Ethereum Foundation has simply bought 100 ETH, in accordance with a transaction on Tuesday. The transfer raises eyebrows within the crypto group as the inspiration bought the crypto asset simply earlier than the spot Ethereum ETF itemizing and buying and selling right now. Traders didn’t reply instantly to the selloff by the inspiration.

Ethereum Foundation Wallets Offloading ETH

It’s an enormous week for Ethereum and ETH with the spot Ether ETFs set to go dwell right now. However, Ethereum Foundation-linked wallets are promoting the crypto asset forward of ETF launch.

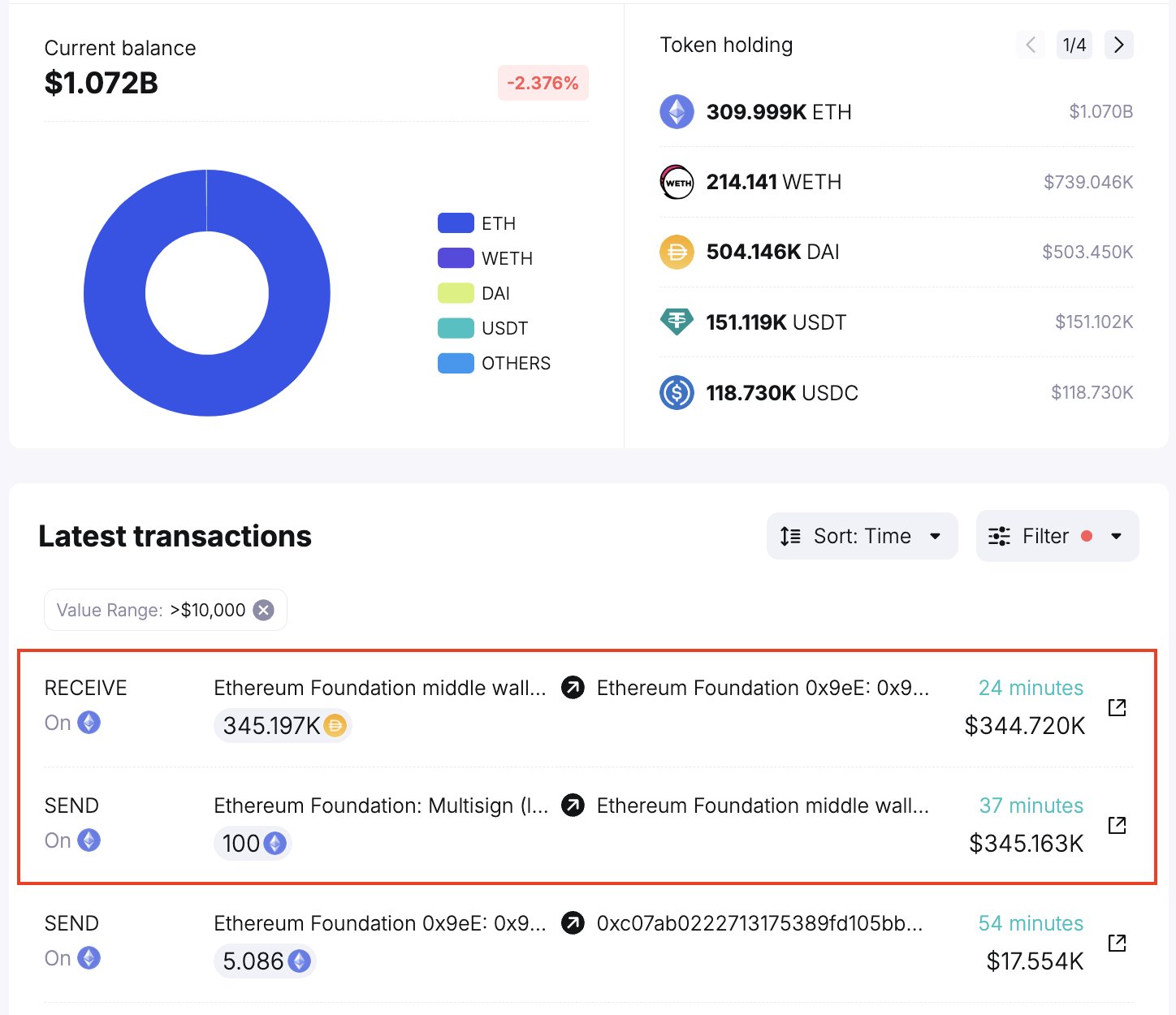

In a big improvement on July 23, Ethereum Foundation bought 100 ETH for 345,179 DAI. Notably, the transaction got here simply earlier than the beginning of spot Ethereum ETFs buying and selling right now. Traders look out for additional cues as establishments proceed to ship ETH to crypto exchanges or different wallets.

As per on-chain knowledge platform Spot On Chain, Ethereum Foundation has bought 2,366 ETH for six.9 million DAI stablecoin this yr. The final Ether selloff by the inspiration was famous on July 2. Investors panicked resulting from offloading by foundation-linked wallets, however general sentiment stay optimistic.

In addition, the pockets deal with “0xdb3” linked to Ethereum Foundation or Ether ICO moved 3,200 ETH price $11.2 million to Kraken. Grayscale additionally transferred $1 billion in Ethereum to Coinbase forward spot Ethereum ETF debut.

Also Read: OKX To Delist XRP, SHIB, ADA, & 27 Crypto In BTC and ETH Pairs

US SEC Issues Effectiveness Notice For Ether ETFs

U.S. SEC has issued the S-1 software effectiveness discover for all spot Ethereum ETFs. Issuers together with BlackRock’s iShares, Fidelity, Franklin Templeton, Bitwise, VanEck, 21Shares, Invesco Galaxy, and Grayscale are set to start out buying and selling right now.

Grayscale Ethereum Trust (ETHE) and BlackRock ETF (ETHA) are witness huge buying and selling exercise in pre-market hours, as per Yahoo Finance.

ETH price jumped 0.50% prior to now 24 hours, with the worth at present buying and selling at $3,505. The 24-hour high and low are $3,425.80 and $3,539.53, respectively. Furthermore, the buying and selling quantity has elevated by 40% within the final 24 hours, indicating an increase in curiosity amongst merchants.

Futures buying and selling additionally information shopping for, with a 4% enhance in ETH futures open curiosity within the lat 24 hours. The complete Ethereum OI rises to $15.33 billion, as per CoinGlass.

Also Read: Terra Sets Preliminary Date For LUNA, LUNC, USTC Recovery

The introduced content material might embody the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability to your private monetary loss.