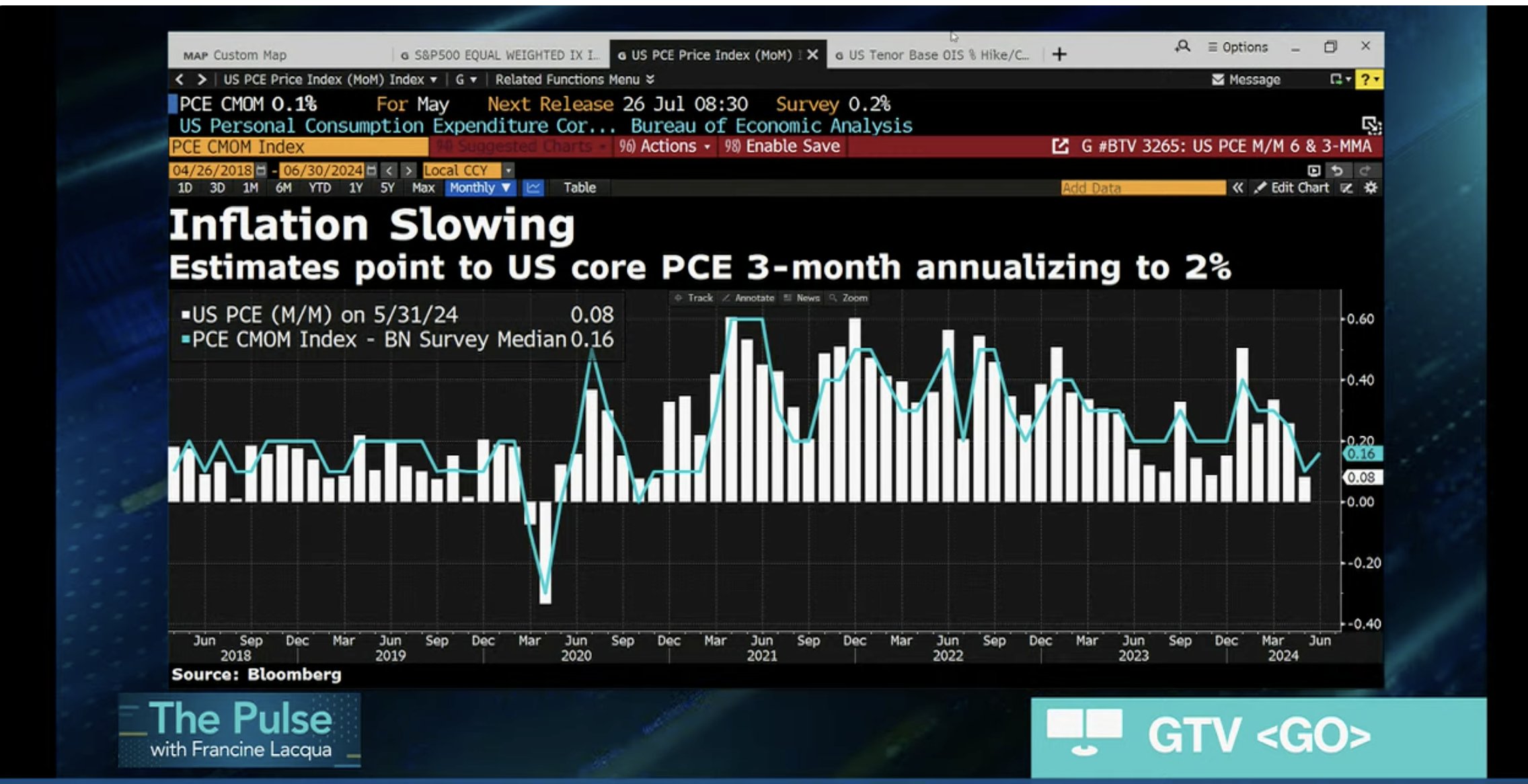

The PCE inflation is predicted to chill additional as per the most recent evaluation by economists. The market expects annual PCE to fall to 2.5%, down from 2.6% final month. Similarly, the annual core PCE inflation is projected to lower to 2.5%, a brand new low since March 2021, from 2.6%.

In addition, the month-to-month PCE inflation is predicted at 0.1% whereas the month-to-month core PCE can be anticipated to return in at 0.1%. Notably, the Federal Reserve’s newest financial projections estimated annual PCE inflation at 2.6% and the core charge at 2.8% for the present yr.

Wall Street giants together with JPMorgan, Morgan Stanley, Bank of America, Goldman Sachs, Nomura, and UBS have estimated a median forecast of two.5% y/y and 0.1% m/m. Meanwhile, the banks estimate core PCE inflation to return in at 2.5%, according to the market forecast. Also, the estimates level to US core PCE 3-month annualizing to 2%, reaching the goal charge of the Federal Reserve.

Also Read: LUNC Delisting – Terra Classic Seeks Clarification From TFL CEO And eToro

Bitcoin and Crypto Market Prepares for Rally

According to Morgan Stanley, “Considerable progress on inflation allows the Fed to inch closer to rate cuts. Chair Powell should emphasize increased confidence.”

Morgan Stanley joined Goldman Sachs to foretell three cuts this yr beginning in September. They anticipate Fed Chair Jerome Powell to proceed indicating that the Fed is nearing a choice to decrease charges, with out committing to a selected timeline.

BTC price jumped 5% within the final 24 hours because the Bitcoin Conference fueled bullish sentiment. The worth is at present buying and selling over $67,300, with the 24-hour high and low of $63,473 and $67,466, respectively. Furthermore, the buying and selling quantity has elevated barely within the final 24 hours, indicating an increase in curiosity amongst merchants.

Meanwhile, the US greenback index (DXY) is shifting close to 104.38, with an additional drop anticipated as a result of anticipation of Donald Trump’s win within the presidential election. Moreover, the US 10-year Treasury yield dropped to 4.244% immediately. As Bitcoin strikes reverse to DXY and Treasury yields, the strain is lowering.

Also Read: Bitcoin Conference – Donald Trump Refuses To Debate With Kamala Harris

The offered content material could embrace the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty to your private monetary loss.