After a decline to $53,600 final Friday, the Bitcoin value skilled a serious restoration over the weekend, exceeding the $63,000 threshold at the moment. This marks a large 17% enhance since final Friday, reaching this stage for the primary time in two weeks. The rally could be attributed to a number of components that collectively propelled the premier’s cryptocurrency’s value upward.

#1 The “Trump Bitcoin Pump”

The resurgence within the Bitcoin value coincided with the tried assassination of former President and 2024 presidential hopeful Donald Trump. The incident considerably impacted his odds within the upcoming election, with betting market Polymarket now forecasting a 70% likelihood of his victory.

Crypto skilled Will Clemente III highlighted on X, “Trump’s odds of winning in November are skyrocketing in prediction markets.” He additional noted, “Based on Bitcoin’s reaction so far, looks like markets are going to begin pricing in a full Trump victory.”

Related Reading

Alex Krüger, a macro analyst, elaborated on the implications of a possible Trump presidency for the monetary markets: “The Trump Trade is now on its way. This what Trump winning, or the expectation of him winning, entails: Bullish for Crypto because Trump’s administration might pursue supportive regulations for cryptocurrencies, fostering innovation and adoption.”

#2 German Selling Exhausted

The current completion of a large-scale Bitcoin sell-off by the German government additionally contributed to the value restoration. Germany exhausted its cache of fifty,000 BTC seized from Movie2k, finishing its ultimate transaction of 3846.05 BTC final Friday.

James “Checkmate” Check, a number one on-chain analyst, remarked on the unimaginable energy of the BTC value on X, “Folks, Bitcoin just absorbed a 50k BTC market sell order in a few weeks. It dipped ~25%, in a very structured and orderly correction. Last time something like this happened was LUNA selling ~80k $BTC and price dropped from $46k to $25k, and soon after to $17k. Not the same.”

#3 DXY Is Showing Weakness

The weakening US greenback might be one other driver of BTC’s current positive factors. The US Dollar Index (DXY), which measures the greenback in opposition to a basket of main currencies, fell 1.8% during the last two weeks to a five-week low of 104.

Related Reading

The expectation of an rate of interest lower and the rising US authorities deficit, which reached $1.27 trillion year-to-date in June, have contributed to the greenback’s decline, pushing buyers in direction of riskier property like Bitcoin and cryptocurrencies.

#4 Bitcoin Miner Capitulation Ends

Joe Burnett, one other famous crypto analyst, highlighted through X yesterday {that a} month-long interval of Bitcoin miner capitulation is nearing its finish, indicating a possible reversal in downward stress on Bitcoin’s value. Historically, the tip of miner capitulation has been related to subsequent value will increase.

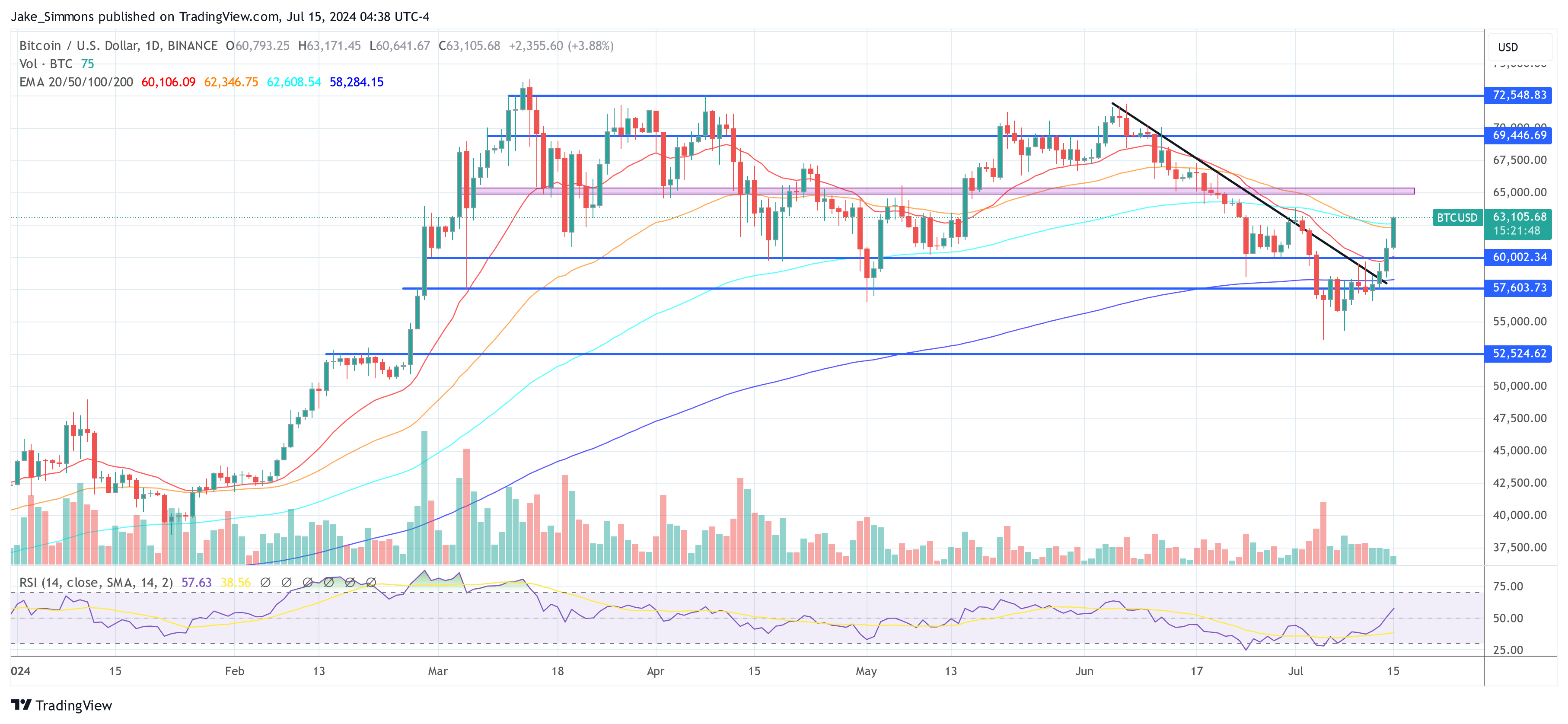

#5 Technical Breakout

From a technical perspective, Bitcoin surpassed the important 200-day Exponential Moving Average (EMA) and a descending trendline this Saturday. This milestone could be thought-about a bullish sign amongst merchants, indicating a attainable finish to the downturn that started in early June.

At press time, BTC traded at $63,105.

Featured picture created with DALL·E, chart from TradingView.com