The crypto market braces for affect as Bitcoin and Ethereum choices price $1.4 billion are set to run out at present, CME BTC futures shut, and PPI information. Traders search for cues of market restoration as CPI inflation falls to a yr low, anticipating Fed charge cuts to begin in September. Let’s test particulars about the explanation why Bitcoin worth is dropping regardless of increased odds of a Fed charge cuts beginning in September.

Bitcoin And Ethereum Options Worth $1.4 Billion to Expire

Almost $1.4 billion in Bitcoin and Ethereum choices will expire on July 12, based on information from the biggest crypto derivatives alternate Deribit. BTC price has dropped to a 24-hour low of $56,561, with no help from buying and selling volumes for Bitcoin worth restoration.

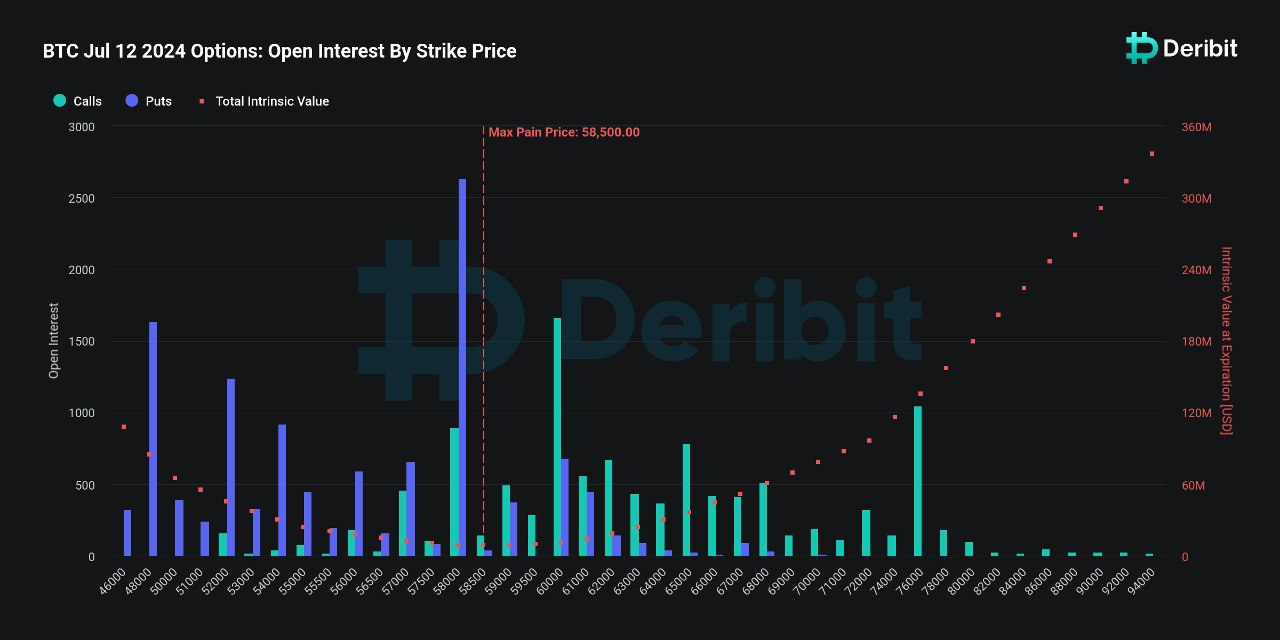

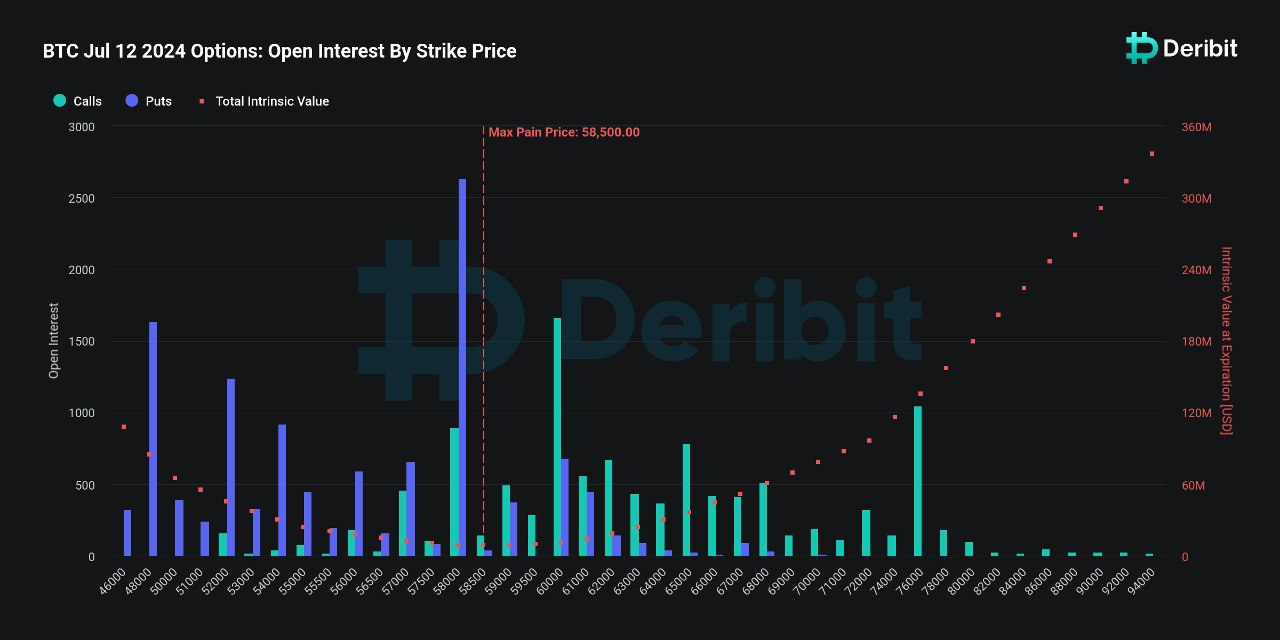

Over 23,722 BTC choices with a notional worth of $1.36 billion expire at present on Deribit. The put-call ratio is extraordinarily excessive at 1.08 as put open pursuits are 12,328.50 towards 11,393.50 name open pursuits, elevating skepticism over restoration within the coming days.

Moreover, the max ache is at $58,500 strike worth, with put choices greater than name choices on the strike worth. Currently, the max ache level is increased than Bitcoin worth. It signifies bearishness amongst merchants continues to persist and Bitcoin stays underneath promoting strain.

Historical Volatility has continued to surge whereas BTC Volatility Index (DVOL) reveals indicators of drop. Options merchants proceed to stay cautious amid German government Bitcoin selloff.

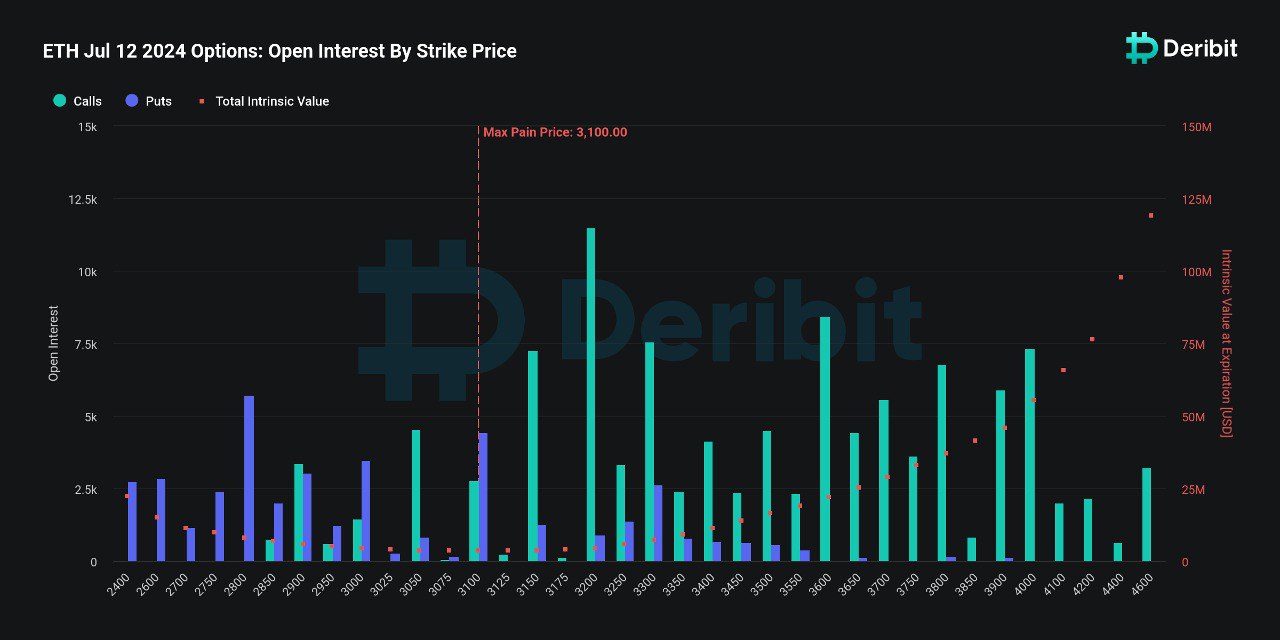

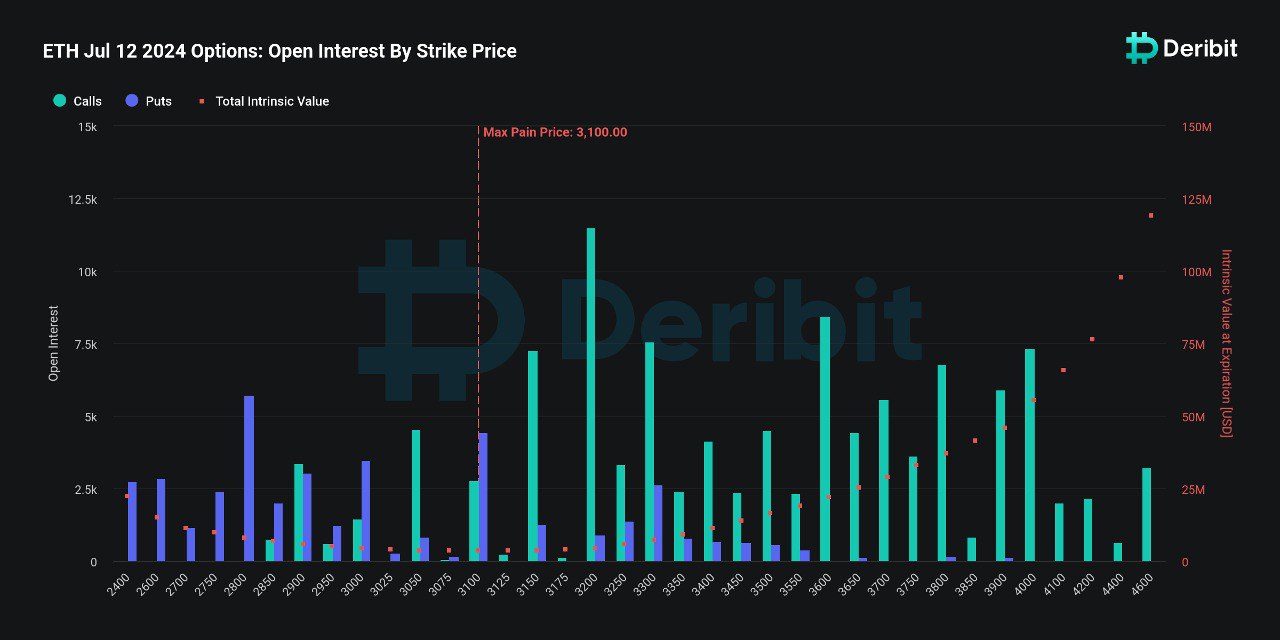

Meanwhile, ETH choices of notional worth $0.48 billion are set expire. The put-call ratio is 0.37 and the max ache worth is $3,100. ETH price is at present buying and selling beneath the max ache level, implying that merchants nonetheless have some room to get well amid the spot Ether ETF sentiment.

PPI Inflation Data Looms

Producer costs index (PPI) annual inflation information within the US is anticipated to return in at 2.3%, increased than 2.2% in May. The month-to-month studying is anticipated at 0.1% towards -0.2% final month.

Meanwhile, economists anticipate Core PPI YoY for June at 2.5%, a 0.2% enhance as in comparison with final month. Also, Core PPI MoM is anticipated to return in at 0.2%, increased than the earlier month’s core PPI information.

Recently, US CPI cooled to three%, inflicting odds of Fed charge cuts to extend above 90%. Bitcoin additionally rebounded above $58,000 amid market optimism. However, the value has dropped amid destructive sentiment.

Also Read: Crypto Market Crash Fails To Dent VanEck CEO’s Bullish Outlook

Bitcoin Price Falls As CME Futures Closes

Traders bought BTC futures as CME closed futures buying and selling for the week, inflicting Bicoin worth to fall beneath $57,000. CME BTC futures buying and selling will open on Sunday.

The crypto market rebounded barely this week, with volatility falling sharply to a brand new low since March. The quarterly supply and huge fluctuations created an ideal entry alternative for sellers. This week, possibility sellers opened giant variety of positions, which additionally turned a driving pressure to decrease the IV of main maturities.

Coinglass information signifies CME BTC futures open curiosity fell over 1% within the final 24 hours. The BTC futures OI has dropped to $8.26 billion.

Also Read: Bitcoin Enters Extreme Fear Zone For The First Time In 18 Months: Market To Crash?

The introduced content material might embrace the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability in your private monetary loss.